The amount of mortgage debt taken on by Canadians over the last two years has surged, especially in the inherently riskier variable-rate segment, according to new data from the Canada Mortgage and Housing Corporation.

The Crown Corporation -- which monitors the state of the nation’s mortgage market as well as acts as an issuer of mortgage default insurance -- released its biannual Residential Mortgage Industry Report this week, revealing some interesting pandemic-era borrowing trends.

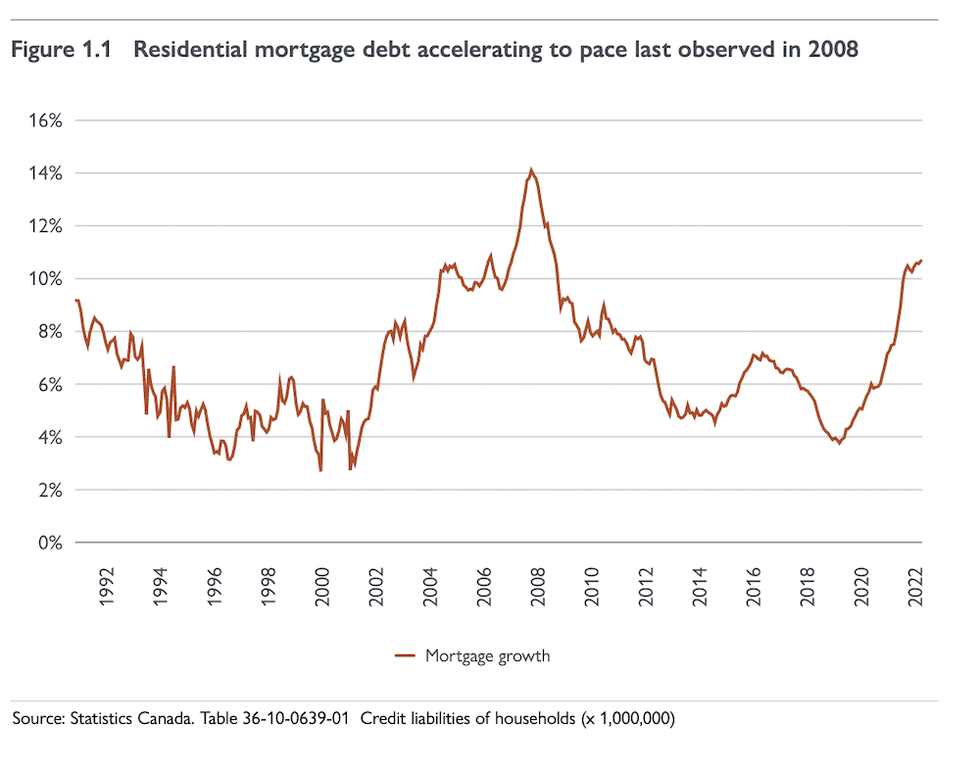

It reports that mortgage originations increased to a pace not seen since 2008 last year, up 9% compared to 2020. The bulk of these were uninsured mortgages (with downpayments over 20%), reflecting an overall higher home price environment, says the CMHC.

This trend was seen both among new and refinancing mortgages, “the result of strong activity in the housing market and the record-low interest rates,” the report states.

Chartered banks -- such as Canada’s “big six” consumer lenders -- saw the number of new mortgages increase by 43% on an annual basis in 2021, with refinances up 22%, totalling $400B worth of new residential loans. Credit unions added $54B to their balance sheets, while mortgage investment entities (MIEs) also saw a boost in activity.

