In light of the pandemic, activity in Canadian housing markets still managed to smash records this year, despite a historically low supply.

According to the latest data from the Canadian Real Estate Association (CREA), home sales grew 32% year-over-year, and home prices rose 14% annually to $603,344. Taking everything into account, this year's 15% growth in new listings couldn’t quite keep up with the strength of demand.

“If I had to sum up the Canadian housing story in 2020, I would say it’s gone from weakness because of COVID to strength despite COVID,” said Shaun Cathcart, CREA’s Senior Economist.

Cathcart says it will be a “photo finish,” but, it’s now looking like 2020 will be a record year for home sales in Canada despite the historically low supply.

“We’re almost in 2021, and market conditions nationally are the tightest they have ever been and sales activity continues to set records. Much like this virus, I don’t see it all turning into a pumpkin on New Year’s Eve, but at least vaccination is a light at the end of the tunnel,” says Cathcart.

READ: The 35 Most and Least Competitive Real Estate Markets in Ontario

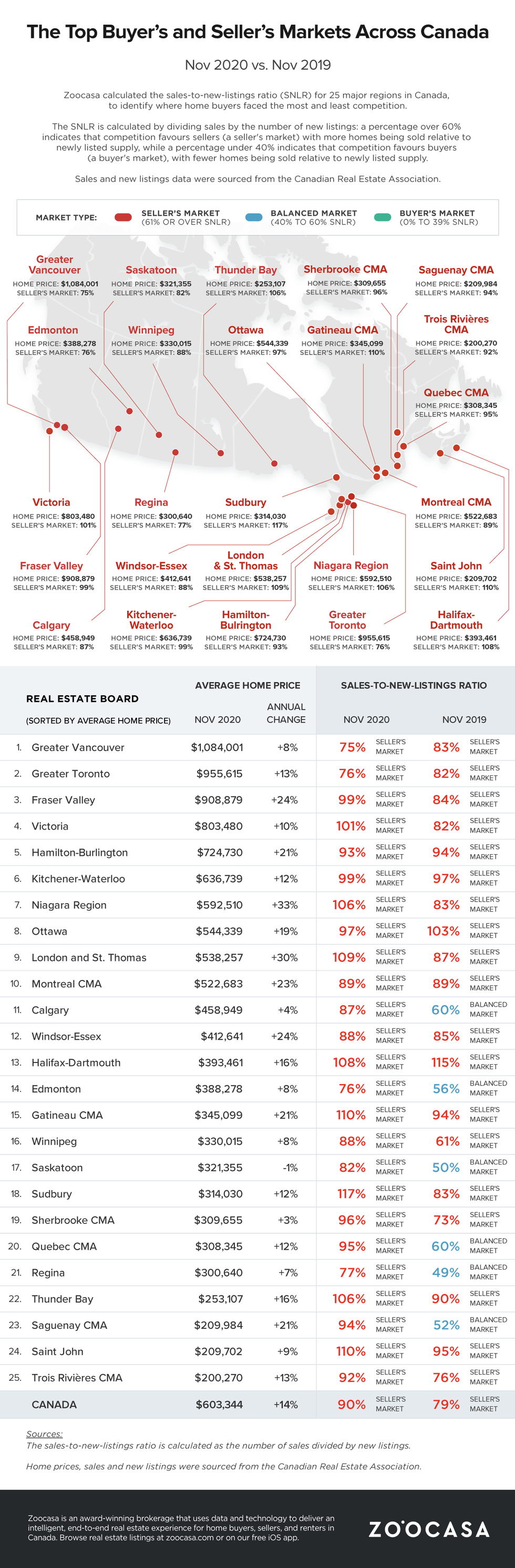

With just weeks left in 2020, Zoocasa took a closer look at housing competition across 25 Canadian real estate markets by reviewing sales and new listings data for each region for the month of November.

To determine which markets were the most competitive (seller's markets) and least competitive (buyer's markets), Zoocasa calculated the sales-to-new-listings ratio (SNLR) for 25 cities throughout the country. To reach this, the number of sales in a city is divided by the number of new listings.

A high percentage of over 60% indicates that many homes were sold compared to homes newly listed (seller's market), while a lower percentage under 40% shows fewer homes were sold compared to homes newly listed (buyer's market).

The results showed that given the historically low supply in relation to demand, the Canadian housing market as a whole overwhelmingly favoured sellers, with an SNLR of 90%.

All 25 markets included in the analysis exhibited competition conditions that strongly favoured sellers over buyers. Comparatively, in 2019, 19 of these 25 markets were seller’s markets, with the remainder exhibiting balanced market conditions, and the national SNLR was 79%.

Of the 25 regions included, "fiery hot" demand coupled with limited inventory resulted in very competitive housing conditions for homebuyers in eight Canadian regions, where the SNLR was over 100%. This indicates that demand was much higher than new listings and buyers began to purchase properties that were listed prior to November.

Canada’s most competitive housing market for buyers was Sudbury, with an SNLR of 117%, where November sales grew 26% year-over-year while listings dropped by 10%. Sudbury also currently offerer friendlier average home prices than what you’ll see in and around Toronto, making it an ideal place to purchase for first-time homebuyers.

Saint John and Gatineau followed next, each with an SNLR of 110%. Home sales grew 30% in Saint John, while new listings increased 12%. That being said, the average home price in both regions remained under $350,000 -- with Saint John at $209,702 (up 9% from 2019) and Gatineau at $345,099 (up 21% from 2019) -- making them one of the most affordable housing markets in Canada based on average price.

READ: 4 Affordable Ontario Real Estate Markets Ideal for First-Time Homebuyers

Zoocasa's findings also found that a number of Canada’s largest housing markets, including the GTA, were among those that were less competitive for buyers in November, compared to last year. Although the GTA, Greater Vancouver, and Hamilton-Burlington showed strong sellers' market conditions, the SNLR declined on a y-o-y basis.

In the GTA, the SNLR was 76% (down from 82% in 2019), with sales growing 24% and new listings rising 34%. The average sold home price in the region was $955,615.

Below, you'll find the list ranks the markets based on housing price. However, the top markets for annual change in average home price are the Niagara Region (up 33% to $592,510), London and St. Thomas (up 30% to $538,257), and Windsor-Essex (up 24% to $412,641) and the Fraser Valley (up 24% to $908,879). Meanwhile, the top markets for SNLR are Sudbury (117%) and St. John and Gatineau (110%).