As we enter week three of being under a state of emergency in Ontario, the threat of the COVID-19 pandemic continues to grow across the province, with all levels of the government enforcing new measures to stop community spread through social distancing.

As residents in the non-essential workforce continue to work from home and refrain from visiting businesses and other public places in the hopes of stopping the spread of the deadly virus, it's beginning to have a noticeable impact on industries that rely on in-person interactions, including the real estate industry.

RELATED:

- Home Sales in Canada Could Drop as Much as 30% This Year: RBC

- Toronto’s Real Estate Market Just Took a Nosedive

- How Toronto’s Real Estate Industry is Dealing with the Impact of Coronavirus

While February was a record-breaking month for new home sales in Toronto, recording the highest number of sales for any February since 2002, showing the industry had yet to be impacted directly by the virus, as tighter measures were implemented in the weeks to follow, the coronavirus outbreak began to have a "profound" impact on housing activity in the Greater Toronto Area (GTA), especially after the state of emergency measures were introduced, according to a new report from Zoocasa.

And almost like clockwork, housing market activity began to slow in response to the escalating measures, with buyers and sellers beginning to hold off on buying and selling homes amidst the uncertain health and economic circumstances.

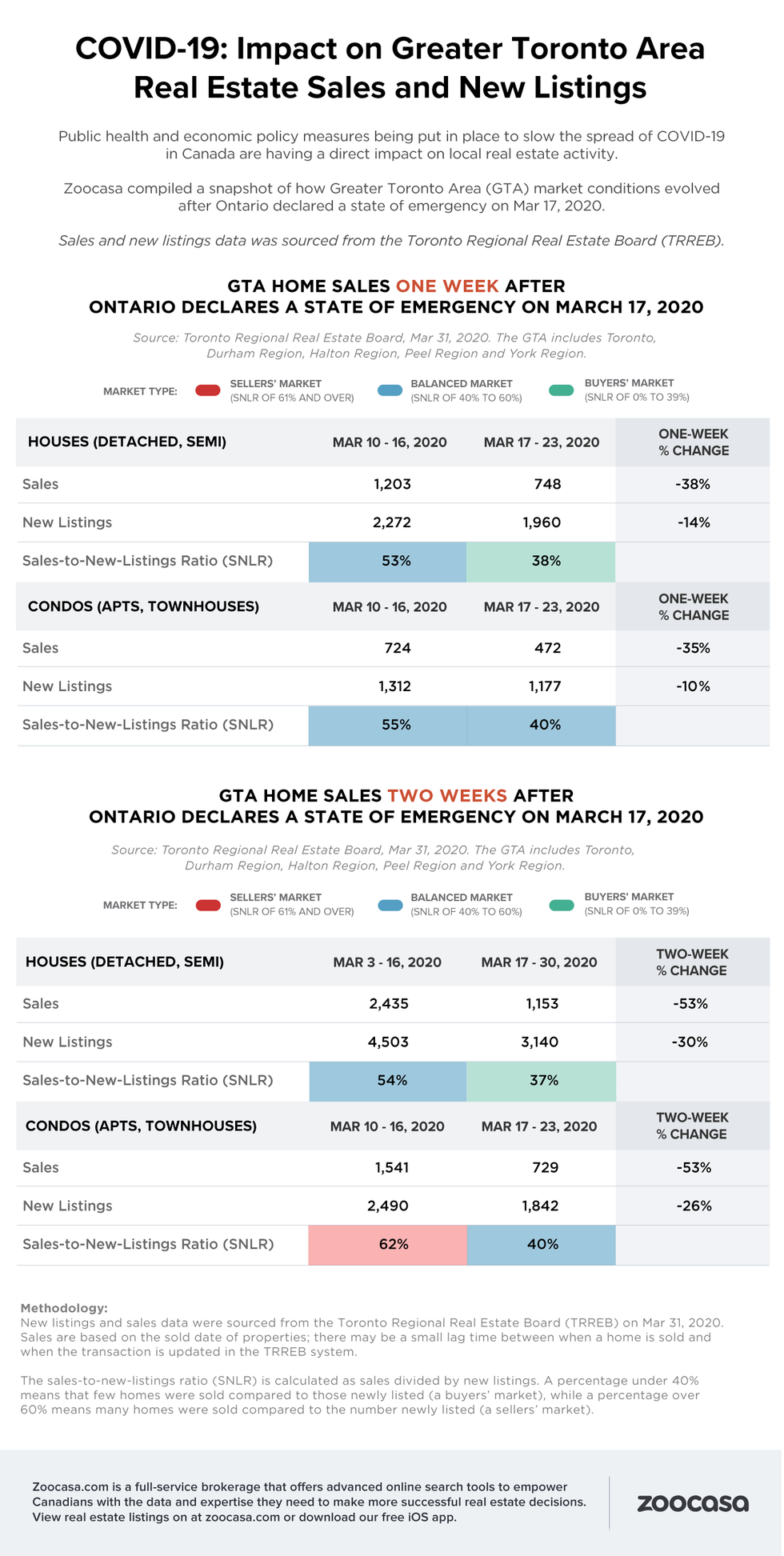

By using data from the Toronto Regional Real Estate Board (TRREB), Zoocasa was able to find exactly how real estate market activity has changed alongside the new measures, which include increased social distancing and the ban of gatherings of more than five people.

According to Zoocasa, the sales-to-new-listings ratio (SNLR), which is described as "a measure of market competition calculated by dividing the number of sales by the number of new listings" dropped to just 38%, from 1,203 to 748 for detached and semi-detached homes in the GTA between March 17-23 – compared to 53% for the week prior. New listings for detached and semi-detached houses were down, too, dropping 14%.

Things weren't much better for condo apartments and condo townhouses, with the SNLR dropping from 55% to 40% for the same time period.

The findings also revealed there were fewer sales and listings within the condo market, with sales dropping 35% for the same period, from 724 to 482. There were also 10% fewer listings for condo apartments and townhouses compared to the week prior, dropping from 1,312 to 1,177.

The following week wasn't much better, with sales of detached and semi-detached homes dropping 53% for the period between March 17-30. While there were 1,153 sales during this period, compared to 2,435 the week prior, new listings dipped from 4,503 to 3,140, representing a 30% drop.

As for the condo market, sales dropped 53% from 1,541 to 729, while new listings were down 26% from 2,490 during the week of March 3-16 to 1,842 in the two weeks following the state of emergency announcement.

Zoocasa says when the SNLR is between 40%–60% it indicates a balanced market, anything above and below that threshold reveals sellers’ and buyers’ markets, respectively.

In turn, the numbers recorded in March demonstrate there has been a noticeable shift in market conditions in a very short period of time.