In a press release dated November 2, 2021, Gracorp Properties announced that they were partnering with Fiera Real Estate to purchase and redevelop a condo building in Vancouver, turning it into a "landmark rental community."

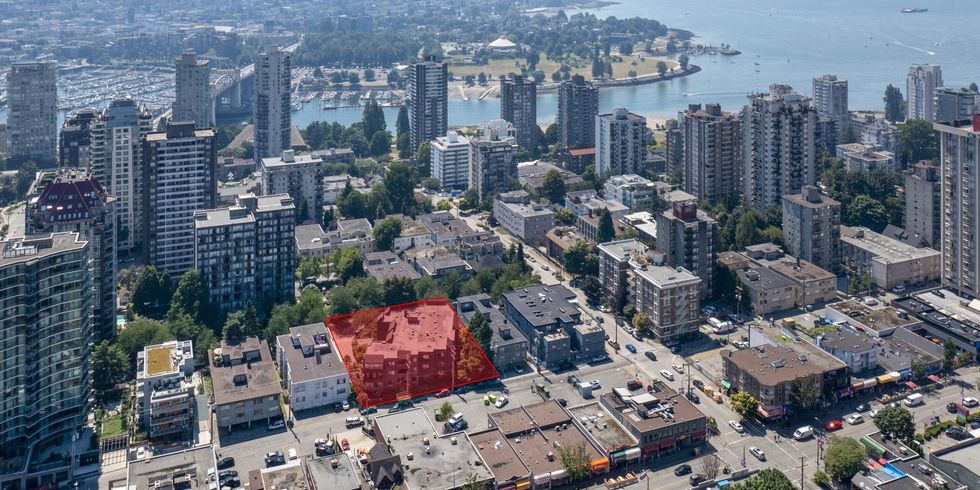

Six months later, in April 2022, the partners submitted their rezoning application for 1045 Burnaby Street, a site located between Thurlow Street and Burrard Street in the West End of Vancouver that BC Assessment values at $29,572,000. The partners acquired the property for $28,830,000.

For the site, Gracorp — the development subsidiary of Calgary-based construction firm Graham Group — and Fiera Real Estate — the investment management firm owned by Montreal-based Fiera Capital Corporation — were planning a 16-storey rental tower with 133 market rental units and 37 below-market rental units.

The partners received rezoning approval from Council at a public hearing on April 27, 2023 and subsequently submitted their development application in August 2023, which was then approved in December 2023.

"This purchase represents the start of a new partnership between Fiera and Gracorp," said Gracorp's then-Managing Director in British Columbia Jake McEwan, in a press release announcing the partnership. "This relationship leverages the synergies of capital, asset, development and construction management amongst the two firms. We are excited to work with our partner Fiera, and the City of Vancouver to create a unique, modern rental community in Vancouver's West End."

That relationship has since taken a drastic turn, however, with the two partners now embroiled a legal fight against one another, according to court filings in the Supreme Court of British Columbia obtained by STOREYS.

The Agreements

The civil claim, initiated in August, is centered around what's known as a crane swing and underpinning easement agreement, which typically entails one party compensating another for the right to swing a construction crane over the airspace of a neighbouring property, according to Vancouver-based business law firm Stirling LLP.

The 1045 Burnaby Street property is owned under 1318743 BC LTD., which is beneficially owned by the two partners. According to their co-owners agreement (COA), Fiera Real Estate holds a 90% ownership interest while Gracorp holds the remaining 10%. Per a development management agreement (DMA), Gracorp was also appointed the development and leasing manager for the project.

As part of that co-owners agreement, both parties must approve any decisions involving $50,000 or more and any encumbrances that would be registered on the land title of the property. In the event of a breach, each of the co-owners are entitled to an opportunity to cure that breach, with 30 days allowed for monetary breaches and 45 days allowed for non-monetary breaches. If the breaches are not cured in that period, then the breach is considered a default.

In early-April 2024, Gracorp entered into a crane swing and easement agreement with Francis Drake Holdings Ltd., the registered owner of the adjacent residential building at 1039 Burnaby Street, according to the Land Owner Transparency Registry. As part of the easement agreement, Gracorp paid Francis Drake Holdings Ltd. $200,000 and the agreement was registered on the land title on April 24.

