The Bank of Canada's decision to pause interest rate hikes coincided with a flurry of building permits issued across Canada. That spike in activity, however, was focused away from housing.

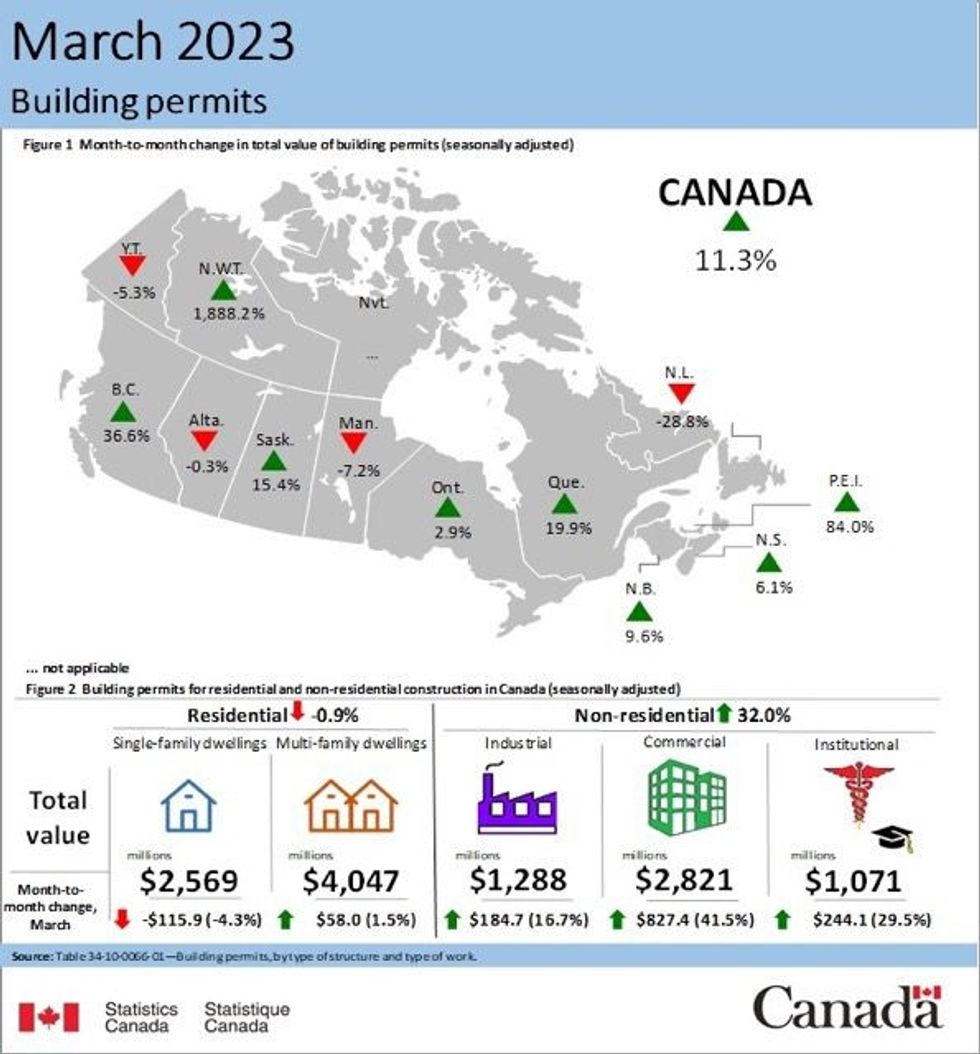

According to new data from Statistics Canada, the total value of building permits issued jumped 11.3% to $11.8B from February to March. The growth was led by the non-residential sector, with the total value of permits rising 32.0% month over month to a record-high of $5.2B.

The commercial sector saw the most significant gains, with construction intentions rising 41.5%, or $827.4M. The institutional sector followed, with permit values increasing 29.5%, or $244.1M, month-over-month.

Ten non-residential projects were valued at over $100M each, the largest of which was the new General Motors and POSCO Chemical facility in Bécancour, Quebec. At $570M, the facility led the value of building permits in the industrial sector to increase 16.7% in March.

On a quarterly basis, the non-residential construction sector also saw record growth. The total value of non-residential permits issued in Q1 2023 increased 16.1% from Q4 2022 to $13.0B, far surpassing the previous quarterly high of $12.4B. The growth was led primarily by the commercial sector, which expanded 17.2% quarter over quarter.

"This coincided with the Bank of Canada's decision to pause interest rate hikes, the first reprieve since initial hikes started in March 2022," StatCan said.

However, the pause has yet to have an effect on residential construction intentions.

The value of new residential construction permits dipped 0.9% in March to $6.6B. Single-family dwellings led the decline, falling 4.3% or $115.9M, while the value of multi-family dwellings rose 1.5% or $58.0M. Nationally, permits for 21,400 new dwellings were issued in March.

British Columbia saw a sharp increase in construction intentions, with permit values rising $321.9M, or 30.9%, month over month. StatCan noted the growth was concentrated in metropolitan high-rise multi-dwelling developments.

Collectively, the four Atlantic provinces also experienced notable monthly gains in multi-dwelling permit values, which rose $48.1M, or 40.6%. Total residential permit values in New Brunswick, Newfoundland and Labrador, Nova Scotia, and Prince Edward Island increased by a combined $39.5M, or 14.0%, in March.

However, the gains were offset by sizeable declines in five provinces. Ontario weighed the sector down the most, with the value of residential construction permits falling by $246.6M, or 8.1%, on a monthly basis. Proportionally, Saskatchewan saw the largest decline, with intentions falling by 27%, or $12.7M.

Richard Lyall, President of the Residential Construction Council of Ontario, told STOREYS that although an 8% decline at this time of the year is "atypical," as the spring market usually sees activity increase, it's not a significant enough drop to cause concern.

The monetary figure is equivalent to a large condo project, Lyall said. Such developments are planned with a lot of lead time, so, between the rapid rise in interest rates in 2022 and the continued unpredictability of the market post-pandemic, it's "not surprising" that permits took a bit of a hit.

Although it followed a "promising" February, March's falter contributed to a third straight quarter of decline in residential construction intentions. Nationally in Q1 2023, the total value of residential permits issued dropped 1.6% from Q4 2022, to $19.4B.

Quarterly gains were seen in Ontario, Manitoba, Nova Scotia, and Prince Edward Island, but they were "more than offset" by declines in six provinces.

Nationally, the total value of building permits in Q1 2023 jumped 4.8% from Q4 2022 to $32.4B, putting an end to three consecutive quarterly declines.