For the third month in a row, new statistics from the Canadian Real Estate Association (CREA) show that real estate, on a national basis, is yet to really wake up from its interest-rate-induced slumber

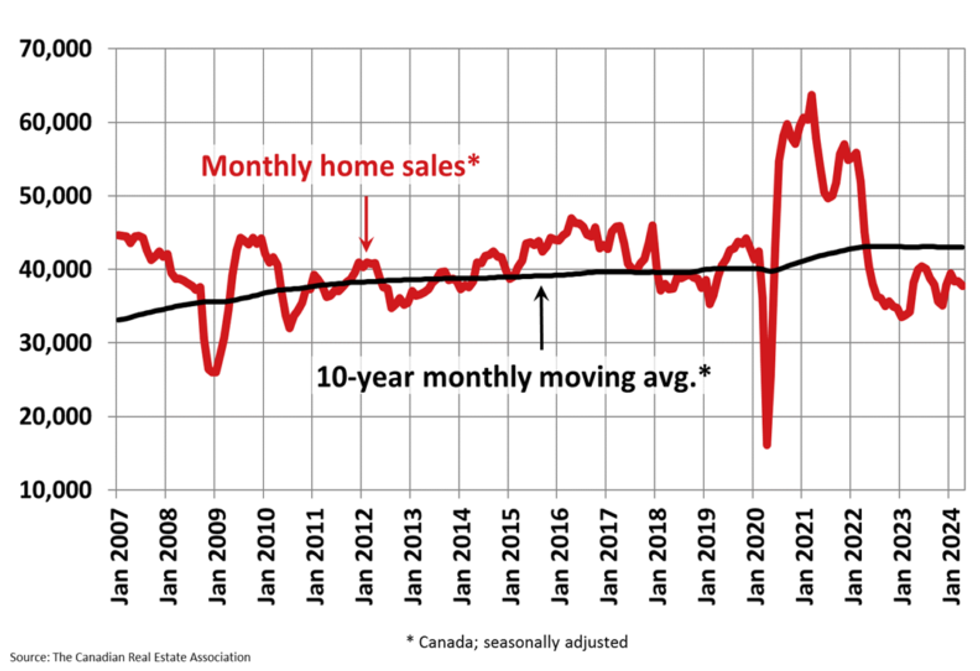

CREA reported on Wednesday that Canadian home sales actually lost some steam between March and April 2024, with the number of sales recorded through the MLS® Systems dipping by 1.7% and clocking in slightly below the average of the last 10 years.

The previous rendition of CREA’s data, released in mid-April, showed a nominal 0.5% month-over-month rise in sales in March. The month prior to that, the month-over-month dip came in at 2.7%.

Circling back to this month’s figures: the number of newly listed homes edged up 2.8% between March and April. At the same time, “slower sales amid more new listings resulted in a 6.5% jump in the overall number of properties on the market, reaching its highest level since just before the onset of the COVID-19 pandemic,” Wednesday’s report notes.

That 6.5% also marked “one of the largest month-over-month gains on record, second only to those seen during the sharp market slowdown of early 2022.”

CREA’s Senior Economist Shaun Cathcart points out that it’s been quite an atypical April for Canadian real estate. “April 2023 was characterized by a surge of buyers re-entering a market with new listings at 20-year lows, whereas this spring thus far has been the opposite, with a healthier number of properties to choose from but less enthusiasm on the demand side,” Cathcart says.

On a not-seasonally-adjusted basis, the number of home sales ended April 2024 just over 10% the level recorded in April 2023. However, the report notes that “a significant part of that gain likely reflected the timing of the Easter long weekend.”

Meanwhile, as a product of slower sales and a spike in listings, April saw the national sales-to-new listings ratio come down to 53.4%, putting the market in “balanced” territory. For some context: the long-term average for the national sales-to-new listings ratio is 55%.

On the inventory front, there were 4.2 months of inventory on a national basis at the end of April 2024 — the highest level recorded since the onset of the pandemic. That figure was also up from 3.9 months at the end of March.

“After a long hibernation, the spring market is now officially underway. The increase in listings is resulting in the most balanced market conditions we’ve seen at the national level since before the pandemic,” says James Mabey, who is the newly appointed Chair of CREA’s 2024-2025 Board of Directors

“Mortgage rates are still high, and it remains difficult for a lot of people to break into the market but, for those who can, it’s the first spring market in some time where they can shop around, take their time and exercise some bargaining power. Given how much demand is out there, it’s hard to say how long it will last.”

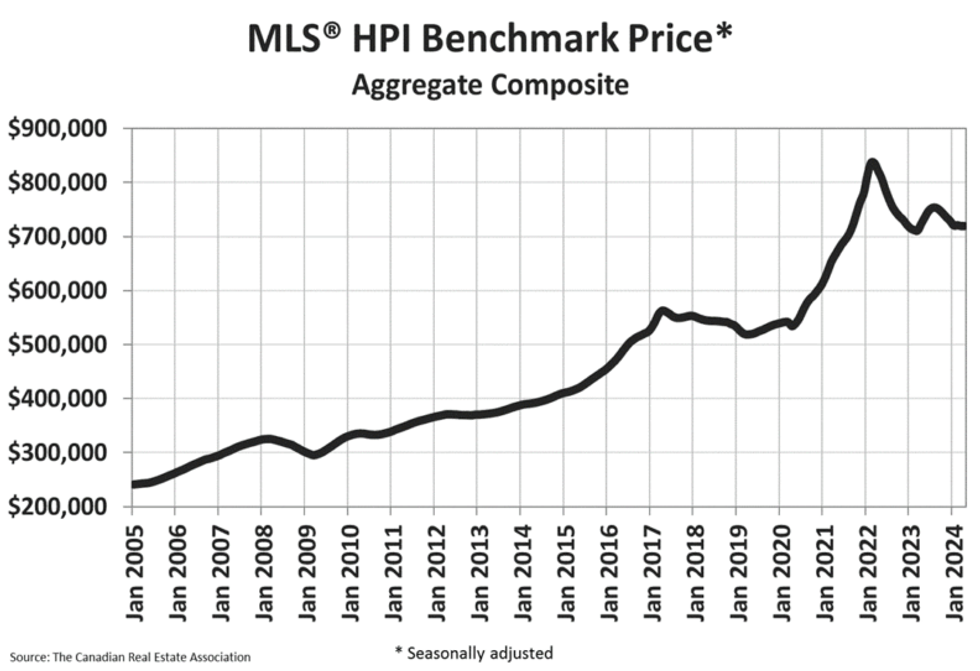

Without the usual spring flurry of sales, the National Composite MLS® Home Price Index (HPI) was unchanged between March and April, marking the third month in a row of “mostly stable prices.”

The not-seasonally-adjusted HPI slipped 0.9% year over year, representing the first decline since July 2023. “This mostly reflects how prices took off last April, something that has not yet been repeated in 2024,” the report explains.

Meanwhile, the actual national average home price came in at $703,446 last month, down 1.8% on an annual basis.

Wednesday’s report additionally notes that “prices are generally sliding sideways” at regional levels. “The exceptions remain Calgary, Edmonton, and Saskatoon, where prices have steadily ticked higher since the beginning of last year.”