The Toronto Regional Real Estate Board (TRREB) has released its market data for February and, while an extra day will always help with overall numbers, it seems the year's shortest month would have performed well with or without a 29th day.

According to the board, some 5,607 GTA home sales were put through TRREB’s MLS® System in February – a sizeable 17.9% jump compared to the same month last year. (Once the "leap year effect" is factored in, year-over-year sales were up by 12.3%.)

TRREB President Jennifer Pearce chalked the bump in sales up to buyers having found a new level of comfort with interest rates.

"We have recently seen a resurgence in sales activity compared to last year. The market assumption is that the Bank of Canada has finished hiking rates. Consumers are now anticipating rate cuts in the near future. A growing number of homebuyers have also come to terms with elevated mortgage rates over the past two years," said Pearce. "To minimize higher monthly payments, some buyers have likely saved up a larger down payment, chosen to purchase a less-expensive home type and/or looked to a different location in the GTA."

Of course, the Bank of Canada's next rate announcement is now just one day away, taking place the morning of Wednesday, March 6, so potential – and hopeful – homebuyers won't have to wait long to see if change is in the air for the country's central bank as we head into the spring market. Current forecasts, however, expect the overnight lending rate will remain at 5% tomorrow, and will do so until seeing a cut later in the spring, or in early summer.

“As we move through 2024, an increasing number of buyers will re-enter the market with adjusted housing preferences to account for higher borrowing costs," said TRREB Chief Market Analyst Jason Mercer. "In the second half of the year, lower interest rates will further boost demand for ownership housing. First-time buying activity will also be a contributing factor, as many renters look to trade high monthly rents for a long-term investment in which they can live and build equity."

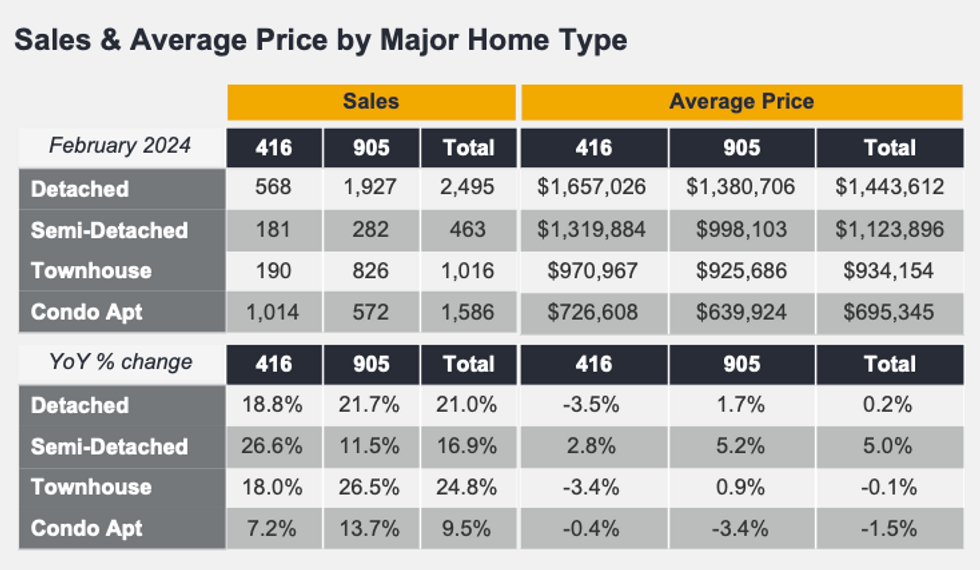

Prices, meanwhile, remained relatively flat year-over-year, with the MLS® Home Price Index Composite benchmark moving up by just 0.4%, and the average selling price of a home in the GTA reaching $1,108,720 (up from $1,096,157 in 2023).

TRREB CEO John DiMichele believes the buildup he's seeing now will be the start of another years' long run in housing demand.

“Population growth has been at a record pace and with the anticipated lower borrowing costs, the demand for housing – both ownership and rental – will also increase over the next two years," he said. DiMichele also praised the provincial government's work to reward communities throughout the GTA in their efforts to build homes faster. Just two weeks ago, Toronto was given a $114M from the province, $38M of which was an additional bonus for exceeding the City's provincially mandated housing target by 51%.