The notion of housing affordability often feels like a pipe dream, but the Canada Mortgage and Housing Corporation argues that it’s attainable… with all hands on deck.

This is according to a report from CMHC authored by Deputy Chief Economist Aled ab Iorwerth. The report, released Monday, examines Canada’s affordability challenges with an interesting preface: “the scale of the challenge is so large that the private sector must be involved -- governments cannot do this on their own,” says the agency.

It states that while the construction of more social and affordable housing stands to help those in lower-income brackets, it won’t restore affordability for all Canadians. The private sector is coined as one of “several sources” that governments should call on to increase supply on the market.

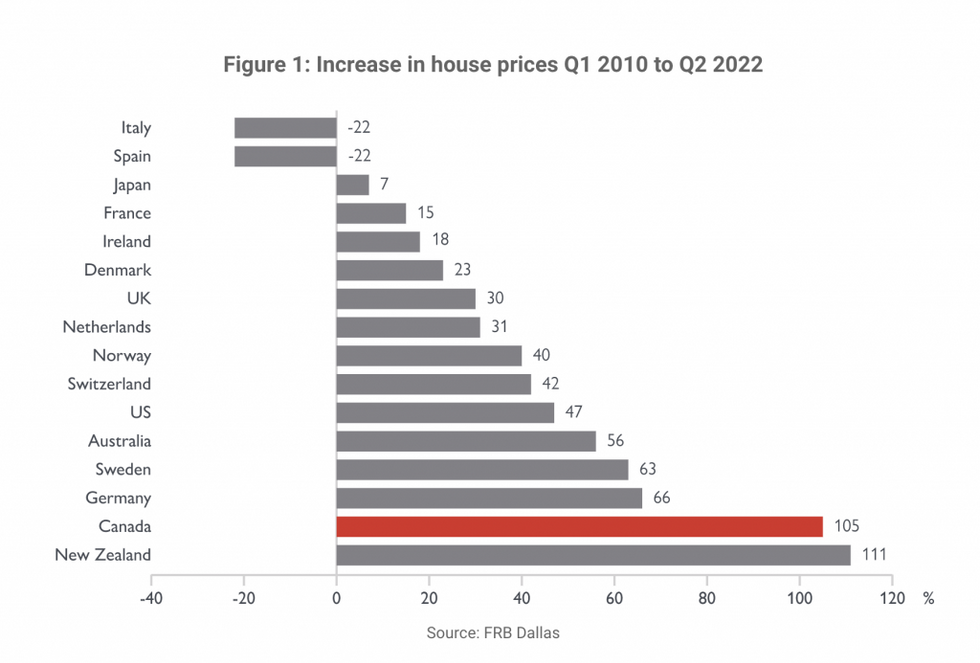

Later in the report, CMHC analysis various metrics to demonstrate the affordability challenges at play. According to the data, Canada has seen rapid price growth over the past decade, with a rate of increase second only to New Zealand amongst 16 developing countries.

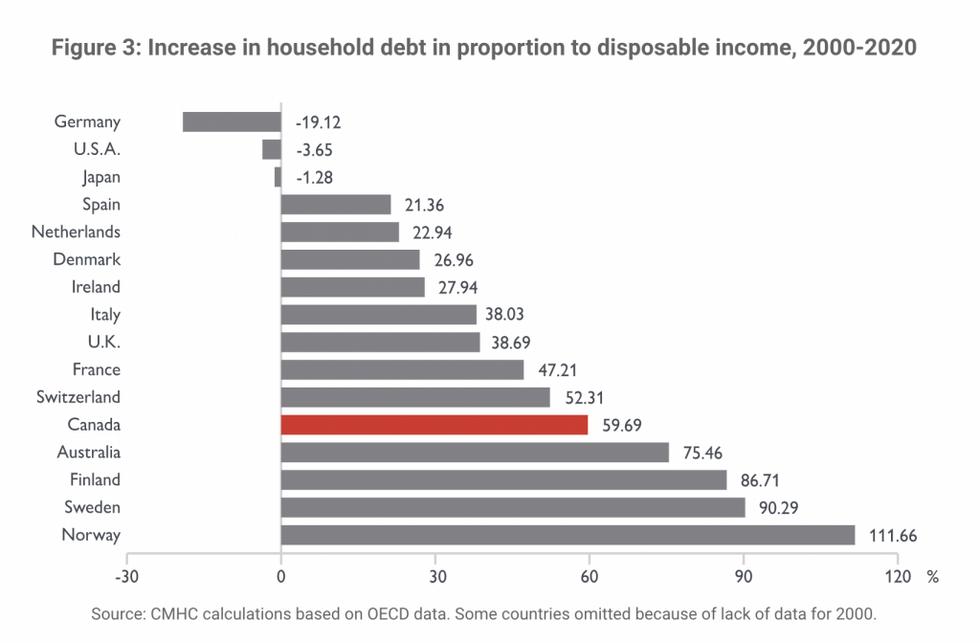

As home prices rise, Canadian household are packing on high amounts of debt by both historical and international standards. This indicates that even those who can afford the housing market must tap into a higher proportion of their income to do so.

With the livelihoods of all Canadians at stake, CMHC calls on a variety of policy approaches to address different income levels.

For the low-income bracket, the agency points to supports such as the federal government’s Canada Housing Benefit. However, it cautions that “there are concerns with such subsidies… They can encourage landlords to charge higher rents and so the benefit of the subsidy goes to them rather than the intended recipient. This is particularly a concern if supply of housing is limited. Governments must therefore ensure that enough housing supply is available."

For households with more income, the challenge is similar -- more supply is desperately needed -- but the solution involves “more private-sector investment… particularly in the rental sector,” says CMHC.

“The burden on low-income households is clearly high, but the risks coming from a lack of housing supply for those with higher incomes are great as well. The financial fallout from not addressing challenges in the housing market can be great, as we saw in many countries around the world in 2008-09. We need a holistic approach to the housing system.

“Addressing only one part of the housing continuum risks wasting resources. Because households can move from one type of housing to another, a solution for one part is likely pushing on one part of a balloon: Some other part of the balloon will pop out and potentially burst the whole balloon. A lack of supply of housing for homeownership means more households will stay in rental, which means other households cannot move out of social and affordable housing. The housing system is interconnected, so fixing Canada’s affordability challenge requires a suite of policies to affect the entire system.”