Canada's rapidly rising home prices are a widely discussed topic, but the costs incurred after you've purchased a property are an often overlooked aspect of affordability.

Once you've made your down payment and secured a mortgage, homeownership costs, like property taxes, can be an afterthought. But they can cost upwards of $10K in some cities, resulting in an unpleasant surprise for cash-strapped buyers.

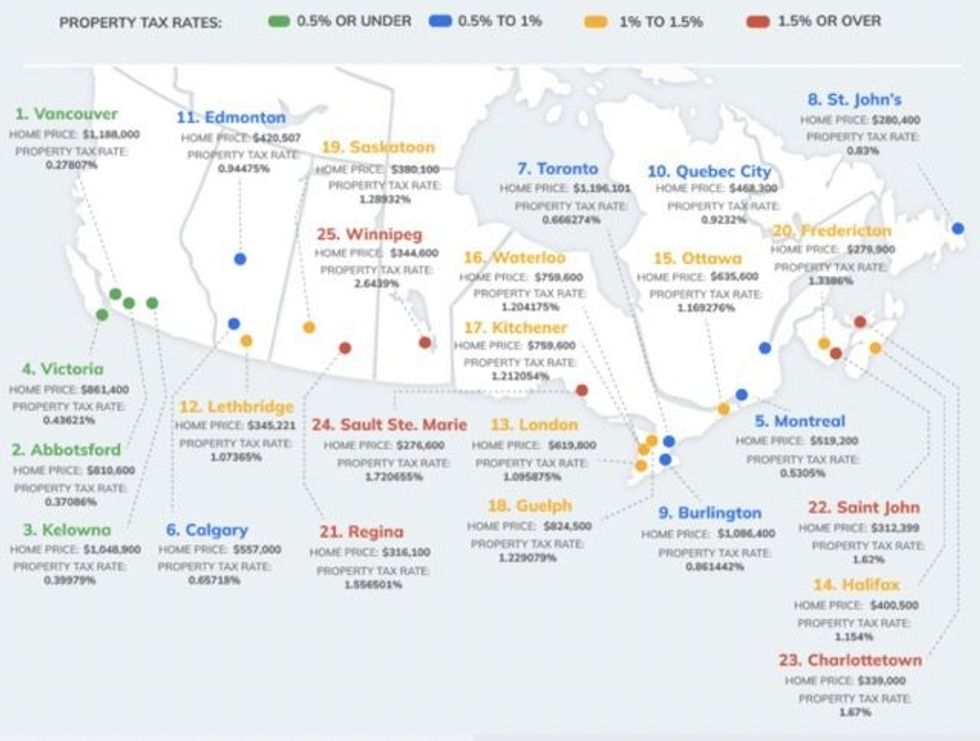

Residential property taxes depend on a home's assessed value as well as the tax rate set by the city, leading to wildly different costs across Canada.

Read: As a Percentage of GDP, Canada Has Some of the Highest Property Taxes in the World

To determine where the lowest, and highest, property taxes can be found, real estate agency Zoocasa analyzed rates from 25 Canadian cities and calculated how much a resident would pay on an average priced home, a $500K home, and a $1M home in each municipality.

According to the data, although British Columbia has some of the highest home prices in Canada, it also has the lowest property tax rates.

In Vancouver, where the average abode costs $1,188,000, the property tax rate is just 0.27807%, meaning that homeowners have to pay $3,303 annually. Abbotsford, Kelowna, and Victoria all have property tax rates under 0.45%, resulting in annual payments of $3,006 to $4,193 on the average priced home.

Montreal rounds out the top five with a property tax rate of 0.5305%, but thanks to the city's average home price of $519,200, residents pay only $2,754 per year. The figure is the lowest on the list in regards to average priced properties.

The only other city where residents pay less than $3K per year in property taxes on an average-priced home is St. John's. The municipality has a property tax rate of 0.83% and an average home price of $280,400, resulting in annual payments of $2,997.

Toronto has a relatively low property tax rate of 0.666274%, which earned it seventh place on Zoocasa's list, but a high average home price of $1,196,101, meaning residents have to pay $7,969 per year in taxes.

Meanwhile, the affordable homes found in the Prairies and Atlantic Canada come with sky-high property taxes.

Despite having an average home price of $344,600, residents in Winnipeg must pay $9,111 per year thanks to the city's property tax rate of of 2.6439%. Sault Ste. Marie followed, with a tax rate of 1.720655%. Residents in the city pay $4,759 per year in taxes on an average-priced $276,600 home.

With property tax rates above 1.5%, Regina, Saint John, and Charlottetown rounded out the bottom five.

Although Guelph has a comparably lower property tax rate of 1.229079%, residents pay the most per year in taxes ($10,134) due to the city's higher average home price ($824,500).

Burlington followed, with residents paying $9,359 in property taxes annually due to a tax rate of 0.861440% and an average home price of $1,086,400.