British Columbia's Whitewater Concrete, a concrete products and services provider for contractors and developers, appears to be headed towards ceasing all operations, according to court documents filed in the Supreme Court of British Columbia.

Whitewater Concrete was founded by Brian Smith and his two sons, Craig Smith and Kyle Smith, who are currently the company's two managing partners. The company is based out of a facility located at 145 Golden Drive in Coquitlam.

According to the company's website, it has been involved in projects such as the residential towers outside Rogers Arena, the Paradox Hotel (formerly the Trump Hotel), the Vancouver House residential tower by Westbank, and several institutional buildings across Metro Vancouver.

The application to appoint a Receiver over the company was filed by the Royal Bank of Canada (RBC), and pertained to a loan agreement the company reached with HSBC Bank Canada, which was absorbed by RBC in March 2024.

The application was approved and came into effect on July 2 and applies to Whitewater Concrete Ltd., the main business entity; Whitewater Developments Ltd., the entity that holds the company's assets, such as its vehicles; and 145 Golden Drive Ltd., the registered owner of the 145 Golden Drive property.

Craig Smith and Kyle Smith are both listed as respondents in the case, along with their respective holding companies, Bastian Holdings Ltd. and Krystle Holdings Ltd.

According to an affidavit of RBC's John Lee, dated June 6, Whitewater Concrete owed $10,747,455.53 and Whitewater Developments owed $730,466.00 to RBC as of May 28, pertaining to a loan facility agreement the parties reached with HSBC in January 2020, for the aggregate maximum principal amount of $11,000,000.

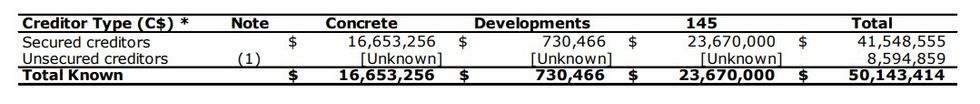

Upon further analysis, however, the Receiver identified that the total debt across the three entities is actually $50,143,414, when including other secured creditors as well as unsecured creditors.

According to court documents, the secured creditor that is owed the most money is actually the Business Development Bank of Canada (BDC), which holds a first-ranking mortgage registered against 145 Golden Drive and is owed $23,670,000 as of June 19.

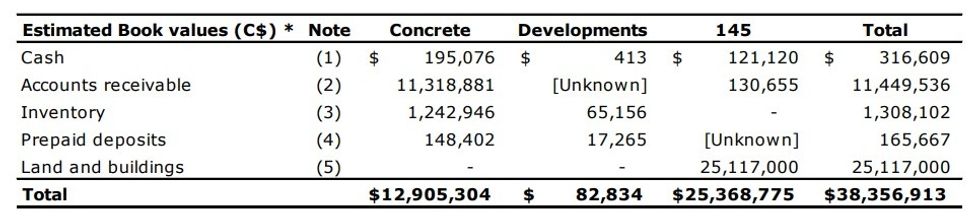

While the total debt is currently estimated to be $50,143,414, the total value of the companies' books is estimated to be just $38,356,913, with most of the value tied to the value of 145 Golden Drive. BC Assessment values 145 Golden Drive at $25,117,000.

According to the Receiver, the intended plan of action now consists of three things: terminating the employment of all employees of the operating companies (Whitewater Concrete Ltd. and Whitewater Developments Ltd.), preserving and maintaining the property owned by 145 Golden Drive Ltd., and conducting a sales process of that property.

It's unclear how many employees were employed by Whitewater, but the 145 Golden Drive property appears to have already been listed by Kyle Dodman, Chris MacCauley, and Travis Blanleil of CBRE, without an asking price.

The decision to terminate all employees likely means the end of Whitewater Concrete, which has drawn unflattering media attention several times in recent years.

In 2022, the company was fined $95,000 by WorkSafe BC for "high-risk violations" pertaining to work it was doing on a high-rise tower in Burnaby. Then, in 2023, the company was held responsible and fined for racist slurs a Whitewater employee, Nicolas Pacheco, said to another employee.

STOREYS reached out Whitewater Concrete on Sunday, July 28, but received an automated message indicating the email address no longer existed.