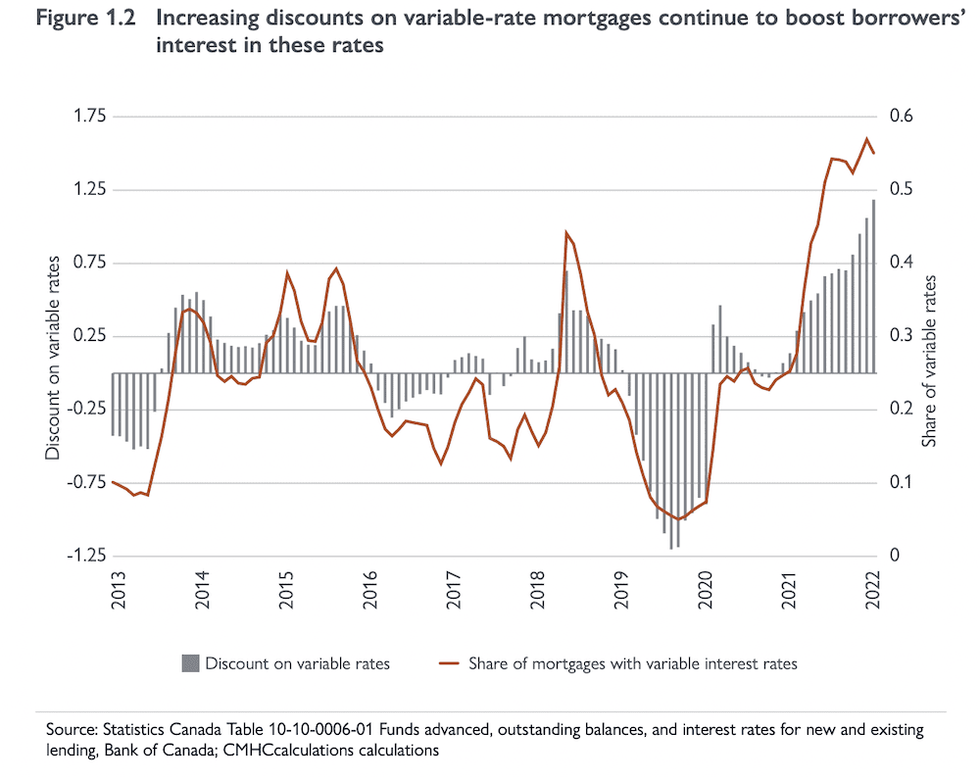

Given their wide, advantageous spread compared to fixed borrowing products and steep discount from prime, variable-rate mortgages were the clear choice among applicants, with their market share rising to 50% in 2021. This reached a peak in January 2022, at 56.9%. However, this has since been chilled by the Bank of Canada’s hiking cycle, which kicked off in March,” notes the CMHC.

“While this trend has continued into the first couple of months of 2022, it seems to have plateaued in response to the recent increases in mortgage interest rates,” the report states.

The Bank of Canada has increased its trend-setting Overnight Lending Rate three times since March, hiking it from a record low of 0.25% to 1.5%. Larger hikes (perhaps up to 0.75%) are highly anticipated to continue for the remainder of the year, which will put further pressure on borrowers who initially took out variable mortgages at historical discounts during the pandemic.

These borrowers are most at-risk as interest rates rise, and pose a large vulnerability to the overall economy, the BoC noted in its Spring Financial Systems Review, especially in the case of a “trigger” economic event. The BoC calculated that a household that took out a variable mortgage between 2020 - 2021 would see a median increase of $700 upon renewal as rates rise.

READ: Rates Will Reach 2007 Levels if boC Hikes by 0.75% Next Week

However, the CMHC’s data shows that despite hefty mortgage loads, borrowers’ financial standing appears to be in a healthier place, at least compared to 2020. Loan-to-value ratios of new uninsured mortgages trended downward at the end of 2021, as the percentage of those with an LTV of 65% and under rose to 38.2% (compared to the previous 37.1% the year before). Those with an LTV of 75% - 80% dropped to 44.2% from 45%.

“This indicates that borrowers in the second half of the year were significantly less leveraged. This trend was also observable when looking into newly originated insured mortgages during that period,” states the report.

However, this is a step backward compared to LTV levels in 2016 and 2017, which came in at 43.5% and 42.8% for LTVs under 65%, respectively.

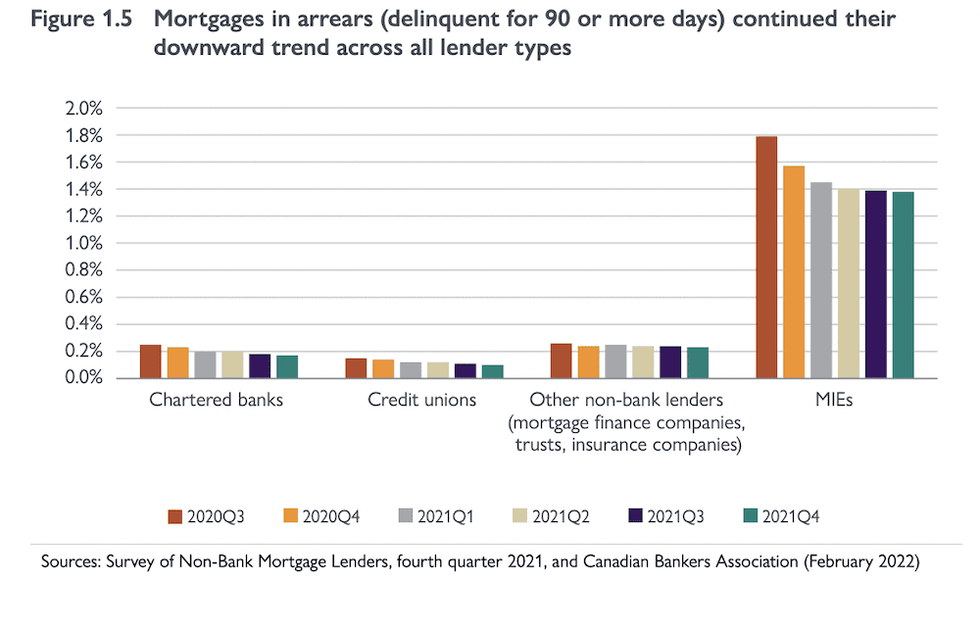

The number of mortgage arrears has also been on the decline, falling 0.17% among chartered banks by the end of 2021, while credit union arrears fell to 0.10%.

“Consumers either continued to make their mortgage payments on time or were able to reach an agreement to defer their mortgage payments during that period,” CMHC said. “The highly liquid housing markets have likely contributed to this downward trend,” writes the CMHC.