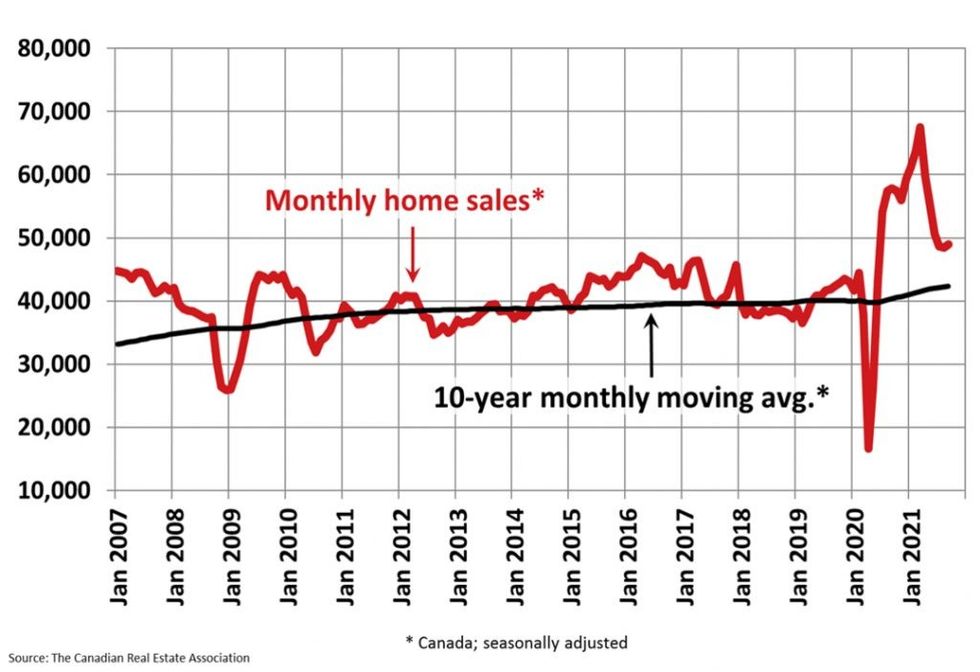

It appears the unpredictable conditions felt across Canada's housing market over the past year-and-a-half are finally behind us as sales edged up month-over-month in September for the first time in six months.

Last month, national home sales totalled 48,949 to mark a 0.9% increase from 48,498 in August, according to new data from the Canadian Real Estate Association (CREA).

However, sales were down 17.5% from September 2020, a tough act to follow, when a new record was set for the month. That said, it was still the second-highest September ever on record for sales by a sizeable margin.

CREA said the number of newly listed properties in September totalled 65,211, a 1.6% drop from 66,293 in August as gains in parts of Quebec were overwhelmed by declines in the Lower Mainland, in and around the GTA, and in Calgary.

READ: Toronto Ranked Second Largest Real Estate Bubble Risk in the World

With sales up and new listings down in September, the sales-to-new listings ratio tightened to 75.1% compared to 73.2% in August. The long-term average for the national sales-to-new listings ratio is 54.8%, according to CREA.

Based on a comparison of sales-to-new listings ratio with long-term averages, CREA said a small but growing majority of local markets are moving back into seller’s market territory. As of September it was close to a 60/40 split between sellers' and balanced markets.

"September provided another month’s worth of evidence from all across Canada that housing market conditions are stabilizing near current levels,” said Cliff Stevenson, Chair of CREA.

“In some ways that comes as a relief given the volatility of the last year-and-a-half, but the issue is that demand/supply conditions are stabilizing in a place that very few people are happy about," said Stevenson.

Stevenson said explained that there is still a lot of demand chasing an increasingly scarce number of listings, which is making the market challenging.

There were 2.1 months of inventory on a national basis at the end of September 2021, down slightly from 2.2 months in August and 2.3 months in June and July.

"This is extremely low and indicative of a strong seller’s market at the national level and in most local markets. The long-term average for this measure is more than five months," said CREA.

The Multiple Listing Service Home Price Index, rose 21.5% year-over-year, which is down from its 2020 high of 24.7%. With new inventory still struggling to keep up with demand, the national average home price rose higher to $686,650, up 13.9% from $602,657 last year.

However, despite the price growth, CREA's senior economist Shaun Cathcart found some positivity in the numbers.

“The small changes observed in most key housing market metrics over the last couple of months suggest that the worst of the pandemic-related volatility we’ve experienced since last spring is in the rear-view mirror at this point,” said Cathcart..

“Having said that, given we are still stuck at around two months of inventory nationally, the thing to keep a close eye on going forward will be the behaviour of prices. While the acceleration in home prices we saw in September was more than most would have expected, the fact that prices are now moving back in that direction is not surprising.”