After a year of "record-breaking," "unprecedented," and "all-time" highs and lows — whether it be in housing starts, condo listings, home sales, or some other metric of our topsy turvy housing market — the fall season has arrived, bringing with it built-up inventory and the promise of lower interest rates.

These exciting conditions have led real estate listings site Zoocasa to ask the big question: "Will pent-up demand [finally] lead to a busy fall market?"

In their Fall 2024 Housing Market Predictions report, Zoocasa reflects on this year's relatively sleepy spring — a time of year when markets are typically hot — highlighting that though a surplus of new listings meant buyers could leisurely browse for homes, the knowledge that lower rates were in their future kept them "on the sidelines."

Following months of rising inventory and three consecutive rate cuts that still haven't quite lit the metaphorical flame under the housing market, we will likely see prices drop even lower this fall, Zoocasa predicts. “Increased supply continues to exert downward pressure on prices, even as the Bank of Canada lowers rates,” says Lauren Haw, Broker of Record and Industry Relations Officer at Zoocasa.

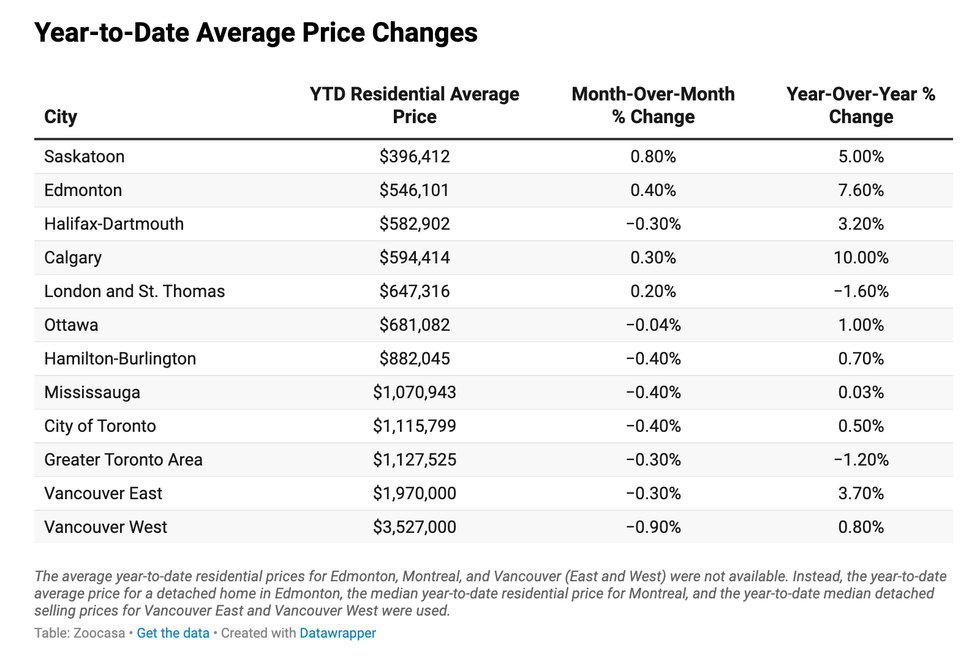

But Haw also warns that low fall prices can often be misleading. “Typically, larger and more desirable homes — often more expensive — are listed in the spring to facilitate moving before a new school year. Consequently, this seasonal pattern can make average prices appear lower in the fall.” Still, Zoocasa notes that several major markets are seeing year-over-year drops in average prices, notably in the Greater Toronto Area and other cities in southern Ontario.

Year over year, condo prices in the GTA have seen a 2% decline, while townhouse prices dropped 1% and detached homes ticked down 0.1%. In Hamilton-Burlington, townhouse and detached home prices saw even more dramatic declines of 5% since July 2023. And in London, that number jumped to 6.2%. But elsewhere, as in Calgary, Edmonton, and Saskatoon, prices are on the rise, with increases of 10%, 7.6%, and 5% respectively.

