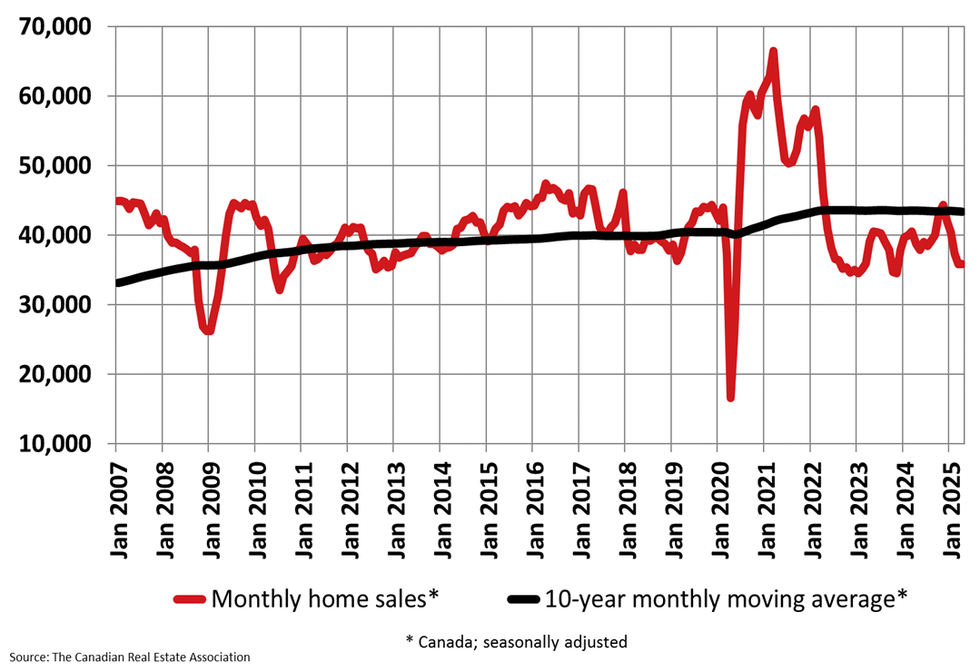

Although Canadian housing markets didn’t get the bustling start to spring that lower interest rates at one point seemed to promise, new national data shows that May brought a slight rally in activity. According to the Canadian Real Estate Association (CREA), sales edged up 3.6% between April and May, marking the first rise since November.

“May 2025 not only saw home sales move higher at the national level for the first time in more than six months, but prices at the national level also stopped falling,” said CREA Senior Economist Shaun Cathcart in a press release. To Cathcart’s point, the national composite home price index slipped just 0.2% month over month, “on the heels of three straight month-over-month declines of closer to 1%.”

“It’s only one month of data, and one car doesn’t make a parade, but there is a sense that maybe the expected turnaround in housing activity this year was just delayed for a few months by the initial tariff chaos and uncertainty,” Cathcart also said.

Without adjusting for seasonal effects, the composite index was down 3.5% over May 2024. While, without seasonal adjustment, the national average home price last month was $691,299, marking a 1.8% decline year over year.

On the supply front, CREA reports that there were 201,880 active listings on the MLS systems by the end of May, and that figure is up 13.2% year over year, but down 5% compared to the long-term average of around 211,500 listings for the month.

