As we head into the holiday spending season, Canadians have been giving their credit cards a workout, which has helped push overall consumer debt to $2.2T -- yes, as in trillion.

But it's not solely credit card activity adding to the rise in consumer debt, mortgage growth was also a key contributor, according to Equifax Canada’s most recent report on consumer credit trends and insights report.

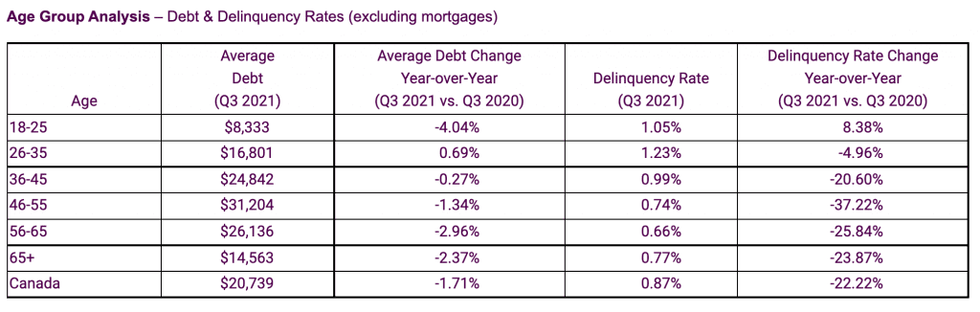

During 2021's third quarter, increasing credit activity in tandem with mortgage growth pushed the overall consumer debt up to $2.2 trillion, an increase of 7.8% when compared to Q3-2020. On an individual basis, the average consumer debt (excluding mortgages) is now $20,739, a drop of 1.7% when compared to Q3-2020.

“The good news is that we saw higher payments and a large fall in non-mortgage consumer debt during 2020 due to government support mechanisms, increased saving levels and reduced credit demand,” said Rebecca Oakes, AVP of Advanced Analytics at Equifax Canada. “Average non-mortgage debt is still below pre-pandemic levels but it has been gradually increasing throughout 2021”.

READ: Disputes Are Costing the Global Construction Industry a Shocking Amount of Time and Cash

New mortgage growth eased in the third quarter, with a modest 7.7% year-over-year increase, unlike the last two quarters, which saw over 20% growth in new mortgages compared to the pre-pandemic period.

However, the lower volume in mortgage growth has not resulted in lower loan amounts. According to the report, the average loan amount for new mortgages increased again by 18.3% year-over-year and 1.4% quarter-over-quarter and now stands at $360,000.

“Future interest rate movements will not only have an impact on consumers with variable interest rate products in the short term but also could put pressure on some homebuyers with fixed interest mortgages in future years,” Oakes cautioned.

“Consumers who took advantage of very low rates over the last 18 months on high-value mortgages may feel pressure at the end of their term when they have to renew their mortgage at a much higher rate.”

During the same period, Equifax said the average monthly credit card spend per credit cardholder was up by 3.9% when compared to the pre-pandemic period of Q3-2019, mostly driven by younger consumers under the age of 35.

However, the growth in spending didn't translate into an inability to pay off credit card balances; in fact, the average monthly payment per consumer increased. For every dollar spent, consumers made payments of $0.97 in the last quarter, meaning the impact on the overall card balance is still relatively small. When compared to Q3-2020, credit card balances are 1.9% lower.

The report did have some positive news, the 90+ day delinquency rates for both mortgage and non-mortgage products continued to decrease in Q3-2021, down by 28.5% and 22.2% respectively, when compared to Q3-2020.

In total, the average consumer debt (excluding mortgages) dropped again this quarter to $20,739, which is a year-over-year decrease of 1.71% from Q3-2020.

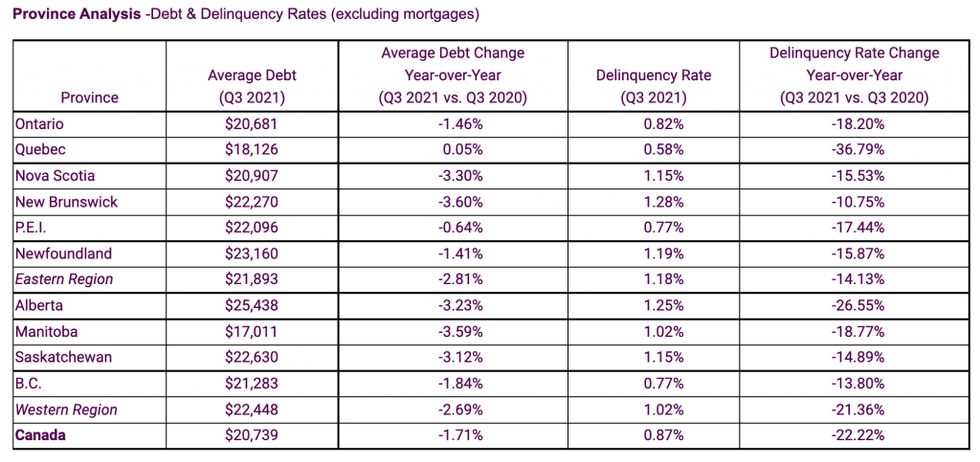

While delinquency rates for both mortgage and non-mortgage products are trending downward, there are some telling variations across cities and provinces. Most provinces and cities have shown a decline in mortgage delinquencies except for Toronto and Montreal.

Canada's largest city showed a slight 0.47% increase to $19,609 in average annual debt change compared to Q3-2020, while Montreal showed the biggest rise with a 2.15% increase to $15,912 compared to the previous year.

“Government support has been a boon for many financially stressed consumers who have managed to pay off their debts in time,” added Oakes.

However, Oakes said she expects there will likely be a rise in delinquency rates in the coming months as government benefits came to an end in October for most consumers.