On Wednesday, in accordance with British Columbia's Financial Information Act, the City of Vancouver published its annual Statement of Financial Information (SOFI) report, which shows that the City saw a significant increase in revenue from property taxes, but an equally-significant drop-off in revenue from developer Community Amenity Contributions (CACs).

The SOFI report was prepared using Canadian public sector accounting standards, was independently audited by KPMG, and includes details about the City's financials for 2022, such as the City's various revenue streams, liabilities, and debts.

In 2022, the City of Vancouver saw a total of $2.452B in revenue, compared to $2.353B in 2021. The City says that much of that revenue can be attributed the re-opening of various facilities and program after the COVID-19 pandemic, as well as increased revenue via property taxes, the Empty Homes Tax (EHT), and investment income.

Major revenue increases from 2021 to 2022 include:

- A $73.5M increase in property taxes and utilities as part of annual rate increases;

- A $51.8M increase in program fees as a result of the resumption of the PNE, annual fair, civic theatre event bookings, parks admissions, and community center activities;

- A $42.5M increase in EHT rate increase;

- A $27.2M increase in investment income due to favorable interest rate returns; and

- A $12.5M increase in parking revenue recovery.

Total revenue from property taxes reached $1,082,144,000 in 2022, compared to $982,108,000 in 2021. Of that nearly $100M increase, approximately $73.5M was the result of the 6.35% property tax rate increase for 2022.

READ: Here's How Much 10 BC Municipalities Are Raising Property Taxes This Year

Somewhat more notable are the revenues that decreased, which include:

- A $36.1M decrease in government transfers including reduction in CMHC Rapid Housing Initiative grant for the purchase of hotels to be converted to affordable housing; and

- A $75M decrease in contributed assets for land and buildings from developers for childcare and affordable housing.

The total revenue the City of Vancouver received from developer CACs in 2022 was $309,948,000 compared to $384,949,000 in 2021. The $75M year-over-year decrease essentially cancels out the $73.8M increase in property tax revenue. Revenue from licensing and development fees did increase slightly, however, from $112,415,000 in 2022 to $110,806,000 in 2021.

Developer CACs, which can be straight cash considerations or tangible amenities such as public spaces or childcare facilities, are charged by the City of Vancouver, and other municipalities, for projects that require rezoning, which means that a decrease in CACs revenue does not necessarily equate to a decrease in development activity.

The City of Vancouver is also currently in the process of restructuring how it charges CACs, with proposed changes expected to be presented to council in April.

READ: Vancouver High-Rise Development Fees 2X Surrey, 6X Burnaby, Highest In Canada

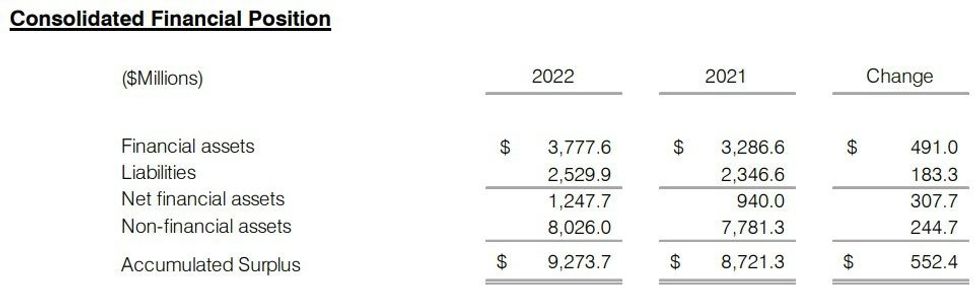

All in all, as of December 31, 2022, the City has a total financial position of approximately $9.27B, with the bulk of that position ($8.03B) courtesy of its non-financial assets. That position is an improvement of $552.4M compared to 2021, as a result of overall asset improvement and decreased liabilities.

Late last month, after a last-minute amendment by Mayor Ken Sim, the City of Vancouver approved its budget for the coming year, which included a 10.7% property tax rate increase for 2023.