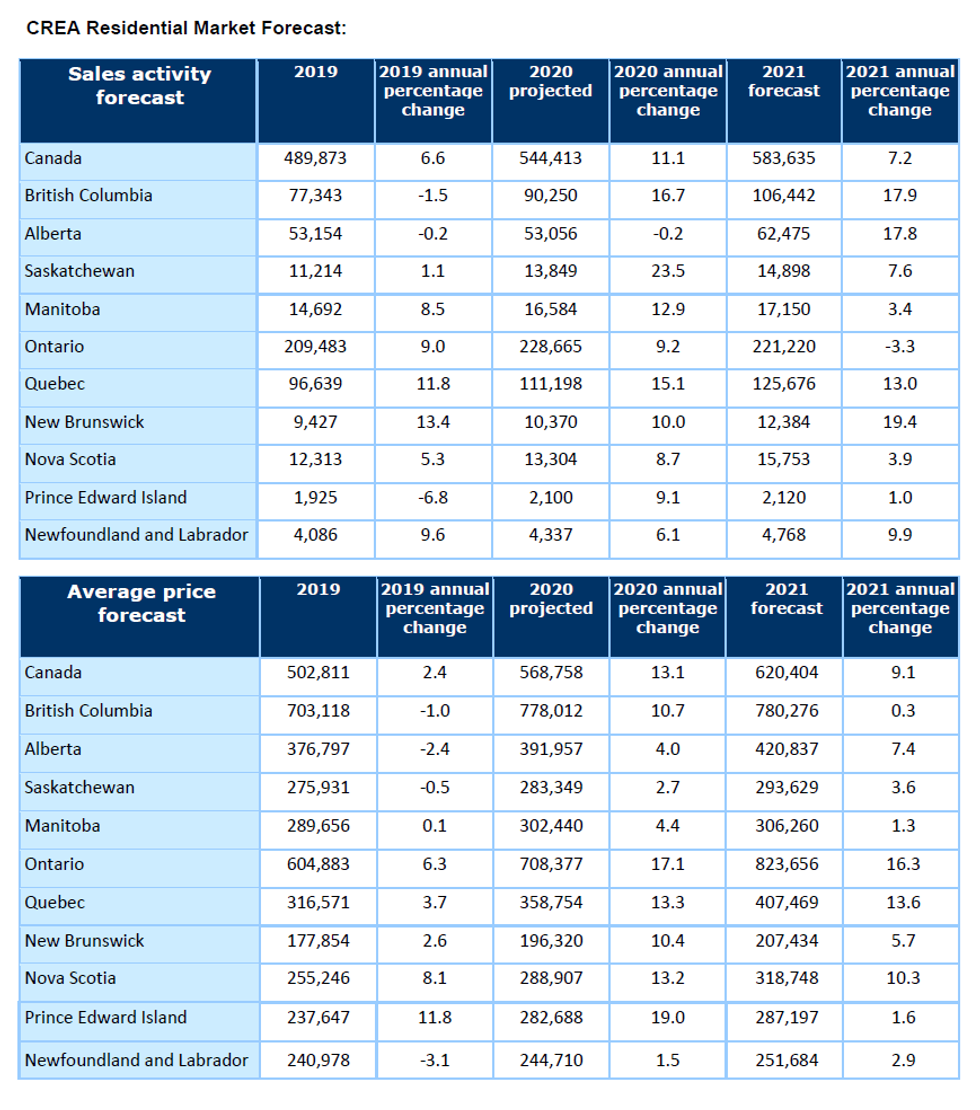

Last week, the Canadian Real Estate Association (CREA) released its latest resale housing market forecast, which revealed that -- despite turbulent spring months -- homebuyers are on track to set a record for activity in 2020, with some 544,413 homes projected to change hands by December 31, an 11.1% increase from 2019 levels.

Subsequently, the national average price in 2020 is on track to rise by 13.1% on an annual basis to just over $568,000 -- reflecting the current balance of supply and demand, which heavily favours sellers in many local markets.

In Ontario, CREA forecasts that 228,665 homes will change hands by the end of the year, up 9.2% from 2019 levels,. While the average price should rise 17% to $708,377, up from $604,883 in 2019.

CREA’s forecast noted that mortgage interest rates have declined to record lows in 2020, including the Bank of Canada’s benchmark five-year rate, which is used by major banks to qualify applicants under the federal mortgage stress test, which has lead to more buyers being able to qualify for mortgages this year.

With the Bank of Canada committing to keep interest rates low into 2023 and with mortgage interest rates expected to remain near current levels through the new year, CREA forecasts 2021 will still be a strong year for sales.

READ: Ontario Housing Inventory to Be Even Tighter in 2021, Prices to Rise: CREA

“On a monthly basis, sales are forecast to ease back to more typical levels throughout 2021,” CREA wrote in the report. However, presuming there’s a more normal spring market in 2021, the year as a whole is expected to see more home sales than 2020.”

On a national level, CREA is predicting 584,000 home sales for 2021, up 7.25% year-over-year. All provinces except Ontario are forecast to see increased sales activity in 2021, as low-interest rates and improving economic fundamentals allow people to get into the markets where homes are available for sale.

For 2021, CREA has predicted that there will be 221,220 home transactions in Ontario, a decline of 3.3% from 2020 levels. However, average home prices are expected to climb 16.3% to land at $823,656.

“Ontario has seen strong demand for several years, particularly outside of Toronto, which has eroded active supply in the province,” CREA said in its report.

“The strength of demand, particularly for larger single-family properties, will drive the average price higher as potential buyers compete for the most desirable properties.”

This forecast comes as Ontario's housing market was down on a year-over-year basis in November, however, this reflected a supply issue rather than a demand issue -- particularly in the ground-home segment. This has led to the average home price in the province remaining up year-over-year.

The largest year-over-year gains in November -- between 25- 30% -- were recorded in Quinte & District, Tillsonburg District, Woodstock-Ingersoll and a number of Ontario cottage country areas.

Year-over-year price increases in the 20-25% range were seen in Barrie, Bancroft and Area, Brantford, Huron Perth, London & St. Thomas, North Bay, Simcoe & District, Southern Georgian Bay, and Ottawa. This was followed by year-over-year price gains in the range of 15-20% in Hamilton, Niagara, Guelph, Cambridge, Grey-Bruce Owen Sound, Kitchener-Waterloo, Northumberland Hills, and Peterborough and the Kawarthas.

Moreover, prices were up in the 10-15% range compared to last November in Oakville-Milton and Mississauga. Across the GTA, the average selling price for all home types was up by 13.3% to $955,615.

READ: 5 Mortgage and Housing Market Predictions for 2021

With just ten days left in 2020, CREA is far from alone with its predictions around average home prices increasing in the new year. James Laird, co-founder of Ratehub.ca, expects detached home prices will increase between 4 to 7% in 2021, with the strongest growth in the suburbs around major urban centres.

“With Canadians working from home, the demand will continue to be strong for more space. Larger homes outside of the city centre will see the strongest demand,” said Laird.

What's more, Royal LePage, predicts that the median price of a standard two-storey home in the GTA will rise 7.5% next year, reaching an average price point of $1,185,800. In a significantly less dramatic increase, the median price of a condominium is forecast to increase 0.5% to $600,800.

Meanwhile, the aggregate price of a GTA home (all home types) is expected to increase by 5.75% year-over-year, ultimately reaching $990,300.

Looking ahead, only time will tell how the housing market will truly perform, but for now, let’s hope 2021 holds as much good news as suggested by the forecasted increase in home prices in the region.