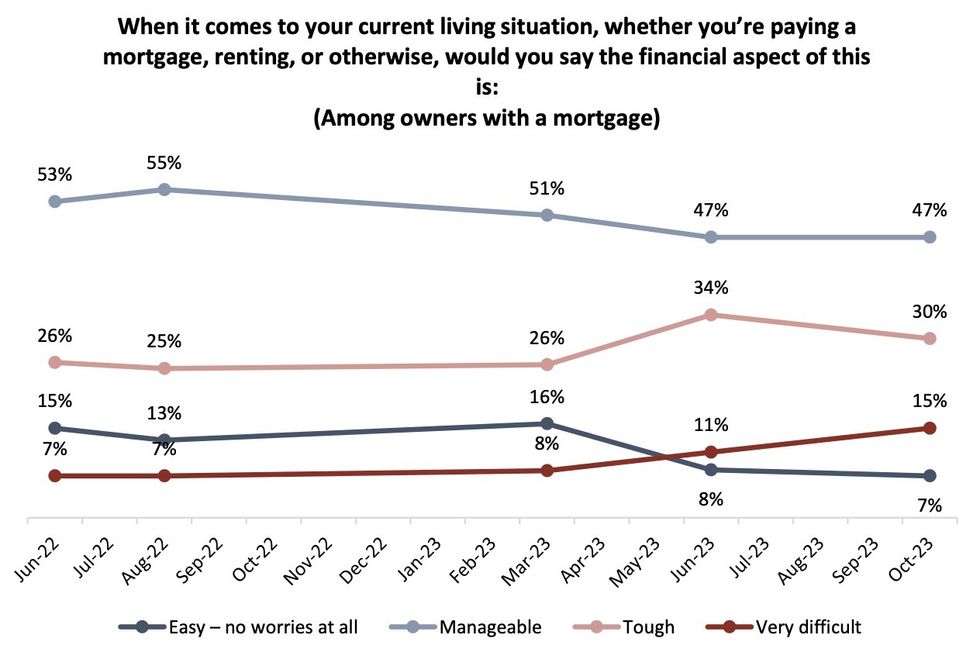

Since March, the Bank of Canada (BoC) has raised interest rates twice, and the number of homeowners struggling to afford their monthly mortgage payments has doubled.

According to a new survey from the Angus Reid Institute, 15% of Canadian mortgage holders find the financial aspect of their living situation "very difficult," compared to just 8% in March.

A further 30% describe meeting such financial commitments as "tough," a figure that stood at 26% in the spring. Encouragingly, 47% of respondents find their monthly mortgage payments manageable, although the number has fallen from 51% in March.

The survey was conducted online in early October and included responses from 1,878 Canadian adults.

Although the BoC has now opted to pause for two consecutive rate announcements, and economists predict cuts will begin next spring, interest rates remain significantly higher than when many mortgage holders agreed to their terms.

Between 2018 and 2020, the policy rate hovered between 1% and 2%. Following the onset of the pandemic, the BoC slashed rates to 0.25% and promised to keep them "low for a long time." But in March 2022, the bank began rapidly raising rates, which currently sit at 5%.

