The new year put a stop to the surprising surge in Canadian housing starts seen in December, a trend that is likely to persist in the near term.

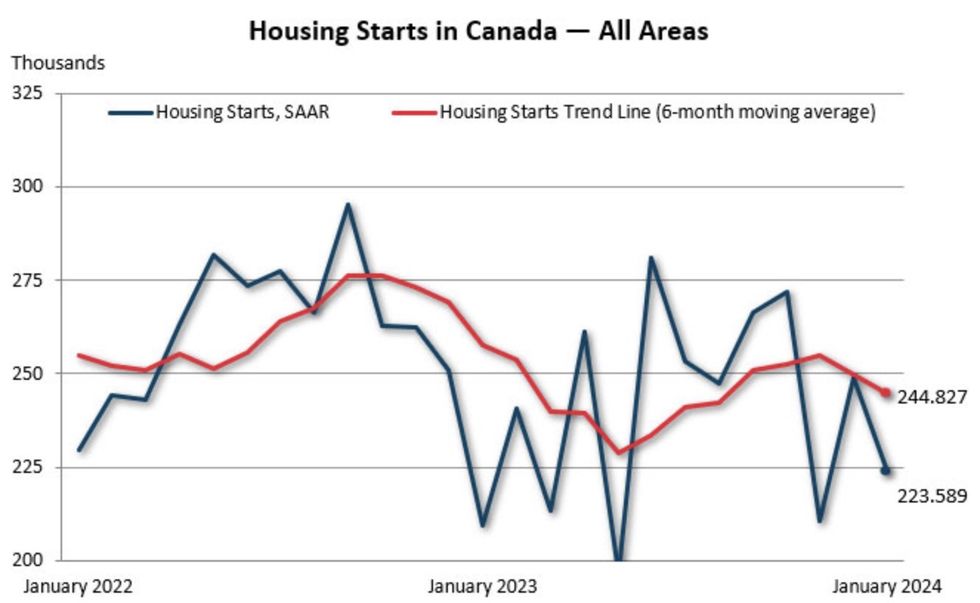

According to the latest data from the Canada Mortgage and Housing Corporation, the monthly seasonally adjusted annual rate (SAAR) of housing starts fell to 223,589 units in January, a 10% decline from December.

Total urban starts dropped 11% on a monthly basis to 208,119 units. The decline was driven by floundering multi-unit urban starts, which fell 14% to 164,789. Single-detached urban starts were relatively flat, experiencing a slight 0.08% monthly uptick to 43,330 units. Meanwhile, the monthly estimate of rural starts was 15,470 units, up slightly from December’s 14,550.

January’s poor reading pushed the six-month trend in housing starts down for a second consecutive month, to 244,827 units. The 2% decline is on par with the slip seen from November to December.

"Despite the trend performance, actual starts saw strong year-over-year growth, driven by high multi-unit starts, particularly in Toronto," said Bob Dugan, CMHC’s Chief Economist. "In fact, from a historical perspective, we observed the second highest number of housing starts for the month of January going back to 1990."

On an annual basis, actual housing starts in urban centres rose 13% to 14,878 units.

As Dugan noted, Toronto was a significant factor in the national increase, with actual starts in the city jumping 49% annually in January. On a monthly basis, the total SAAR of housing starts soared in Toronto 179%.

Meanwhile, actual housing starts declined 44% in Vancouver and 6% in Montreal year over year. From December to January, the total SAAR of housing starts in the cities fell 55% and 28%, respectively, due to a “sizeable decrease” in multi-unit starts.

However, more significant declines in the total monthly SAAR of housing starts were seen in Guelph (99%), Kamloops (98%), and Drummondville (89%). And Toronto’s growth was outshone by Oshawa, Lethbridge, and Trois-Rivières, which marked monthly increases in the SAAR of 429%, 324%, and 293%, respectively.

On a provincial level, the largest decline in the total SAAR of housing starts was seen in British Columbia, at 52%, followed by Saskatchewan at 40% and Manitoba at 34%. As they did locally, multi-unit starts dictated much of the monthly movement, whether positive or negative.

Despite flat or faltering growth in single-detached starts, the total SAAR of housing starts soared 149% in Prince Edward Island, 55% in Newfoundland and Labrador, and 17% in Ontario from December to January.

Despite the growth, Marco Ercolao, an Economist at TD, expects that starts will "remain subdued" in the near term, even as home sales pick up across Canada.

"It's no surprise that Canada needs to accelerate the pace of homebuilding to prevent a continual deterioration in housing affordability," Ercolao said. "While today's report doesn't inspire any change to our fairly muted forecast, the prospects for BoC policy rate cuts may add some fuel to existing home sales in the coming months, potentially propping up new home building as a result."

The Bank of Canada's next interest rate announcement is scheduled for March 6, but economists don't predict cuts will come until June.