It’s not been your typical summer for the Canadian rental market. Generally speaking, markets across the country heat up come June — as leases come up for renewal and post-secondary students map out their plans for the fall — and stay steamy through the end of August. This summer, however, things have been a bit different; rent growth has incrementally slowed to a crawl.

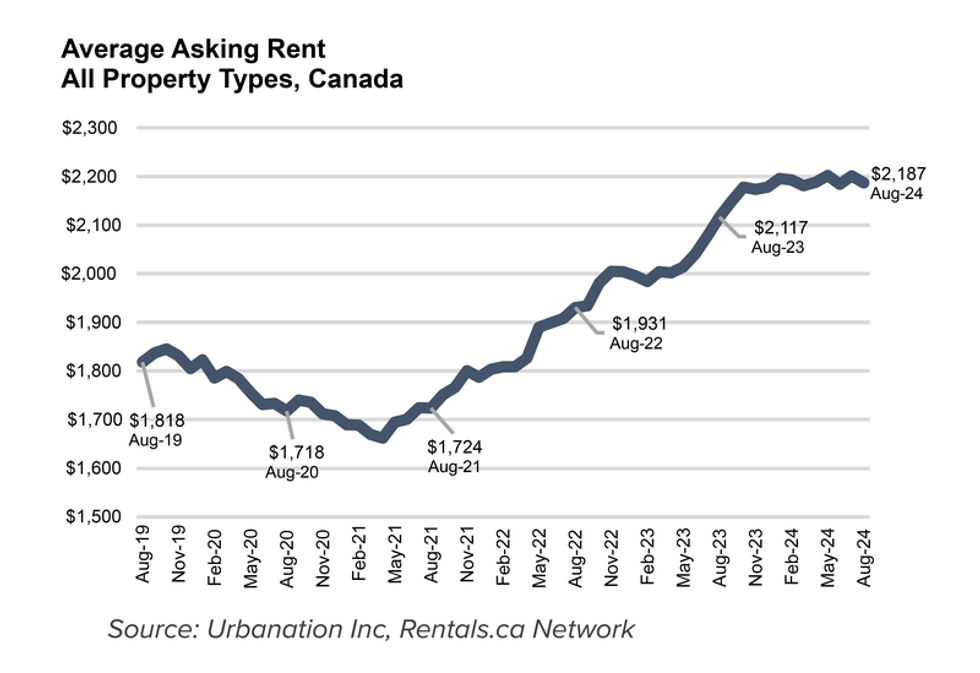

A new report from Rentals.ca and Urbanation, released Tuesday, shows that asking rent across all property types in Canada averaged $2,187 last month, marking a year-over-year increase of just 3.3%. That same metric clocked in at 9.3% in May, 7% in June, and 5.9% in July. It also represents the slowest rate of annual rent inflation in 34 months.

“Since reaching a record high of $2,202 in May 2024, average asking rents in Canada have declined by 0.7%,” the report says. “Outside of the COVID-19 period, it is historically irregular for rents to decline at this time of year.”

As for why we’re seeing this downtrend play out: Urbanation President Shaun Hildebrand says it’s “a combination of more supply being built, as well as a rollback in demand from population-related changes in government policies.” The report additionally points to the “softening labour market.”

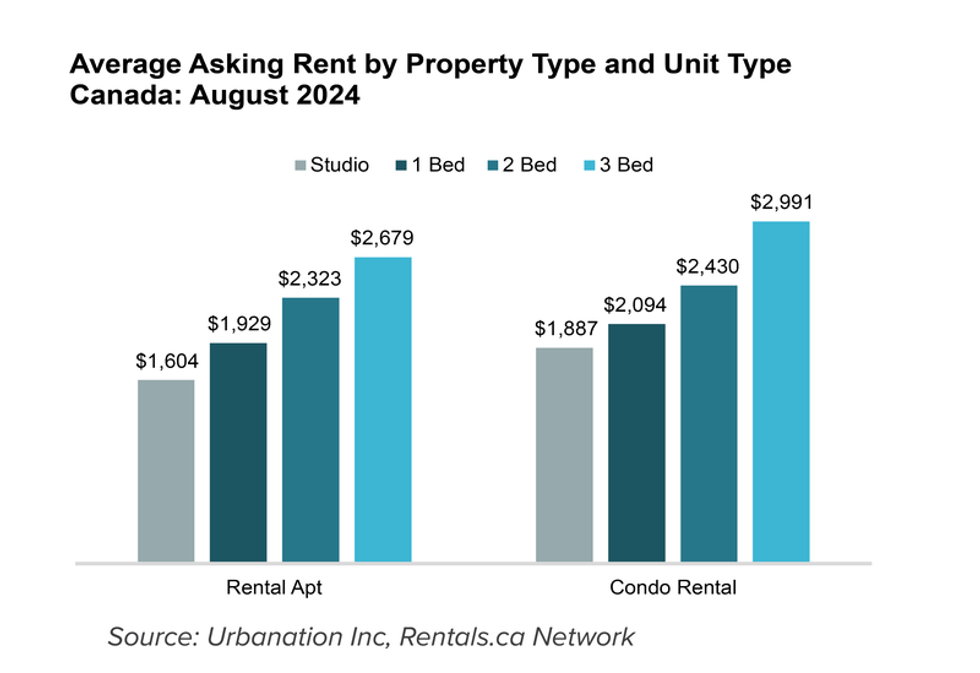

Delving a little deeper into the data reveals that asking rents specifically for purpose-built and condominium rental apartments saw a 4.7% annual rise in August to an average of $2,142. “However, growth was almost entirely attributable to purpose-built apartment rents, which increased 6.2% to an average of $2,118,” the report explains. “Condominium apartment rents increased by just 0.1% over the past year, averaging $2,308 in August.”

