On Monday, the Province of British Columbia announced that it was setting the maximum allowable rent increase for 2025 at 3.0%, tying it to inflation.

"Tying the allowable increase to inflation saves renters hundreds of dollars, over the previous government's policy of inflation plus 2%," said Minister of Housing Ravi Kahlon on Monday. "At a time when we know renters are struggling, our rent cap protects renters against unfair rent hikes, while allowing landlords to meet rising costs so that rental homes can stay in BC's housing market."

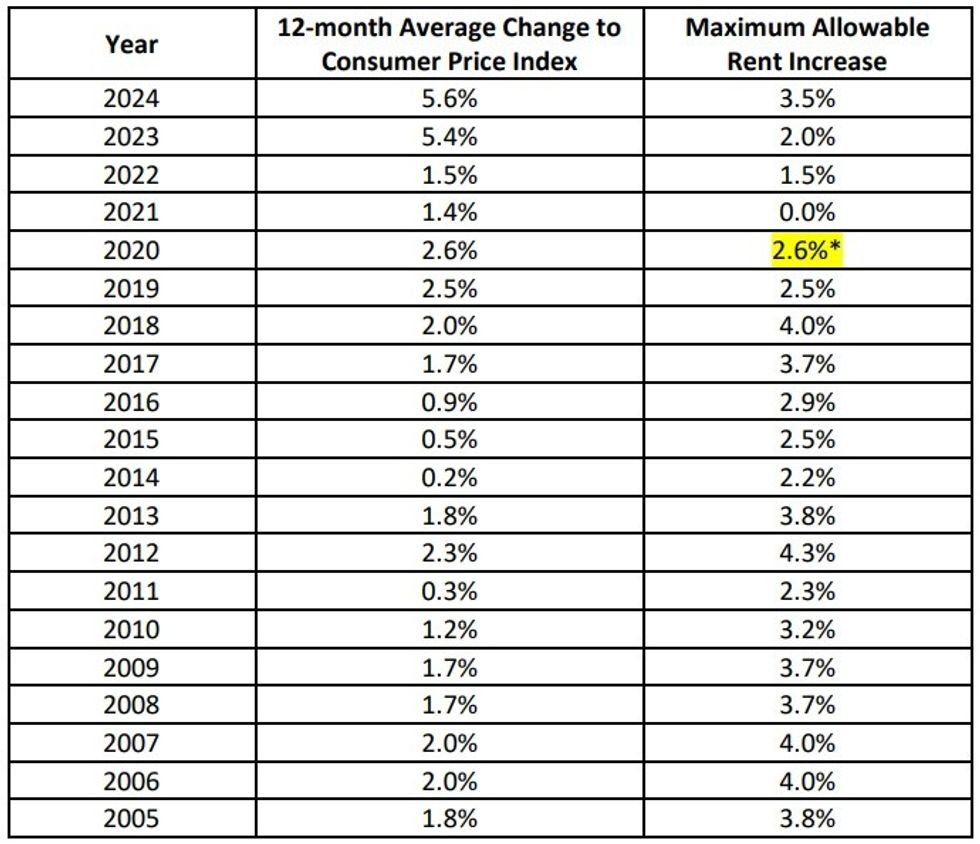

Speaking directly to renters, the Province has repeatedly noted in the past few years that prior to 2018, the maximum allowable rent increase was set at inflation plus 2%.

"Government policy prior to 2018 allowed for an additional 2% rent increase on top of inflation, costing the average BC family hundreds of dollars in additional rent," the Province said on Monday, adding that today's announcement "represents a return to the standard formula of tying allowable rent increases in BC to the Consumer Price Index, as inflation begins to return to more normal levels."

The rent increase cap was set at 3.5% for 2024 after being set at 2.0% for 2023, 1.5% for 2022, and 0% in 2021, in response to the COVID-19 pandemic. In 2020, the cap was set at 2.6%, but rent increases were frozen in March 2020, after the onset of the pandemic.

As usual, the maximum allowable rent increase for 2025 cannot take effect before January 1, 2025, and landlords must give their tenants at least three months notice in advance of a rent increase, which is also only allowed once per 12-month period.

The announcement of the maximum allowable rent increase, also known as the rent increase cap, typically occurs this time of year in order to facilitate that notice period and to allow rent increases to come into effect on January 1 — although, the announcement occurred in early September the last two years.

The rent increase cap, oftentimes also referred to as rent control, continues to be a divisive issue, with homebuilders often against the concept, saying that it caps their revenue streams while no such cap exists for their various costs, while the general public welcomes it.

Last week, the United States Justice Department sued RealPage, a property management software company, alleging that its software facilitated price-fixing on rents, which was made possible in part because of a lack of rent control. In July, President Biden proposed legislation to introduce nation-wide rent control for apartments owned by corporate landlords, which has since been embraced by Democratic nominee Kamala Harris and received similar pushback from developers and economists.

Today's rent cap announcement also comes shortly after a much-discussed decision the Residential Tenancy Branch made in May (and published this month), which allowed a 23.5% rent increase. The landlord made a formal application for a rent increase above the annual cap, citing increasing costs as a result of their variable-rate mortgage.

The decision surprised many, both because many were unaware that British Columbia had such an application mechanism, and because the mortgage cost increase argument was allowed. Tenants do not get a rent decrease when a landlord's mortgage costs drop, many have pointed out, and rising mortgage costs were foreseeable in this case as a result of the mortgage being a variable rate mortgage.