The rollercoaster of a year that was 2020 concluded with rental apartment vacancy rates in Toronto hitting a record high in the fourth quarter.

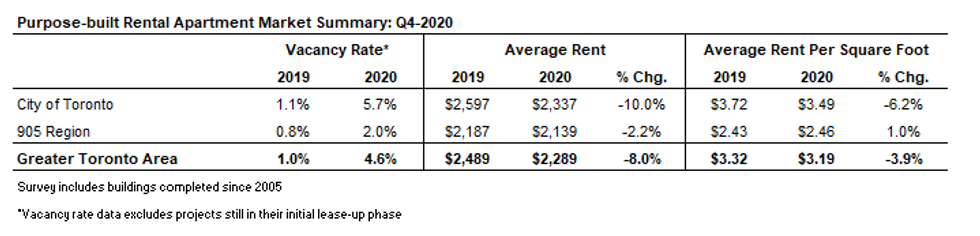

On Monday, Urbanation -- the leading source of information and analysis on the GTA condominium and rental apartment markets since 1981 -- released its Q4-2020 rental market results. Included in the report is a survey of newer purpose-built rental apartment projects that have been completed in Toronto since 2005, in which a vacancy rate of 5.7% is now being reported for the fourth quarter of last year, up 1.1% from the fourth quarter of 2019.

This rate also marks a 50-year high when looking at historical CMHC survey data for Toronto dating back to 1971.

Urbanation says the 905-region also saw vacancy rates rise during this time, increasing from 0.8% in Q4-2019 to 2% in Q4-2020. Urbanation attributed the low vacancy rate to a relatively limited amount of rental supply and an increasing population outflow from Toronto.

What's more, the report said the overall vacancy rate for the GTA was 4.6% in Q4-2020, up from 1% in Q4-2019.

READ: Average 1-Bedroom Rent in Toronto Has Dropped Over 20% Year-Over-Year

According to the latest data, average rents for purpose-built units that became available for rent in Toronto during the quarter fell 10% on a year-over-year basis to $2,337, with average per square foot rents down 6.2% year-over-year to $3.49 psf.

Outside of Toronto, the annual decline in average rents in the 905 region was milder, down 2.2% to $2,139, with average per square rents increasing 1.0% year-over-year to $2.46 psf.

When looking at the GTA as a whole, average monthly rents were down 8% year-over-year to $2,289, declining 3.9% year-over-year on a per square foot basis to $3.19 psf.

However, when excluding new buildings typically offering higher rents that finished construction in 2020, average GTA purpose-built rents declined 8.9% year-over-year or down 5.7% on a per square foot basis.

Urbanation says the reported decline in rents was additional to incentives, as the majority of rental buildings surveyed continued offering incentives in the fourth quarter to attract new tenants, which included perks such as two months’ free rent for new residents.

READ: Average Rent Prices in Downtown Toronto Are Now Less Than the GTA Average

While the construction of purpose-built rentals was active in 2020, it was still slow when compared to 2019 (following the onset of COVID-19). After reaching a multi-decade high of 13,764 units under construction in the GTA in Q1-2020, the number of rentals under construction declined to 12,521 units as of Q4-2020, which was slightly below the level in Q4-2019 (12,551 units) but the second-highest year-end level in more than 30 years.

Looking ahead, 18 rental projects (15 in Toronto and three in the 905) totalling 4,977 units are scheduled for completion in the GTA in 2021, representing the highest total since 1993.

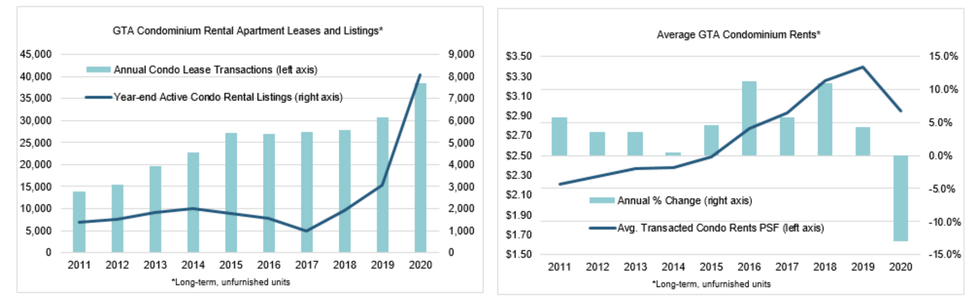

When looking at condo rentals, the new data showed that rents continued to decline despite a record volume of lease activity last year.

According to the data, rental lease transactions in the GTA increased 25% to a record high of 38,366 units, while the number of units that became available for rent increased by 46%. This resulted in a 162% annual increase in year-end active listings to a record high 8,066 units.

Urbanation says the average rent for a condo apartment in the GTA declined 14.1% to $2,076 year-over-year in Q4, marking the lowest level since Q2-2017. On a per square foot basis, average condo rents declined 13% to $2.95 psf, marking the first time rents fell below $3.00 psf since Q1-2018.

The report says rent declines were felt the most in downtown markets, with average per square rents down 17.2% year-over-year to $3.14 psf ($2,104) in Q4.

In the outer 416 region (including North York, Etobicoke and Scarborough), average rents declined 12.7% year-over-year in Q4-2020 to $2.78 psf ($2,036), while average rents were down the least in the 905 region with an annual decline of 4.9% to $2.69 psf ($2,050).

"The GTA rental market faced its toughest challenges to date in 2020 due to COVID-19," said Shaun Hildebrand, President of Urbanation.

"While rents have a long way to go before returning to their peak and supply will continue to be a headwind in the near-term, some improvement can be expected in 2021 as vaccinations eventually lead to higher immigration and at least a partial return to the office for downtown workers and in-class learning for post-secondary students.”

Urbanation's data coincides with a recent report from Padmapper, which also suggested that while average rents are down now, recent declines came at a slower rate than what we’ve seen in the last few months.

However, as the vaccine continues to be rolled out in the months to come, we can expect that renters will begin to feel more and more comfortable renting and living in the big city again, which will undoubtedly have an impact on rental prices.