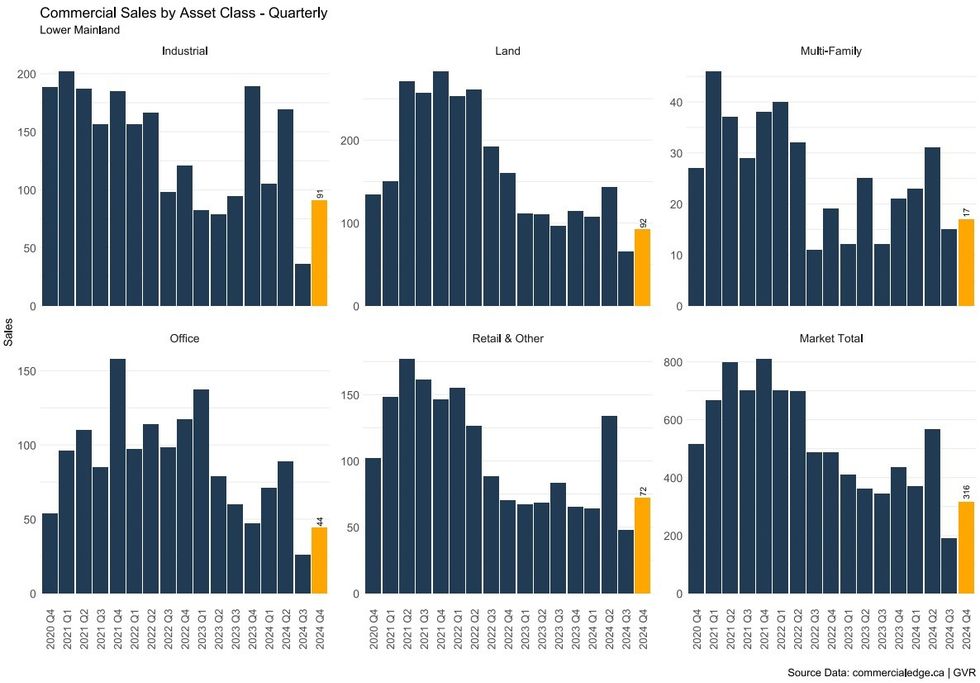

It felt subdued throughout the year, but there are now some numbers to back it up: the amount of commercial real estate transactions recorded in Greater Vancouver last year was the lowest total recorded in over a decade, according to statistics published by Greater Vancouver Realtors (GVR) this month.

In 2024, the region recorded a grand total of 1,442 transactions, which represents a 7.0% decrease from the 1,551 sales recorded in 2023, although the total dollar volume increased by 13.2% from $8.471 billion in 2023 to $9.589 billion in 2024.

Here's the breakdown by asset class, as well as what Greater Vancouver Realtors is forecasting for 2025.

Office

Sales for office properties (including strata office units) totaled to 230 in 2024, which represents a 28.8% decrease from the 323 recorded in 2023, although the total dollar volume was again higher, increasing by 45.7% from $609 million in 2023 to $888 million in 2024.

"Fundamentals need to improve considerably before investors renew their interest in this asset class in a significant way," said GVR in their 2025 forecast.

"Offsetting these headwinds over the longer term however, is the fact that even fewer new office developments were in the pipeline in 2024 versus 2023 in the City of Vancouver, which should support well-located, higher quality office assets in the downtown core over the long-run," they added.

READ: Deka Completes Purchase Of Vancouver Office Buildings From Oxford

Industrial

Sales for industrial properties (including strata industrial units) totaled to 401 in 2024, which represents a 9.7% decrease from the 444 recorded in 2023. Unlike the office segment, however, the total dollar volume did not increase, instead decreasing by 13.3% from $2.084 billion in 2023 and $1.806 billion in 2024 — the only segment where the dollar volume decreased.

The Metro Vancouver industrial market — long considered one of the strongest in Canada — "showed continued signs of cooling in 2024," said GVR. The 2024 total was the lowest total since the 2008 financial crisis.

"Despite these headwinds, industrial space remains relatively scarce in the region, and with limited new supply in the pipeline, any significant pickup in demand could tighten vacancy and push rents higher in this segment," said GVR.

READ: TransLink Pays $85.6M For Two Industrial Properties In Surrey

Retail

Retail properties was one of two segments that saw a sales increase last year, with total recorded sales jumping by 12.4% from 283 in 2023 to 318 in 2024. The total dollar volume also saw an uptick, increasing by 31.6% from $1.010 billion in 2023 to $1.330 billion in 2024.

The retail segment was "one of the few bright spots in 2024" and was "spurred on by a steady continued recovery in the retail spending throughout the Canadian economy," said GVR, who also believes the segment to be in a good position in 2025.

"With limited availability, the retail segment may be better positioned to weather the economic turmoil brought about by the new US administration's tariff war than other asset classes," they said. "With the potential to significantly alter retail spending patterns, these new tariffs may bring opportunity along with turmoil, as Canadians pivot spending to domestic products in the face of rising costs for imported goods. Whether a 'support local' movement will be enough to offset the negative impact of these tariffs remains to be seen, but the potential for a national-pride-driven boost to spending, even if temporary, certainly exists."

READ: Shato Holdings Buys Willowbrook Park Shopping Centre In Langley For $137M

Multi-Family

The multi-family segment was the other segment to see an increase last year, with total recorded sales increasing by 22.9% from 70 in 2023 to 86 in 2024. The total dollar volume increased by 61.7% from $793 million in 2023 to $1.283 billion in 2024.

GVR notes that the numbers are a little skewed by the Rental Protection Fund facilitating numerous transactions by non-profit organizations, but that the numbers for the other deals remained relatively strong over the course of the year.

"With record levels of new purpose-built rental construction completing, and with a policy-induced contraction in non-permanent residents, new multi-family product faces increased competition for tenants at asking rents far exceeding those found in older purpose-built rental product," said GVR. "We expect this dynamic to continue throughout 2025, which is likely to keep rents for new product from rising over the near-term. Even with these new additions however, the stock of purpose-built rental throughout the region remains chronically undersupplied, which positions older established multi-family product as an attractive opportunity, with stable vacancy and room to upgrade older buildings to improve revenue."

READ: Westbank Continues Selling Spree With $133M Sale Of Zephyr To Crombie REIT

Development Land

Sales of development land totalled to 407 in 2024, which represents a 5.6% decrease from the 431 recorded in 2023. Again, however, the total dollar volume went the other way, increasing by 7.8% from $3.975 billion in 2023 to $4.283 billion in 2024.

The market for development land "held relatively steady amidst a turbulent economic environment," said GVR, who added that presales and the feasibility of new rental projects were both flagging.

"Developers throughout the region are sitting on the highest levels of completed and unsold inventory seen in over a decade, while inventory in the resale market also continues climbing," said GVR. "With feasibility of new projects eroded, various government policies all presently discouraging investment into the segment (despite the ongoing supply shortage), as well as the economic uncertainty brought about by the new US administration's trade policy, we expect transaction volumes for development land to remain subdued in 2025."

READ: GWLRA Planning Twin Rental Towers On Robson After $121M Land Assembly