In major Canadian markets, the commercial tax burden is weighing heavily.

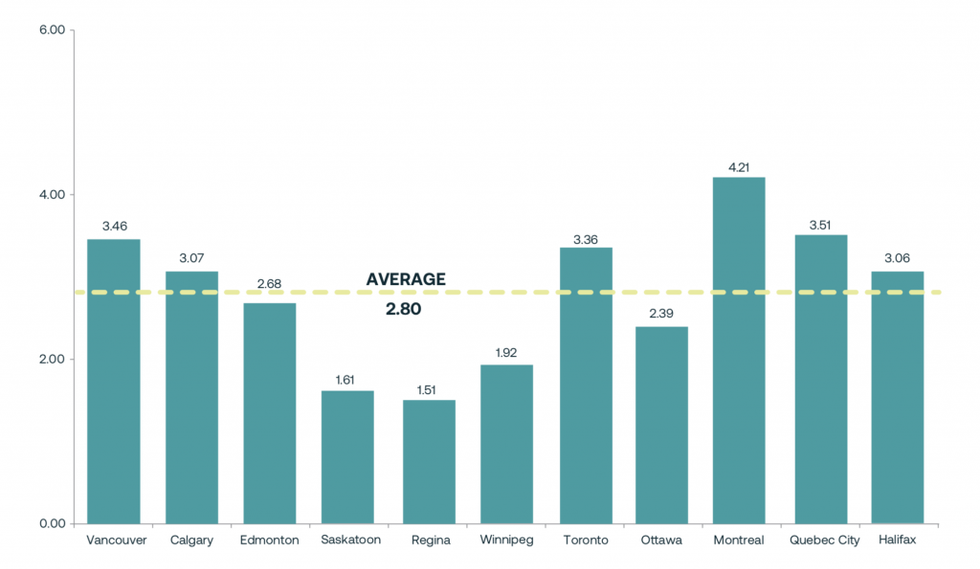

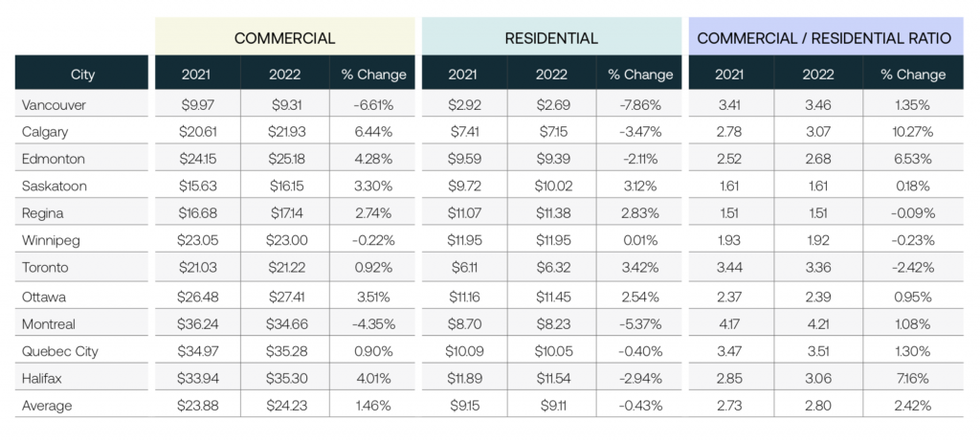

This is according to the latest Canadian Property Tax Rate Benchmark Report from Altus Group, which revealed that, nationally, the average commercial-to-residential ratio has risen to 2.80 in 2022, up 2.42% from 2021, when the average ratio was 2.73.

