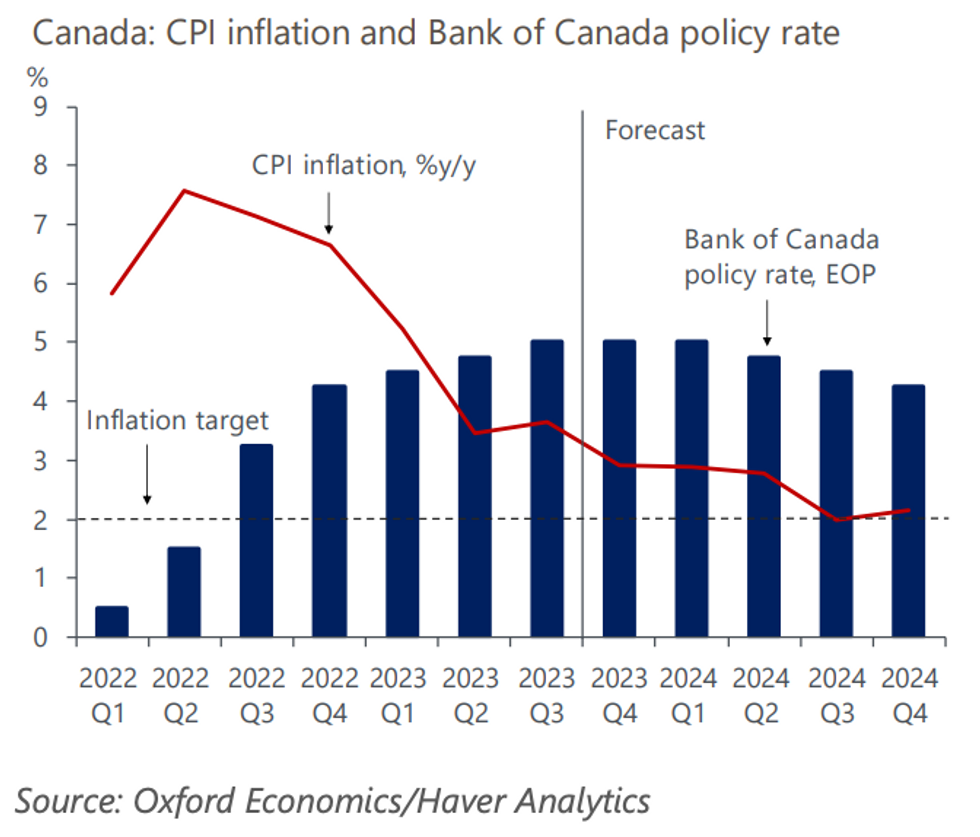

Canadian inflation is on track to slip below 3% in the near term and return to the Bank of Canada’s (BoC) 2% target by the end of 2024, research from Oxford Economics suggests.

Economists with the global forecasting company say in a recent report that the bank should have “ample evidence of a firm disinflationary trend” by mid-year, which would give them reason to start lowering the benchmark policy rate, which currently sits at a 22-year high of 5%.

“We anticipate growing slack from the deepening downturn, alongside an easing of global oil and food prices will help return CPI inflation to the 2% target by late 2024, about one year earlier than the BoC's forecast. This means further rate hikes by the BoC are not warranted. Accordingly, we expect the Bank will keep the policy rate steady at 5% until mid-2024 when we predict it will begin an easing cycle and start to slowly lower the policy rate to 4.25% by year end.”

From there, the expectation is that the bank will ease the rate gradually to “a 2.25% neutral stance over several years.”

In the meantime, Canada is weathering a moderate recession that tracks back to late 2022, says Oxford.

“Weaker interest sensitive housing and non-residential investment combined with a marked slowdown in inventory accumulation to drive a 0.2% quarter-over-quarter GDP decline in Q4 2022 — the first contraction since the BoC began its tightening cycle earlier that year.”

Though rate cuts are expected to help bring the Canadian economy out of recessionary territory, the company warns that any sort of rebound will be “muted” in the near term. In fact, economic activity may even contract a further 1.1% through mid-2024 “as soaring debt service costs from mounting mortgage renewals push indebted households to deleverage and unaffordability extends the housing correction.”

With the country’s resale market still in the grips of correction, home prices could deteriorate by a further 5% to 10% by mid-2024, according to the report. Peak to trough, prices could end up down 22%.

“Still, a larger population together with an ongoing housing shortage does put a floor under house prices and, over time, will lift both house prices and rents if supply is not sufficiently expanded," the report reads.

On the homebuilding front, Oxford forecasts that higher financing costs facing both buyers and builders will cause housing starts to slip to the low-200,000 range over the first half of 2024. Starts are expected to pick up up in late 2024 as the economy recovers, mortgage rates ease, and government incentives designed to boost housing supply come into play.