The Claims

In their Notice of Civil Claim dated August 8, Gracorp claims that Fiera approved the easement agreement and payment on May 3, but then issued Gracorp notices of default on June 25, saying that Gracorp entered into the easement agreement without approval from Fiera. On July 9, Gracorp nonetheless sought out approval for the easement agreement from Fiera, in an attempt to cure the alleged default, but Gracorp says Fiera "refused to provide written approval as requested" and "has refused or neglected to provide any substantive objection."

On July 25, Fiera then informed Gracorp that it was terminating their co-owner agreement and development management agreement, saying that Gracorp had failed to cure the default within 30 days, while "further alleging that the alleged Events of Default were incapable of being cured by Gracorp Owner over any time period," according to Gracorp.

At the same time, Gracorp says Fiera also indicated it wanted to exercise a buy-out clause in their co-owner agreement that allows one partner to buy out the stake of the other, upon a default, at 90% of the fair market value. Gracorp says at this time, Fiera also provided them with an appraisal report.

Gracorp argues that Fiera had "no valid basis" to terminate their agreements and is thus also "not entitled to exercise any rights under the Discounted Buy-Out Clause." Gracorp argues that Fiera "acted unreasonably" when it withheld approval for the easement agreement and is accusing Fiera of "breach of duty of good faith performance" pertaining to their agreements.

In terms of relief, Gracorp is seeking a declaration from the Supreme Court that the termination notices Fiera issued are invalid and unenforceable, a declaration that Fiera is in breach of their agreements, and a declaration that Gracorp is entitled to specific performance on the co-owners agreement and development management agreement, or damages for breach in the alternative. Additionally, Gracorp requested that a certificate of pending litigation (CPL) be registered on the land title and also submitted an application for injunctive relief that would prevent Fiera from taking any further steps.

The Conflict

In their first response to Gracorp's Notice of Civil Claim, dated August 13, Fiera said that Gracorp had not received approval to enter into the easement agreement and saw the easement agreement for the first time on April 29. In an affidavit, Fiera Real Estate Head of Development Kathy Black also said that this "led Fiera to lose substantial confidence in Gracorp’s ability to protect the co-owners’ joint interests and to act as a fair and transparent co-owner in the Project."

After Gracorp sought out "retroactive approval" on July 9, Fiera says it denied the approval because the co-owners agreement and development management agreement did not set out terms for retroactive approval and that "Gracorp's disregard for the decision-making process required by the COA and DMA led to a loss of the necessary trust between the parties."

Fiera also disputed Gracorp's claim that it would suffer "irreparable harm" since Fiera would be compensating Gracorp for its 10% stake. Fiera then filed an application to have the CPL cancelled.

Additionally, Fiera also said that both before and after they entered into the COA and DMA, Gracorp "made it clear that it had no long-term plans or intentions with the Project" and "would primarily be involved with the development management, after which it would sell its interest in the Project to Fiera." On Graham Group's website, Gracorp is identified as a "merchant-style" developer — a developer that builds then quickly sells.

In the most-recent update, on October 2, Fiera said that it issued a second termination notice to Gracorp on September 9, argued that it was not in breach of any of the agreements, and also asked the Supreme Court to dismiss Gracorp's claims.

In their own filing on October 2 arguing against the removal of the CPL, Gracorp said Fiera also proposed to purchase Gracorp's stake in the project and triggered a contractual 15-day period in which the two parties had to agree on a fair market value. Gracorp says that it accepted the fair market valuation on September 24 and that Fiera says the expected closing date for the transaction is November 7.

It is unclear whether the transaction will successfully close and whether that would even bring the legal fight to an end, however.

"If Fiera proceeds to exercise Discounted Buyout Clause on November 7, 2024, Gracorp Owner will no longer be a beneficial owner of the Property," said Gracorp. "Should it be successful in the Action, Gracorp Owner may be entitled to specific performance of the COA and its beneficial ownership in the Property may be reinstated."

STOREYS reached out to both Gracorp and Fiera Real Estate on October 15, but has not received a response.