Despite some speculation in recent months that Canadian housing markets were in for a frenzied spring, new data from the Canadian Real Estate Association (CREA) shows that both home sales and prices were “mostly unchanged” between February and March 2024.

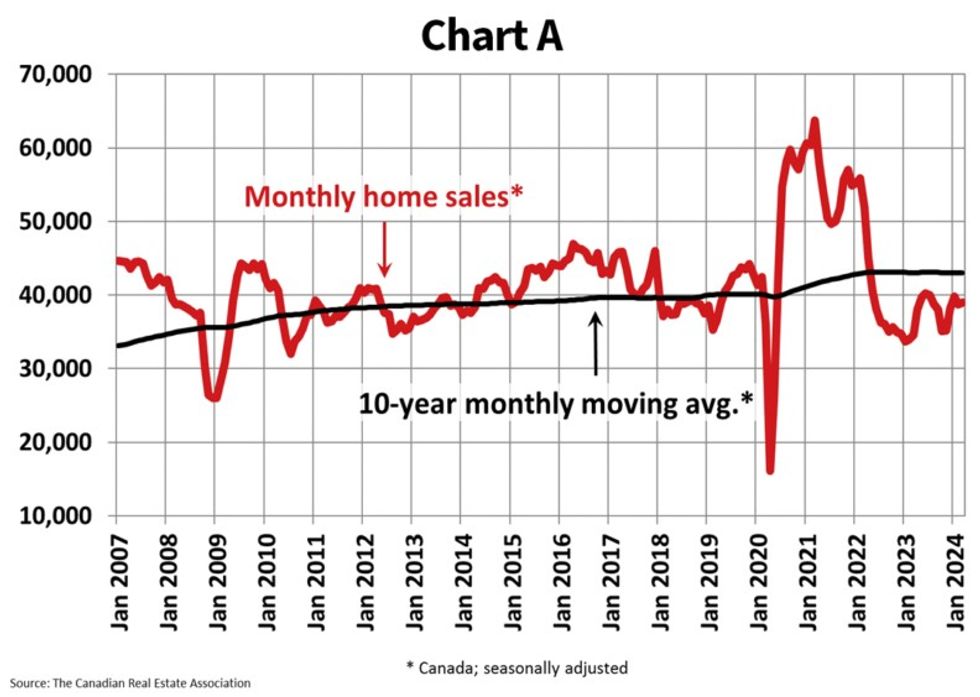

According to CREA’s data, which came out on Friday, home sales recorded across Canada edged up 0.5% month over month in March, but remained around 10% below the 10-year average for the metric.

Meanwhile, the actual (not seasonally adjusted) number of transactions ended up 1.7% above March 2023’s level. “That was a much smaller gain than those recorded in the previous two months, although a part of that does reflect a mostly inactive market during the Easter long weekend,” CREA noted.

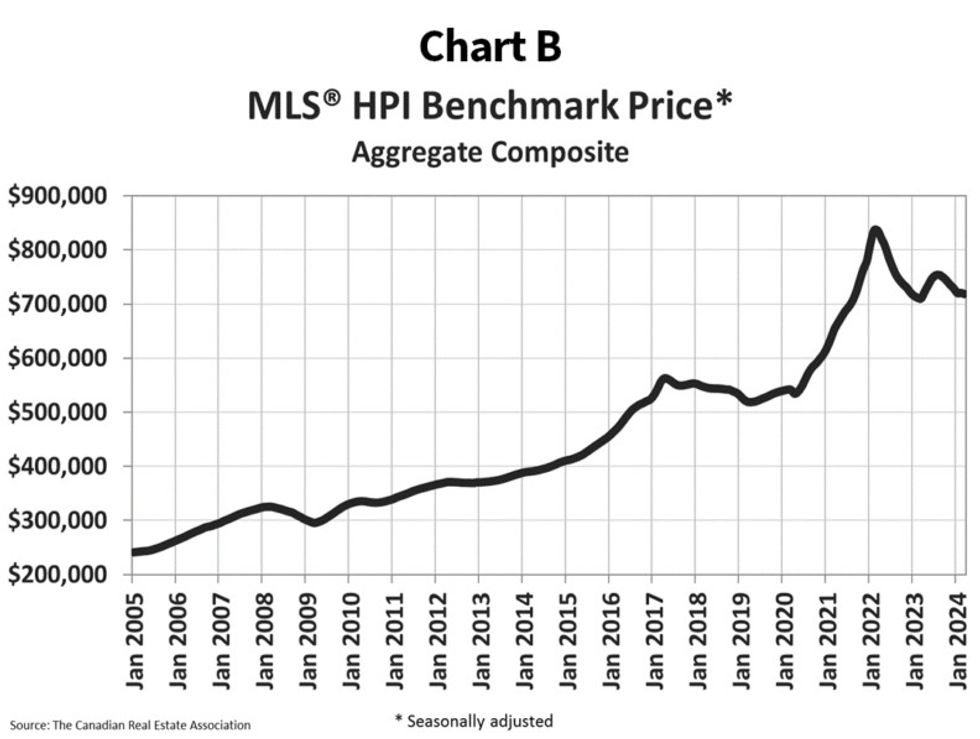

On the price side: the National Composite MLS® Home Price Index dipped nominally, but just 0.3% on a monthly basis.

According to CREA Senior Economist Shaun Cathcart, last month’s figures should be taken with a grain of salt.

“We’ll have to wait for the April data to really understand how buyers are responding to all these new properties for sale, but if you look at last spring as a guide and add to that record population growth in the last year and a central bank that is far more likely to cut this summer than raise like it did last year, it could get interesting,” he said. “Will the story be high interest rates keeping a lot of people on the sidelines this year, or the much expected and anticipated first rate cuts enticing a lot of people back into the market? Probably a bit of both.”

Though the number of newly listed homes slipped by 1.6% between February and March 2024, CREA noted that “weekly tracking” told a different story. And more specifically, the board said that “a bounce in new supply” around the second week of March led to “a burst of sales” by the end of the month and “a jump in listings” by the first week of April.

“With sales edging up and new listings falling in March, the national sales-to-new listings ratio tightened to 57.4%,” CREA also said. “The long-term average for the national sales-to-new listings ratio is 55%. A sales-to-new listings ratio between 45% and 65% is generally consistent with balanced housing market conditions, with readings above and below this range indicating sellers’ and buyers’ markets respectively.”

CREA also released its updated forecast for home sales activity and average home prices on Friday, and according to that, interest rates will continue to dictate the way Canadian housing markets move in 2024 and 2025.

“Many Canadian housing markets have been quiet since the Bank of Canada’s summer rate hikes last year. Interest rates have been the major factor affecting markets over the last few years, and this is expected to continue to be the case in 2024 and 2025,” the forecast said. “Expectations around the timing of the first rate cut in 2024 seem to have solidified to the second half of the year, and financial markets are currently pricing in about 50 basis points of cuts by the end of 2024.”

CREA’s stance is that markets could already be “gearing up” given the aforementioned “weekly tracking,” and that some 492,083 residential properties are expected to trade hands over the course of 2024.

That figure, which is “mostly unchanged” from CREA’s previous forecast, would mark a 10.5% increase from 2023.

In addition, CREA’s expectation is that national home prices will edge up 4.9% on an annual basis to $710,468 over 2024, while sales will jump 7.8% to 530,494 units in 2025 “as interest rates continue to decline and approach more normal or ‘neutral’ levels.”

In addition, the national average home price is forecasted to increase by 7% from 2024 to $760,120 in 2025.