Down Payment

Learn what a down payment is in Canadian real estate, how much is required, and how it impacts your mortgage, insurance, and homeownership affordability.

May 22, 2025

What is a Down Payment?

A down payment is the initial lump sum a homebuyer pays upfront toward the purchase price of a property, with the remainder covered by a mortgage.

Why Down Payments Matter in Real Estate

In Canadian real estate, the down payment plays a critical role in determining mortgage size, eligibility, insurance requirements, and monthly payments. The minimum required down payment depends on the home’s purchase price:

- 5% for homes under $500,000

- 5% of the first $500,000 + 10% of the remainder for homes priced between $500,000 and $999,999

- 20% for homes priced at $1 million or more

If a buyer puts down less than 20%, the mortgage is considered a high-ratio mortgage and requires CMHC insurance. A larger down payment reduces the mortgage principal, lowers interest over time, and may eliminate the need for insurance.

Saving for a down payment is often the biggest hurdle for first-time homebuyers, who may also benefit from programs like the First-Time Home Buyer Incentive or use of RRSP funds through the Home Buyers’ Plan (HBP). Buyers should ensure their down payment funds are accessible and verifiable by their lender before closing.

Example of a Down Payment in Action

A buyer purchases a $600,000 home in Ontario. They contribute a 10% down payment of $60,000 and finance the remaining $540,000 through a mortgage.

Key Takeaways

- The upfront payment made when purchasing a home.

- Required minimum depends on the property’s price.

- Affects mortgage size, insurance needs, and interest paid.

- Less than 20% down requires mortgage loan insurance.

- Programs exist to help first-time buyers save or borrow.

Related Terms

- Mortgage Pre-Approval

- CMHC Insurance

- High-Ratio Mortgage

- Closing Costs

- Equity

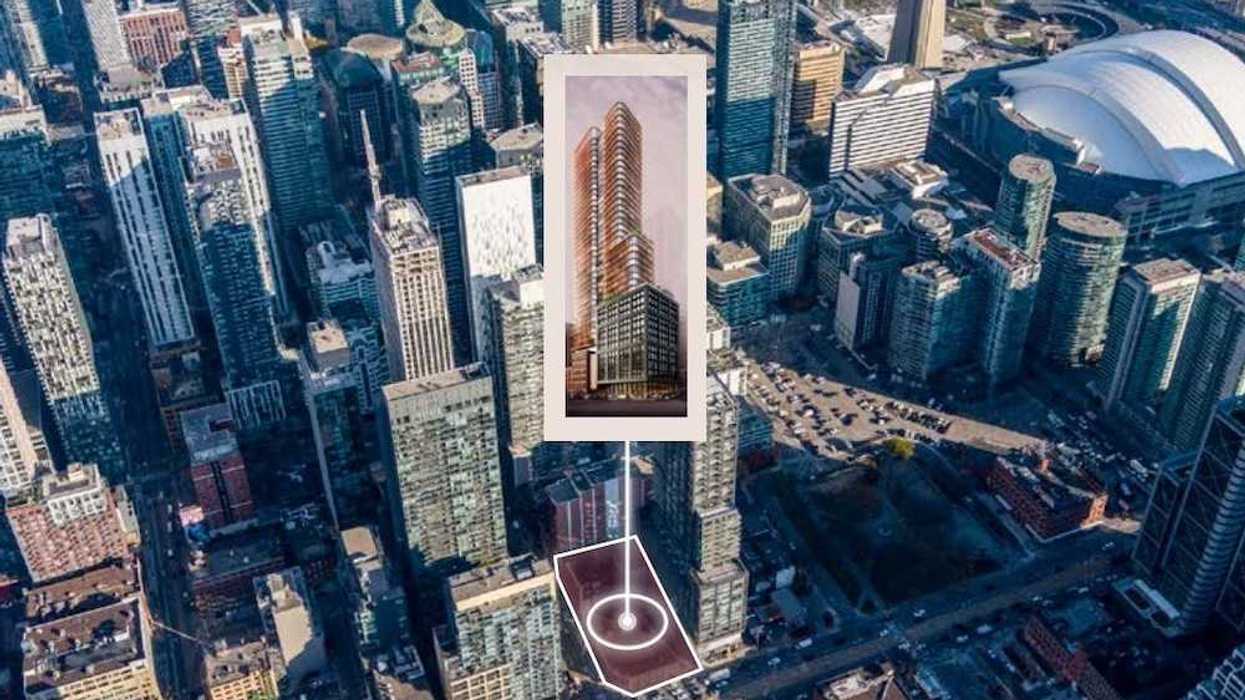

401-415 King Street West. (JLL)

401-415 King Street West. (JLL)

Eric Lombardi at an event for Build Toronto, which is the first municipal project of Build Canada. Lombardi became chair of Build Toronto in September 2025.

Eric Lombardi at an event for Build Toronto, which is the first municipal project of Build Canada. Lombardi became chair of Build Toronto in September 2025.

