If you think your rent is too damn high already, you may want to take a seat while we tell you that, according to a recent study from Concordia University, average rent for a two-bedroom apartment in Toronto could reach $5,600 a month just eight years from now.

The study, released last Wednesday, is based on research from Concordia's John Molson School of Business in partnership with Equiton, a Burlington-based private equity real estate firm, and uses AI to examine the major trends driving rent increases and low vacancy rates in Canada.

The outlook for Toronto rent growth represents an astounding 72% increase compared to 2023 and projects a 26% rent increase to $4,100 by 2027. But the study finds Toronto won't be alone in seeing this kind of rent growth as most major cities, including Vancouver, Montreal, and Calgary, are likely to see "significant increases" in the coming years as well. In the Greater Vancouver Area, rents are projected to increase by 52% by 2027 and another 53% by 2032.

At the same time, the most recent data from Rentals.ca shows that Canadian rent-growth slowed to a three-year low over the summer — a "historically irregular" deviation from a typically frenetic market season. As of the end of September, rent across all property types in Canada averaged $2,187 last month, a decline from May 2024's record high of $2,202. Urbanation President Shaun Hildebrand attributed the decline to “a combination of more supply being built, as well as a rollback in demand from population-related changes in government policies.”

Interestingly, the Concordia study finds that the culprit driving their predicted rent increases is what the report calls Canada's "atypical market," nurtured by low supply and high immigration.

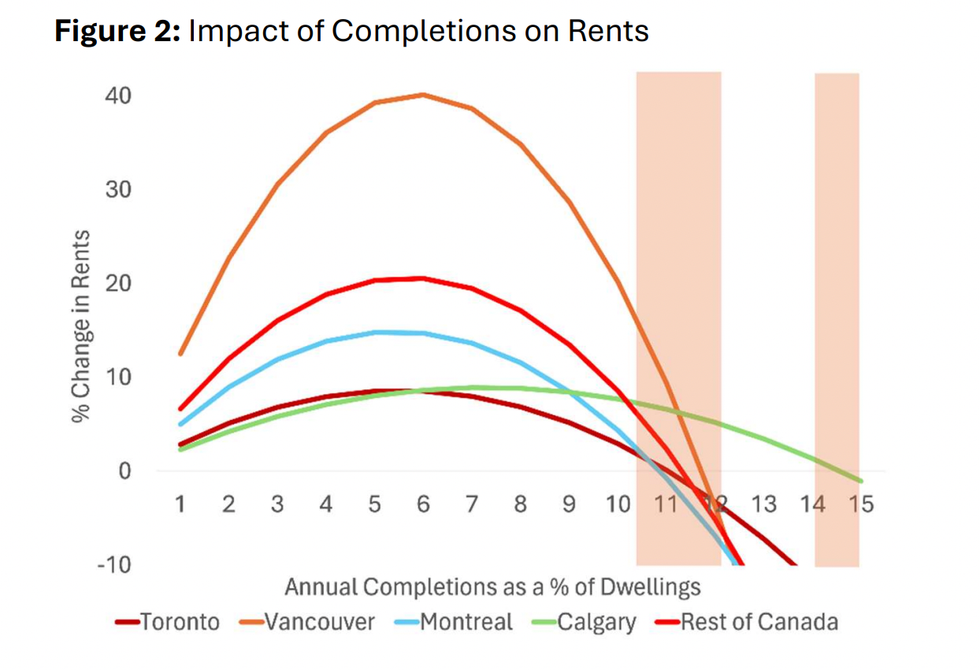

Canada's atypical market diagnosis can be described as a breakdown of the "traditional market," where more supply would equate to lower rents. Instead, because demand is so extreme – due to factors such as immigration and low supply – the study finds housing completions are having next to no impact on limiting rent increases.

On the supply side, the report paints a worrisome image of Canada's housing growth. "Among [the G7] countries, Canada suffers the lowest average housing supply per capita at 424 units per 1,000 residents." And exacerbating this issue is the record-high levels of immigration. "In just the first nine months of 2023, Statistics Canada noted that the country had seen a higher level of population growth than 'any other full-year period since Confederation in 1867'," said the report. Canada's numbers match those of the US — a country with a population nearly 10 times our size.

The issue, when it comes to rents, is that while immigration has many positive effects on Canadian society, the study found that "a 1% increase in the share of immigrants in a market increases local rents by approximately 0.6%. Meanwhile, a 1% increase in non-permanent residents can increase local rents by 2%." In Canadian markets, record immigration driving "extreme demand" has played a large role in pushing vacancy rates toward 1% across the nation, the study finds.

In fact, in Montreal, where rent is projected to increase by a comparatively low 18% by 2027, immigration is limited to a greater extent than in Ontario or BC, notes the report. However, Montreal is also known for its generous zoning laws and superb public transit systems, which help make it a more affordable City on average.

So, what will it take for rents to steady or even decline? In Toronto and the GTA, "annual housing completions must reach an astounding 11% of the total number of dwellings (nearly 10 times the rate achieved in 2023) before supply levels result in a reduction in rents," according to the report. Across most other major markets, rents will continue to grow until annual housing completions reach approximately 6% of total dwellings.

But as the report notes, Canada is nowhere near reaching those levels.

"Canadian immigration and housing policies have been out of sync for decades," says Dr. Yönder, head author of the report. "This research helps create a roadmap showing where private investment, regulatory relaxation, and infrastructure improvements could have maximum impact in terms of creating new housing."

The study also found that other factors leading to higher rents, besides low supply and high demand, included high work from home rates, higher educational attainment (bachelor’s degrees), and higher median income.

- Toronto Rental Starts Slashed In Half As “High Cost Of Financing” Cuts Into Profitability ›

- Toronto Ranks 5th Most At Risk For Housing Bubble Globally ›

- High Interest Rates Resulted In 30,000 Fewer Housing Starts In 2023: CMHC ›

- Rent Control In Ontario: 'Destroyer' Of Cities Or Necessary Protection? ›

- Ontario Lowers 2026 Rent Cap To 2.1%, Tightest In Four Years ›