Vancouver-based addy Technology Corp has reached a settlement agreement with the BC Securities Commission (BCSC) after addy was found to have been operating as an unregistered trader since its inception.

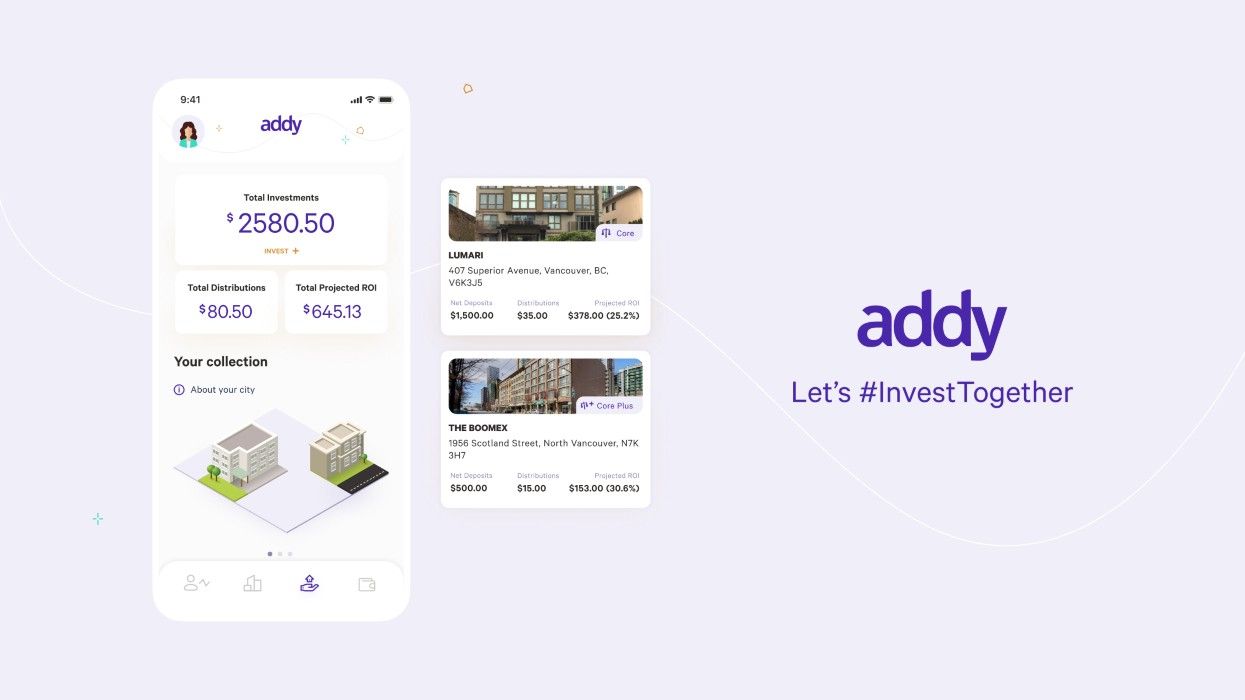

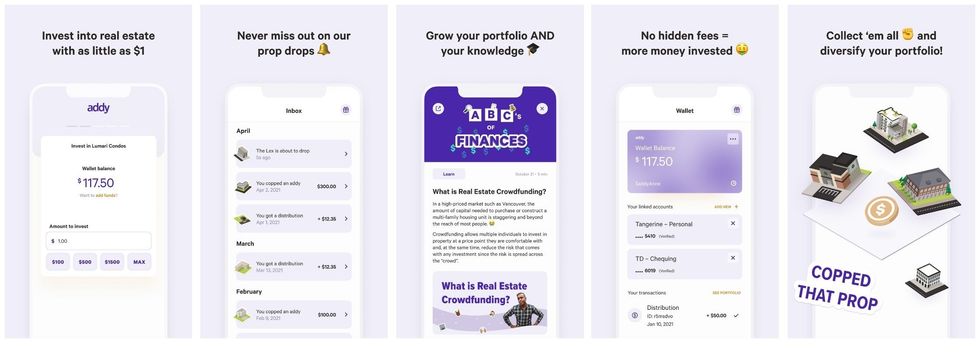

"addy operates an online platform where investors can fractionally invest in real estate properties and developments in amounts as low as $1 by purchasing shares or limited partnership units in various issuers," said the BCSC in a settlement agreement dated March 17. "addy has never been registered under the Act in any capacity."