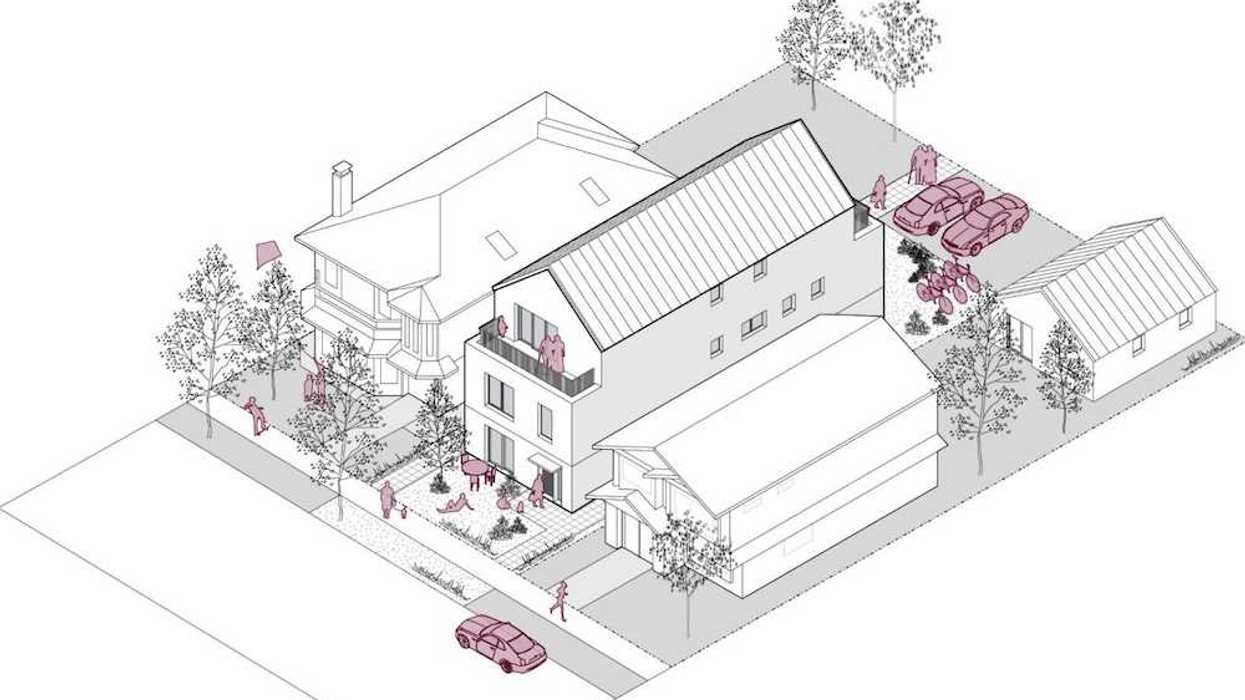

Rendering of 9 Shortt Street/CreateTO, Montgomery Sisam

Rendering of 9 Shortt Street/CreateTO, Montgomery Sisam Rendering of 1631 Queen Street/CreateTO, SVN Architects & Planners, Two Row Architect

Rendering of 1631 Queen Street/CreateTO, SVN Architects & Planners, Two Row Architect Rendering of 405 Sherbourne Street/Toronto Community Housing, Alison Brooks Architects, architectsAlliance

Rendering of 405 Sherbourne Street/Toronto Community Housing, Alison Brooks Architects, architectsAlliance

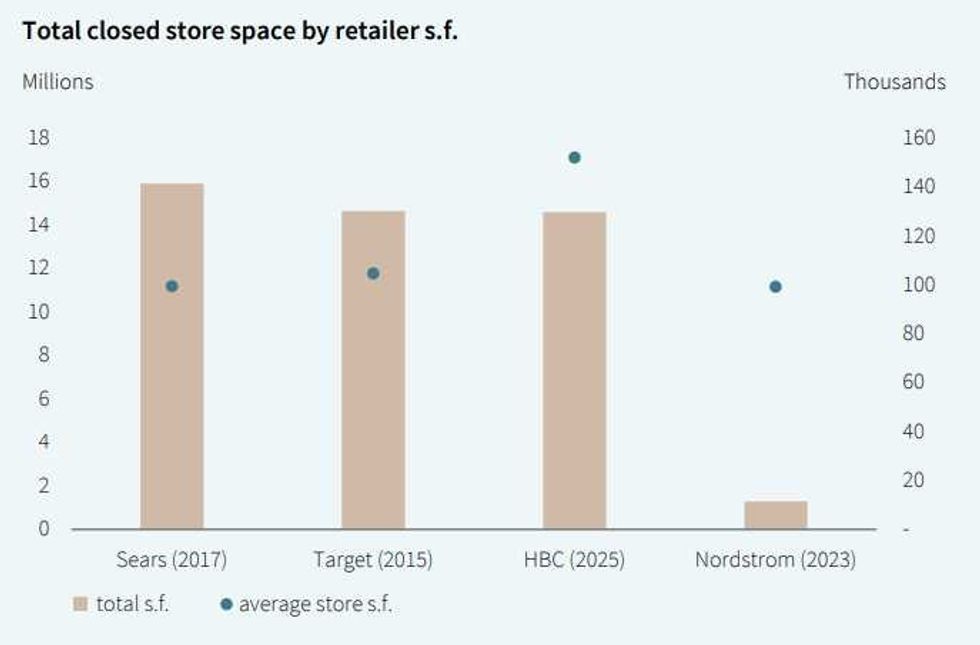

Hudson’s Bay vacated about as much space as Target did in 2015. (JLL)

Hudson’s Bay vacated about as much space as Target did in 2015. (JLL)