New year, new tax? As of Wednesday, January 1, the Government of British Columbia's new home flipping tax is now in effect, which the Province says is "intended to discourage short-term holding of property for profit."

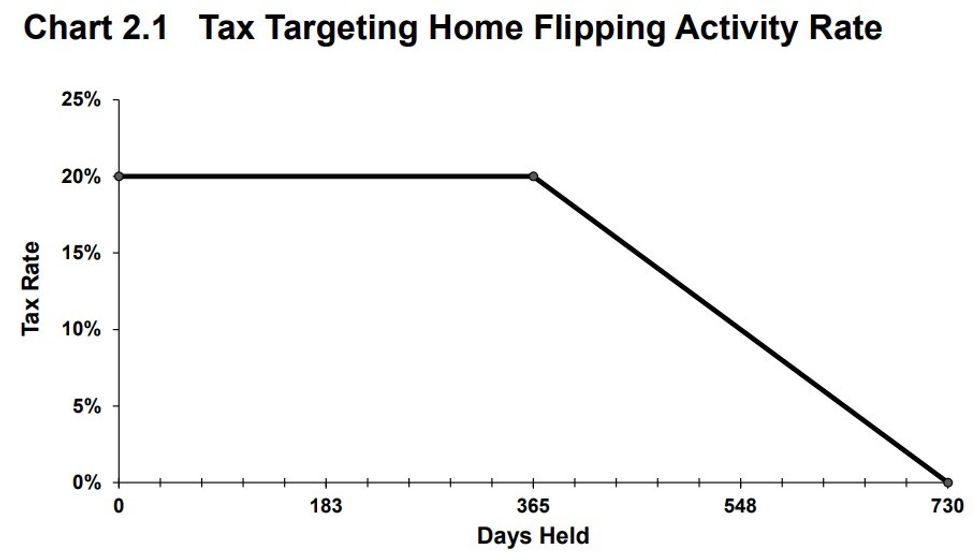

The home flipping tax rate begins at 20% of the "net taxable income" earned from a property sold within 365 days of acquiring it and then decreases on a pro rata basis until 730 days, after which the tax no longer applies.

The taxable income on a property sale is calculated by subtracting the original purchase price and the costs of improving the property from the sale price. If the property was being used as a primary residence, sellers can then deduct $20,000 x their beneficial interest in the property. The amount that remains is the net taxable income on which the tax rate is applied.

The tax applies to profits involving the sales of housing units, properties zoned for residential use, as well as pre-sale purchase assignments. (Full terms and definitions are listed here.)

Although the new home flipping tax came into effect on January 1, 2025, that date is pursuant to the sale, not the original purchase, meaning properties sold today, for example, are subject to the tax if they were owned for less than 730 days, barring any exemptions.

Exemptions from the home flipping tax include various life circumstances, property sales between related entities, properties used exclusively for commercial purposes, and sales pertaining to properties in exempted locations. Some exemptions require a return to be filed, while others do not, the Province says.

Developers are also exempt. For example, if a developer acquires a property for a project, but then changes their mind on the project and disposes of the property less than two years after acquiring it, they are not subject to the flipping tax — even if no work on the property has been done.

Unlike the Province's speculation and vacancy tax, you only have to file a return — within 90 days of the sale — if you are involved in a transaction that is subject to the tax or have an exemption that requires a return to be filed.

Announced as part of Budget 2024 last February, the Province said in a press release on December 20 that it anticipates 4,000 properties to be subject to the new home flipping tax in 2025 and that the tax revenue will be going towards "strengthening housing programs and building new affordable homes in BC."

"The BC home-flipping tax is just one more tool in our toolbox to help people find affordable housing," said Minister of Housing and Municipal Affairs Ravi Kahlon. "We're working to deliver more homes so the people who keep our communities working, like teachers, nurses and construction workers, can find a place to live they can afford in the communities they love."

Whether or not British Columbia needs a flipping tax, however, remains up for debate, as flipping has become less and less of a problem in recent years. The federal government also introduced its own home flipping measure that came into effect in 2023 and the Province notes that the two are separate and not harmonized.

The new flipping tax also comes into effect a week after a high-profile flipping case was brought to light when the Canada Revenue Agency announced that it was levying a fine of $2,153,394 on a Richmond man named Balkar Bhullar for flipping 14 properties between 2011 and 2014 and evading taxes by not reporting the income.