Rising interest rates and deteriorating affordability have led a record-high number of Canadians to believe that they will never be able to buy a home.

A new survey from Mortgage Professionals Canada (MPC) found that 33% of non-homeowners don't think they will ever be able to purchase a primary residence -- a "record-high" number, MPC said. The figure grew 8% in six months, and was up 15% from a year ago.

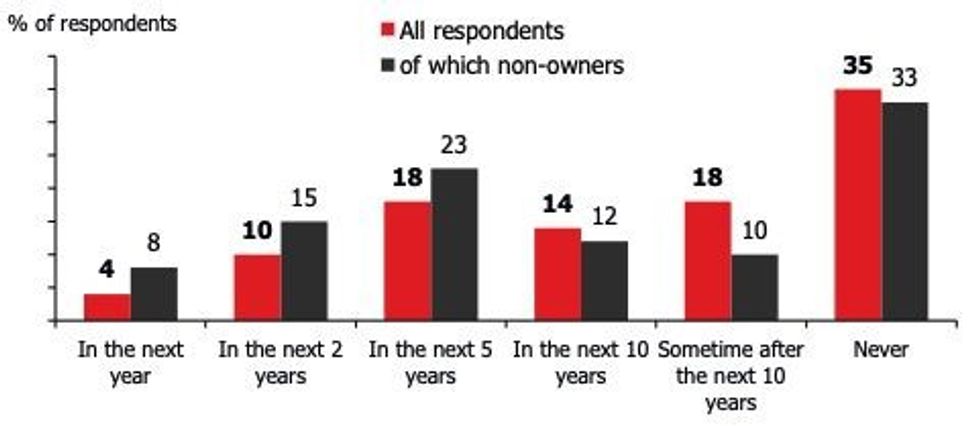

Only 23% of non-owners plan to buy a home within the next five years, and just 15% intend to buy in the next two years.

Timing Of Purchase Of Primary Residence

"Canada's housing market has undergone a dramatic shift since the middle of 2022, with home prices down and interest rates up significantly," MPC's 2022 Year-End Consumer Survey reads.

Said rapid rise in interest rates -- from 0.25% in March 2022 to 4.50% in January 2023 -- is a growing concern. Nearly 60% of survey respondents said they were anxious about inflation and their family's finances -- a 20% increase in just six months.

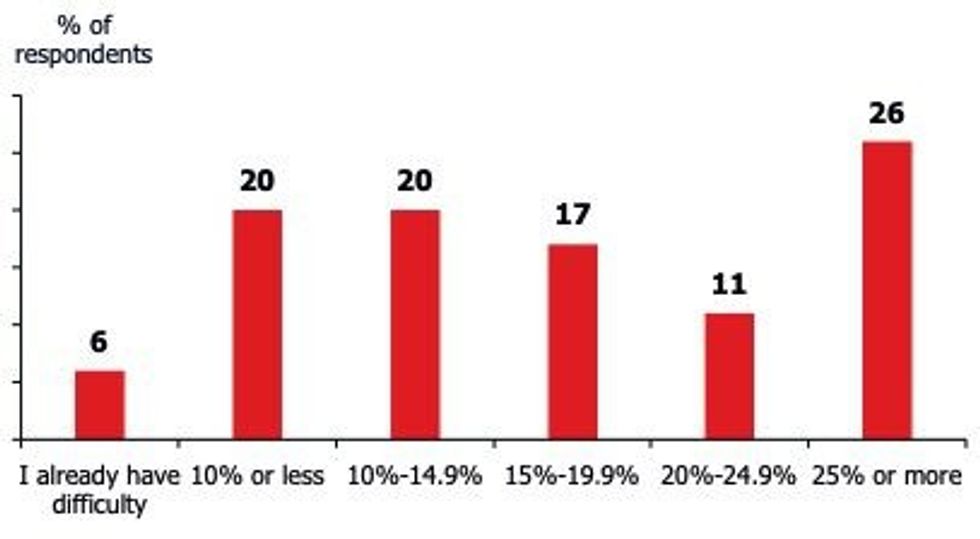

Nearly 6% said they are having trouble making their monthly mortgage payments; the figure rises to 14% amongst first-time buyers. Twenty percent of respondents said they'd struggle to afford their mortgage if their payments increased by 10% or less.

Mortgage Increase That Would Cause Payment Difficulties

Oxford Economics, the company that conducted the survey on behalf of MPC, believes that the residential mortgage market will remain under "intense downward pressure" until mid-2024.

The firm expects a 30% peak-to-trough decline in housing prices by year-end 2023. Despite the decline, roughly half of which has already occurred, higher mortgage costs have led to a "broad deterioration of affordability" across Canada.