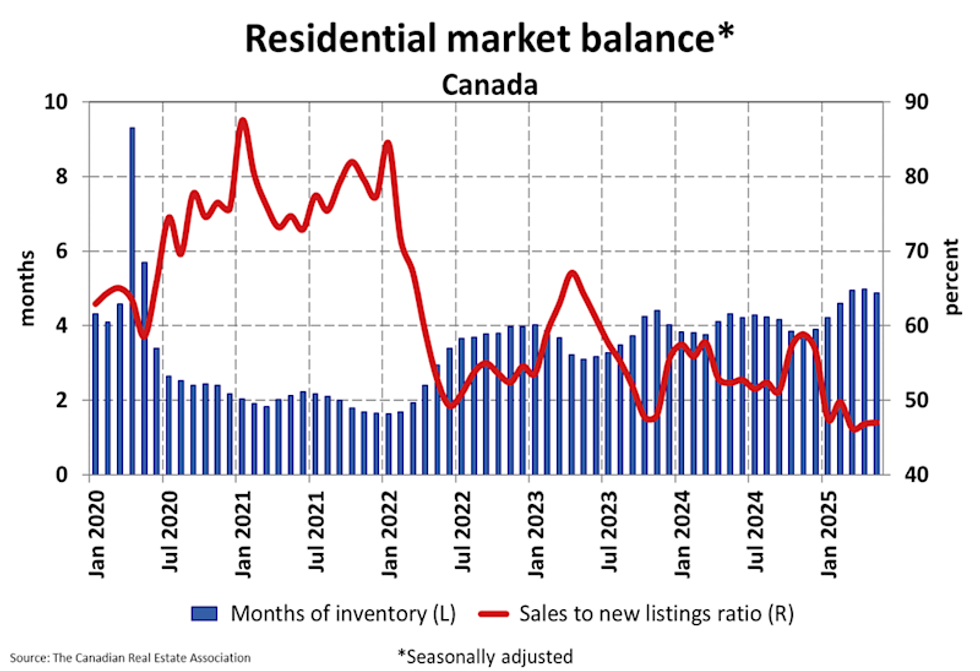

Meanwhile, the two metrics used to ascertain whether the market is in buyers’, sellers’, or balanced territory showed a slight shift in favour of sellers. For one, the sales-to-new-listings ratio was 47% in May, after coming in at 46.8% in April. By CREA’s definition, a ratio below 45% points to a buyers’ market, while a ratio above 65% suggests a sellers’ market. The long-term average for the metric is 54.9%.

The other indicator of market balance (or lack thereof) is months of inventory, and that metric clocked in at 4.9 months at the end of last month. CREA considers anything over 6.4 months to be a buyers’ market, and anything below 3.6 months to be sellers’ territory. The long-term average is five months of inventory.

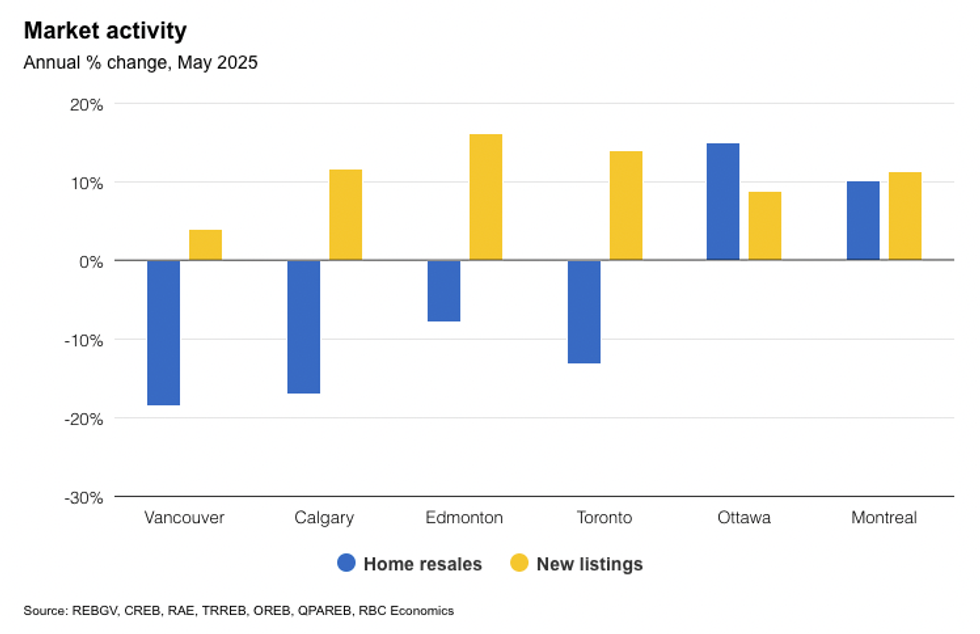

Coming back to the national uptick in sales, CREA notes that it was led by activity in the Toronto Area, Calgary, and Ottawa. This is reflected in a recent report from RBC Economist Robert Hogue, which says that “the number of transactions partially rebounded from significant declines earlier this year” in those three markets, as well as in Edmonton, the Fraser Valley, Saskatoon, and Regina.

In his report, Hogue zeroes in on Calgary, where resales rebounded over 8% on a monthly basis in May, and Toronto, where resales rose 8.4%. However, also reflected in the report are the astronomical level of listings in some of these ‘rebounding markets,’ which is bound to temper any price growth and keep conditions buyer-friendly until the inventory can be absorbed.

Taking Toronto as an example, there were 21,819 new listings recorded in May — the highest level since March 2021 — and nearly 31,000 active listings — the highest level since at least August 2002.