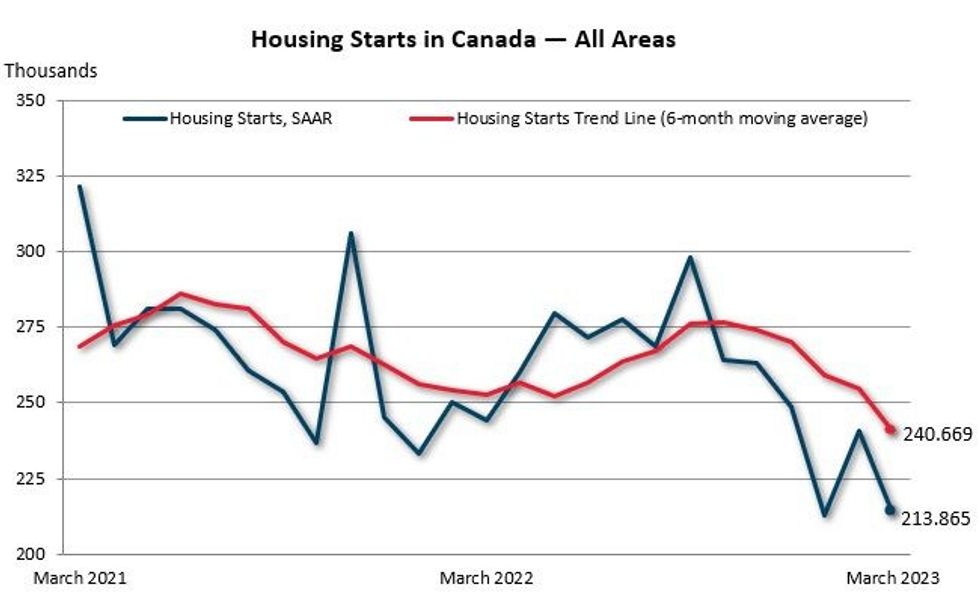

Housing starts declined across Canada in March, falling to their lowest level since the early days of the pandemic.

According to the latest data from the Canada Mortgage and Housing Corporation, the seasonally adjusted annual rate of housing starts dropped to 213,865 units in March. The figure is an 11% decline from February's 240,927 units, and marks the lowest level of housing starts since June 2020.

Total urban starts fell by 12% in March, to 192,545 units. The decline was led by single-detached urban starts, which fell 16% to 40,776 units, while multi-unit urban starts dropped 11% to 151,769 units.

With interest rates remaining high, developers and homebuilders face a challenge as they attempt to get projects off the ground, noted Bob Dugan, CMHC's Chief Economist.

The pause was seen in nearly every province -- only British Columbia and New Brunswick saw an uptick, with housing starts increasing 40% and 18%, respectively, from February to March. The most significant monthly declines were seen in Saskatchewan (53%) and Prince Edward Island (37%). Ontario saw a 22% drop in housing starts last month.

READ: Inventories of Unsold New Homes Hit Historic Lows Across Canada

A similar trend played out in Canada's largest cities, with housing starts jumping a startling 98% in Vancouver from February to March, and declining 26% in Toronto. London and Sherbrooke posted the largest increases across Canada, with housing starts rising 277% and 183%, respectively, in March. Meanwhile, starts dropped 97% in Greater Sudbury and 85% in Nanaimo.

Randall Bartlett, Senior Director of Canadian Economics at Desjardins, expects the "slump" in housing starts to continue trending downwards.

"However, with the population surging, labour market remaining tight, and interest rates falling on expectations of future cuts, the existing home market is revving up for a rebound," Bartlett said in an economic update.

"Prices shouldn’t be far behind, particularly with the pace of new supply trending lower."