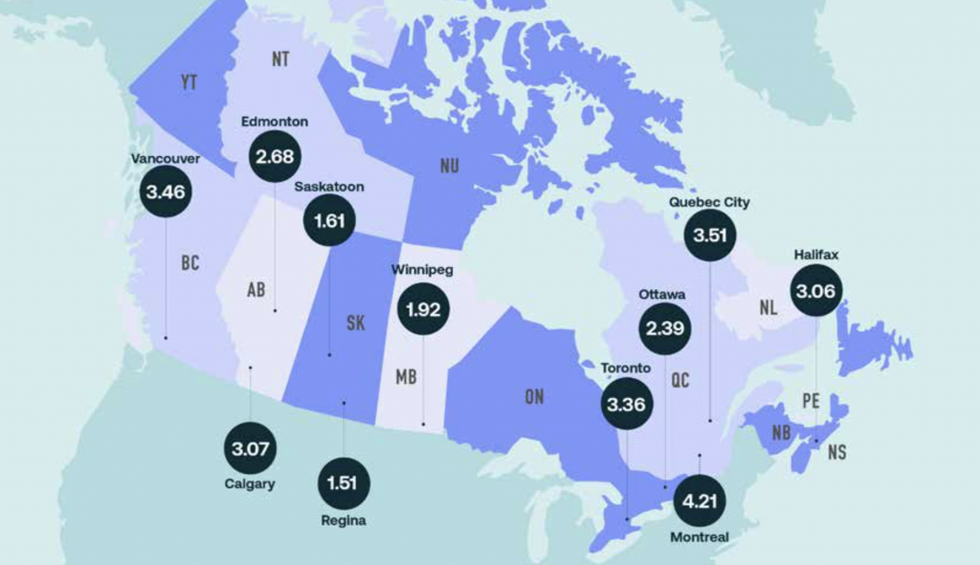

Although the commercial-to-residential ratio clocks in at more than 2.50 in seven out of the 11 markets examined, Calgary, Edmonton, and Halifax -- where the ratio increases ranged from 6.5% to 10.27% -- have driven the increase in the national average.

The commercial-to-residential ratio measures the residential tax rate against the commercial tax rate. For instance, a ratio of 2.50 indicates that the commercial tax rate outweighs the residential tax rate by two-and-a-half times. Altus’s report considers the residential tax rates of primary residences only.

Of all markets examined in Altus’s report, Calgary has seen the steepest commercial-to-residential ratio increase of 10.27% year over year, now sitting at 3.07. Edmonton’s has climbed by 6.5% to 2.68. The rise in both markets' ratios can be attributed to reductions in commercial assessment bases, which have led to increases in commercial tax rates. Meanwhile, the residential rates in both markets have seen nominal growth -- if any.

Halifax has also seen a significant increase in its commercial-to-residential ratio, jumping 7.16% from 2021 to 3.06. This is due to the fact that the Halifax Regional Municipality has increased the commercial tax rate and dropped the residential rate.

Montreal and Quebec City have the two highest commercial-to-residential ratios of any other market in the report, seeing an increase of 1.08% to 4.21, and 1.30% to 3.51 respectively. Both markets have seen the ratio trend above the national average for the past several years.

Vancouver has the third-highest ratio at 3.46, and that figure is up 1.35% since 2021. Although Vancouver has the lowest commercial and residential tax rates of any city considered in Altus’s data, the rate of taxation for residential properties has dropped further than the commercial rate, contributing to the current ratio.

Meanwhile, Ontario is in the midst of a second-straight year of assessment freeze, with assessments continuing to be based on 2016 valuations.

Nonetheless, Ottawa has seen its commercial-to-residential ratio increase nominally by 0.95% to 2.39, while Toronto's ratio has dropped 2.42% to 3.36 -- the most substantial reduction in the survey and a clear indication that the market is continuing to “move toward tax equity, increasing the tax rate for residential properties by a higher percentage than commercial,” according to Altus’s report.

Saskatoon, Regina, and Winnipeg also saw their ratios decline to 1.61, 1.51, and 1.92 respectively. These are the lowest ratios in the survey.

With commercial tax rates outpacing residential in most major Canadian markets, Kyle Fletcher, President of Property Tax Canada at Altus Group, puts the onus on governments, saying that proactive measures need to be taken to “address the value shifts without increasing inequities between commercial and residential taxpayers.”

“There are two factors that drive property taxes -- assessed values and municipal revenue requirements. To achieve equitable taxation and to support economic recovery, governments like Ontario’s need to embrace more frequent reassessment to keep up with market changes, and municipalities need to move away from policies that shift a greater portion of the tax burden to commercial properties.”