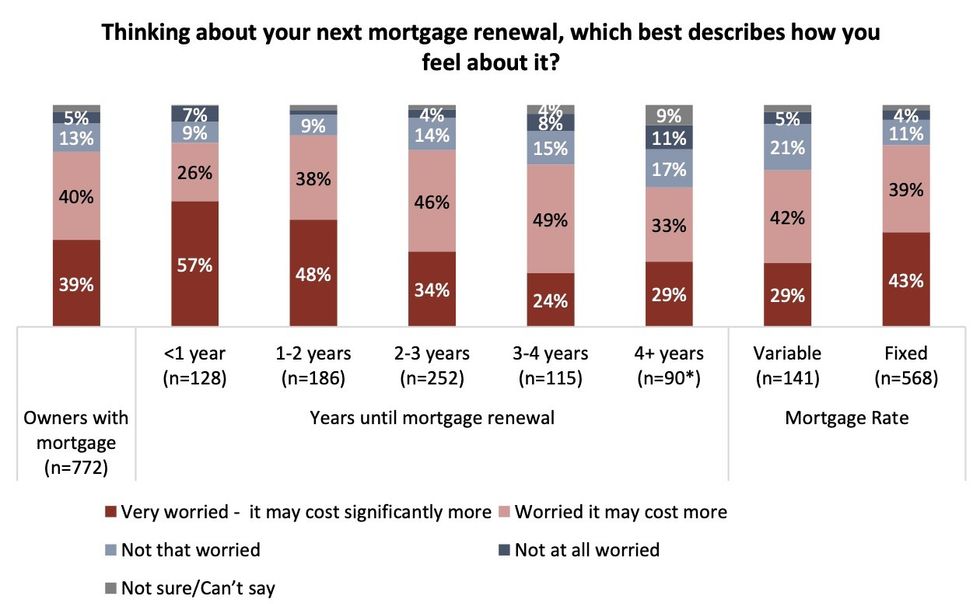

With the most common mortgage term in Canada being five years, homeowners who locked in at low rates are now staring down the barrel of renewal.

Based on Angus Reid’s Economic Stress Index, half of Canadians with a year or less left on their mortgage term are already struggling financially. Fifty-nine percent already find their monthly payments difficult to manage, and 57% are "very worried" that their payments will cost significantly more upon renewal.

Of those with one to two years left on their mortgage term, 48% are very worried at the prospect of renewal, and 46% find it tough or very difficult to make their payments every month.

Between impending renewals, high interest rates, and the ever-increasing cost of living, household debt is a significant source of anxiety for mortgage holders.

Sixty-five percent of all respondents said their household debt level was a source of stress, but the figure rises to 81% amongst those with a mortgage — 33% of which cite it as a "major" cause for concern. Just 7% of mortgage holders have no debt, compared with 44% of homeowners with no mortgage.

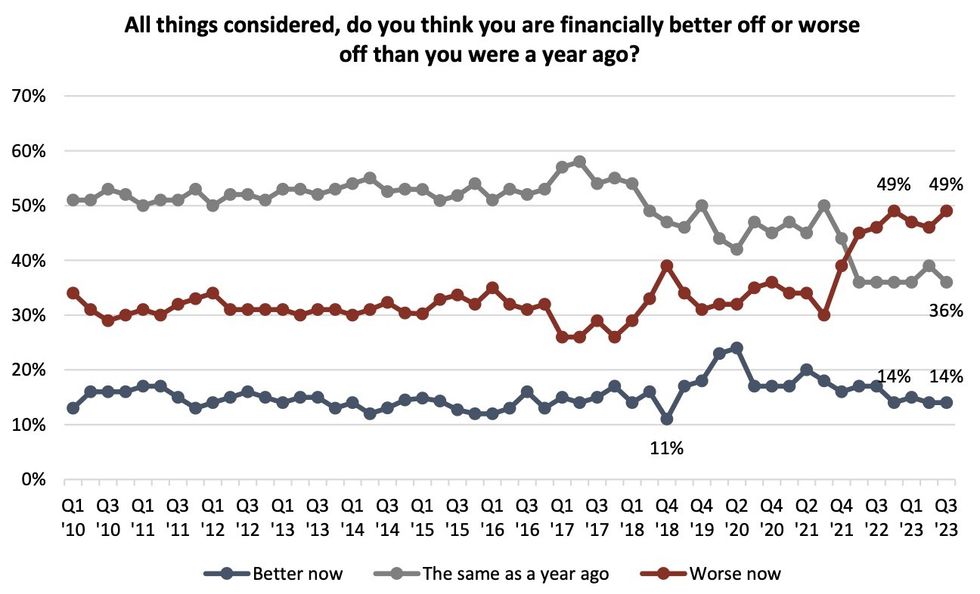

Mortgage or no mortgage, 49% of Canadians feel they are worse off financially today than they were a year ago; 35% believe they will be in an even worse situation a year from now. Both figures tie record-highs seen over 13 years of Angus Reid data.