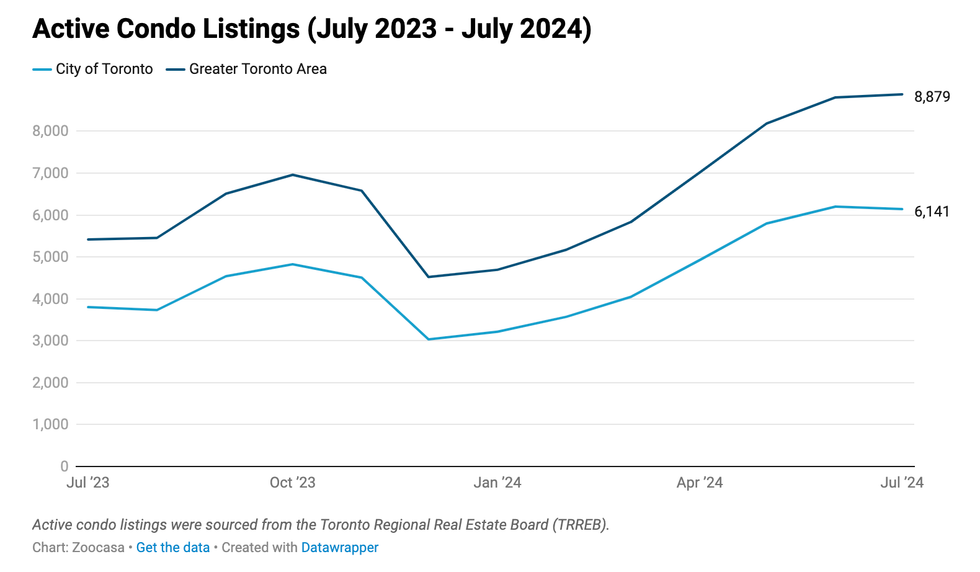

Despite lower prices, Zoocasa is also predicting that condo inventory will continue to rise, hitting "all-new highs" come fall. “We’re seeing condo inventory reach unprecedented levels, driven by a surge in newly registered buildings, many of which are investor-owned, along with an increase in resale units,” says Haw. “Buyers can expect a more diverse selection and greater negotiating power as the market becomes increasingly saturated.”

So, good news for condo buyers, bad news for investors, which has been the narrative for some time now, according to Zoocasa. "As interest rates have increased over the past three years, the cost of holding onto investment properties, like condos, has also increased." As a result, landlords have struggled to cover costs, with many being cashflow negative, ultimately leading to a sharp increase in condo listings, especially in Toronto.

Year over year, condo listings in the GTA increased by a whopping 63.9%, and in Toronto, they rose 61.5%. Similar trends were seen in London, Hamilton-Burlington, Vancouver, Ottawa, and Mississauga, where listings saw year-over-year increases of 40%. Of the major city centres, Quebec City was the only one to see a decrease in listings (-12%) between July 2024 and July 2023.

With condo inventories on the rise, average prices on the decline, and rates dropping almost every month, you might think the house of your dreams will be ripe for the picking come fall. But Zoocasa is keeping things real. "Competition for desirable homes will remain fierce," they predict. This is largely because inventory owned by boomers reluctant to give up their homes, i.e., detached or semi-detached homes with yards and space for a young family, will remain tight.

“In highly sought-after school districts, where inventory remains low, boomers are holding off on selling their retirement homes, leading to pent-up demand for family-sized, move-up properties," says Haw. “The most desirable homes — those that are move-in ready, with good layouts, easy parking, and access to schools and transit — will continue to attract multiple offers."

For instance, in High Park North, Junction, and Runnymede, which has more than 12 public schools and five Catholic schools, homes sold for an average of $105,397 above the average list price, found Zoocasa. So if you're shopping school-centric areas, they recommend acting "sooner rather than later" before demand picks up.

The final morsel of wisdom Zoocasa has to impart on homebuyers as we head into the fall season: invest in two- to four-unit multi-residential properties.

“With many investors over-leveraged and facing the challenge of rents not covering new mortgage payments, we expect to see more duplexes, triplexes, and fourplexes coming to market at competitive prices,” explains Haw. “Not only might you secure a larger property at a discount compared to other single-family homes in the area, but the potential for rental income can also make it easier to manage your mortgage.”

In the GTA, listings for these types of properties increased by 19.5% between August 2023 and August 2024, and in Toronto, multi-residential property listings have increased by 28%, found Zoocasa. "First-time homebuyers may find that their dollar goes further when qualifying for a mortgage that includes rental income potential."