Breaking down the national data further shows that studio units and three-bedrooms led the pack in terms of purpose-built rent growth with rises of 10.7% and 11.8%, respectively, last month. Meanwhile, rents for studio condominium fell 3.3% over last August’s level. That metric — for studio condo rents — has been down for six straight months.

Provincially, rents continued to be the highest in BC and Ontario in August — although both provinces observed year-over-year declines.

Putting numbers to that latter statement: asking rents slipped 5.2% to an average of $2,536 in BC, and 4.3% to an average of $2,390 in Ontario. “Outside of BC and Ontario, as well as Quebec, which recorded an annual rent increase of only 1.6% for apartments in August, rent inflation remained strong in the rest of the country,” the report says. “The province with the least expensive rents was also the fastest growing, with Saskatchewan apartment rents rising 21.4% from a year ago to an average of $1,338.”

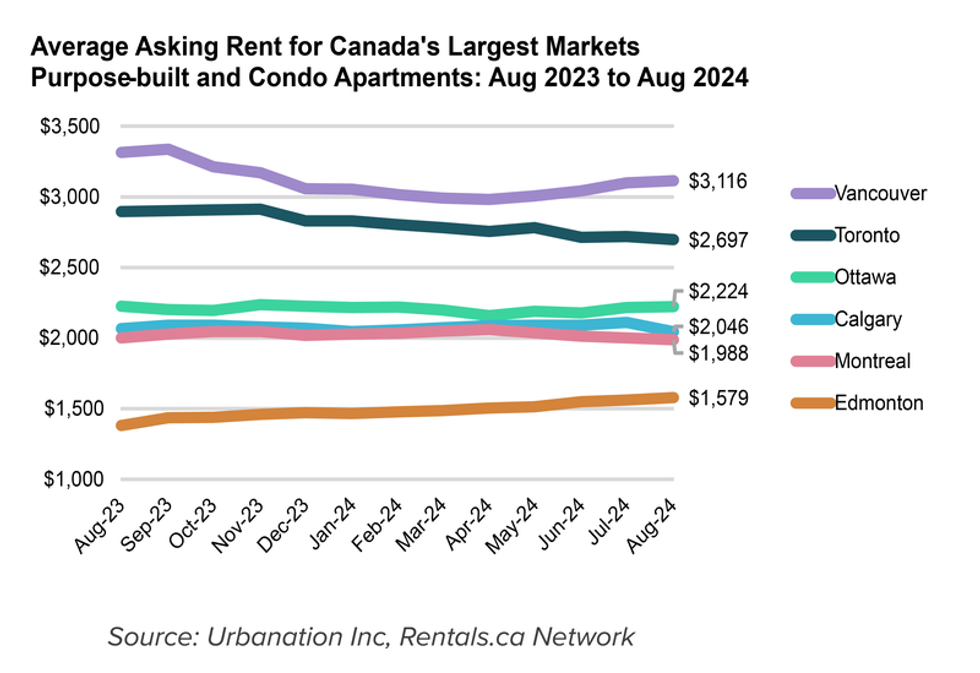

Tuesday’s report also gives a snapshot into what’s happening in local rental markets. Of Canada’s six largest markets, rents fell in the lion’s share — five markets — last month. Edmonton was the only exception, with rents rising 9.2% to an average of $1,579.

It was a different story entirely in Toronto, where average rent fell 6.9% year over year to a two-year low of $2,697 (marking the seventh straight month of decline), and Vancouver, where rent dropped 6% to $3,116 (marking the ninth straight month of decline). Meanwhile, in Calgary, where “double-digit annual rent growth” was recorded at the start of 2024, rents came down 1.1% year over year to $2,046, and that marked the first decrease in the metric since February 2021. “Marginal annual declines for asking rents were found in Ottawa (-0.1%) and Montreal (-0.6%) to an average of $2,224 and $1,988, respectively,” the report says.

Notably, it adds, “rents generally performed” for three-bed apartments across all six major markets in August, perhaps speaking to the popularity of these family-friendly unit types, and the scarcity of them as well. Rentals.ca and Urbanation report that three-bedroom apartment rents recorded “the lowest annual declines by unit type in Vancouver (-4.7%) and Toronto (-1.4%) and the highest annual growth in Calgary (+0.1%), Montreal (+8.2%) and Edmonton (+15.8%).”

The tail-end of Tuesday’s report includes data on shared accommodations in major markets, and that reveals that roommate rents across Ontario, BC, Quebec, and Alberta, on average, were up 8% year over year to a “record high” of $1,011. That figure is propped up by lofty rents for shared units in BC and Ontario, where the asking averages came in at $1,211 and $1,106, respectively.

There were no record highs in sight when looking at shared accommodations in Toronto and Vancouver, though, where average roommate rents slipped annually to $1,234 and $1,481, respectively. “All other major markets saw average asking rents for shared accommodations rise compared to a year ago, reaching an average of $928 in Calgary, $778 in Edmonton, $944 in Ottawa, and $950 in Montreal,” the report says.