Founded in 2018, addy takes an equity slice in a real estate development project and breaks it down into investment increments valued at $1 per share, then allows retail investors to buy those shares. Investors are thus investing in specific properties, rather than a company at large like they would in a real estate investment trust (REIT).

According to the BCSC, between July 9, 2018 and February 14, 2025, addy traded in approximately $26 million of securities of various issues and the average amount invested in those issuers was $700 per investor.

Up until October 2022, addy charged investors membership fees of $25 per year or $500 for a lifetime membership, with membership providing early access to certain properties and additional features on addy's platform. After October 2022, the annual membership fee was increased to $50, although membership fees remained optional to use the platform.

The BC Securities Commission says that addy was required to register because they were soliciting investment, serving as an intermediator of trades, receiving compensation, and carrying on those activities regularly. They add that during the period from July 9, 2018 to February 14, 2025, addy operated while relying on two registration exemptions, neither of which were applicable.

The first exemption was a crowdfunding exemption in the federal Start-Up Crowdfunding Registration and Prospectus Exemptions policy, which the BCSC said was not applicable to addy because "certain of the Issuers had principals in common with addy, contrary to section 5(1)(o) of the Crowdfunding Exemption."

The second exemption is one that's allowed when the company is an intermediary that makes trade through a registered dealer rather than solicit or contact investors themselves. The BCSC said this also does not apply to addy "since it continued to solicit prospective purchasers on its portal, by email and through social media."

Critically, the BCSC has not suggested addy mishandled any of the money, adding that addy has no prior history of misconduct and that the company has since begun the registration process. The BCSC adds that addy has been forthcoming and has agreed to immediately pay $100,000 to the BCSC to settle the matter rather than proceed to a hearing.

Reached for comment by STOREYS, Co-Founder Stephen Jagger declined to comment on why addy did not register to begin with, but said the company was excited about its evolution and becoming registered.

addy

On its corporate website, addy lists just over 50 properties that has been made available to investors on their platform, a majority of which are labeled as "sold out" and some of which are labeled as "exited."

In Vancouver, some of those properties include Lina at QE Park at 5212 Cambie Street by Everbright Properties and The Lex at 1249 Granville Street by Pure Multi-Family REIT LP. There are also numerous properties in Alberta, such as the The Cornerstone and Petro Fina office-to-residential conversion projects by Peoplefirst Developments, and many in Ontario, such as two projects by LCH Developments and a project by Lankin Investments.

According to the company's website, addy has also introduced "addy Business," which uses a similar structure that allows companies to raise capital. Home equity loans and land loans are also being offered by addy.

addy was founded in 2018 by Jeff Booth, Michael Stephenson, and Stephen Jagger, the latter two of whom also previously co-founded HR platform Payroll Hero, real estate website builder Ubertor, and web-hosting business Combustion Hosting.

The company's Board of Directors consists of Booth, Stephenson, and Jagger, as well as Keith Spencer of Fasken Martineau, Pascal Spothelfer of Genome BC, Steve Evans of American Hotel Income Properties REIT (formerly of the aforementioned Pure Multi-Family REIT LP), and Meir Bulua of LeverageIT & LeverageVC. The company's advisors then include Vikram Dhir of Koffman Kalef LLP, Lindsay Brand of Concert Properties, and Thuan Pham, who was formerly the Chief Technology Officer of Uber.

In recent years, addy has received plenty of media coverage and has also begun producing media itself, whether at events or for its podcasts. Featured guests have included Minister of Housing Ravi Kahlon, Mayor of Vancouver Ken Sim, and Mayor of Burnaby Mike Hurley, among others.