As the population of renters continues to grow in Canada, the need for more rental housing also continues to grow. Thus, it is important to understand the challenges developers face, since they provide a vast majority — 95% according to a recent CMHC estimate — of housing in Canada.

While economic conditions are now starting to improve and sentiment among developers is also improving, a key challenge rental developers continue to face is with financing and raising capital — arguably the most critical component, since it determines whether projects can move forward.

Earlier this year, Ernst & Young conducted a survey of rental developers across Canada on behalf of the CMHC, with 96 developers of various sizes responding, and 85% of those developers said they were facing difficulties getting financing for their projects, according to survey results published last week.

"The sourcing of project funding remains a significant concern for all participants, as indicated by 85% of respondents citing difficulty obtaining funding," said Ernst & Young. "These challenges stem from various factors including interest rates, government regulations and fees, and construction costs, mirroring the main funding challenges identified in last year's survey."

Rental projects are financed differently than condo projects and also generate revenue differently, with a rental building starting to sustain itself only after it is occupied and then taking years to provide a real return.

On the other side of this is the lenders, who themselves also have to consider various economic factors, returns, and risks. Here, the size of the developer becomes more important, as the amount of assets it has under its management generally has some correlation to its stability, and a dichotomy starts to form between big developers and smaller developers.

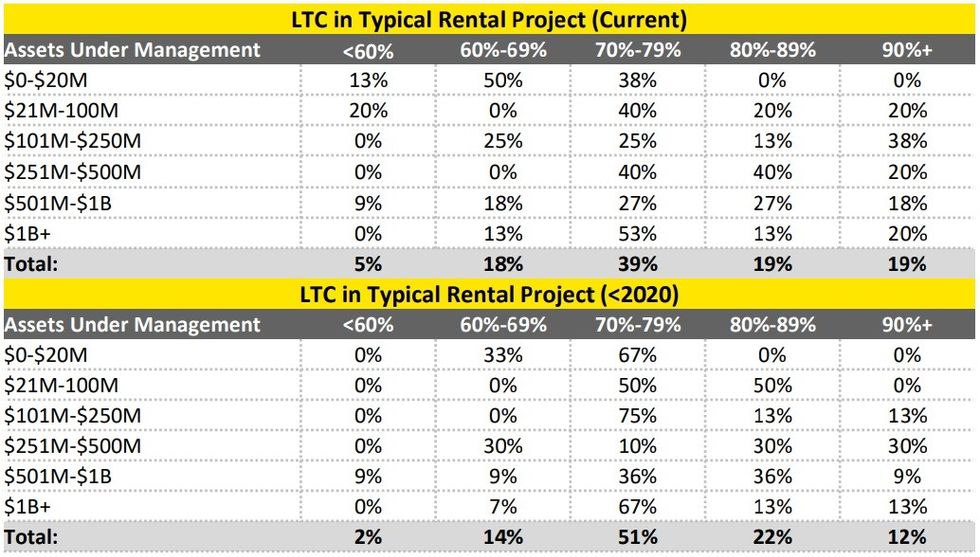

According to the survey, the loan-to-cost ratios — a $10 million project funded with $7 million in financing has a loan-to-cost ratio of 70% — for smaller developers have decreased in recent years, which means those developers have to inject more of their own equity into projects.

Prior to 2020, the loan-to-cost ratios for developers with $20 million or less in assets under management were between 60% and 79%. These days, for that same tier of developer, loan-to-cost ratios between 70% and 79% are less common and those below 69% have become more common, with some now even below 60%. For developers with between $21 million and $100 million in assets, none reported loan-to-cost ratios of less than 60% before 2020, but 20% have seen it more recently.

At the other end of the spectrum, developers with over $1 billion in assets under management continue to not face loan-to-cost ratios of below 60%. Before 2020, around 93% of loan-to-cost ratios were at 70% or higher, whereas the number now is 86%. For mid-tier developers with between $251 million and $500 million in assets under management, the amount of projects with a loan-to-cost ratio of 70% or higher has increased from 70% to 100% since 2020.

What this illustrates, says Ernst & Young, is an "uneven playing field in the capital markets" where the major lenders prefer the bigger developers and the smaller developers are left out in the cold. Finding a loan is also only half of the challenge, with the other half being the interest rate the loan carries.

For the top developers, they can secure financing from the big banks at reasonable interest rates. This summer, when CAPREIT announced that it had acquired The Pendrell, it revealed that the mortgage on the property, which was developed by Westbank, had an interest rate of just 3.1%. A step down from the big banks are the top non-bank lenders, like KingSett Capital, where interest rates can potentially get to around 10%, depending on circumstances. Take another step down to secondary non-bank lenders and interest rates can climb as high as 20%.

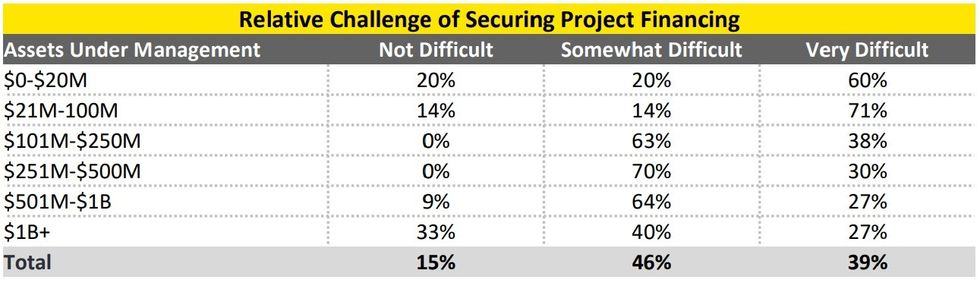

The Ernst & Young survey did not examine the range of interest rates developers faced, but survey results showed a clear dichotomy between the smaller developers and the big developers, with a strong majority of developers with less than $100 million in assets under management describing securing project financing as "very difficult." Conversely, only 27% of developers with over $501 million in assets described it as "very difficult."

Asked what the most significant challenge was towards obtaining project financing, the top response was interest rates, cited by 92% of respondents, followed by government regulations and fees (90%), construction costs (87%), inflation (72%), and market conditions (66%).

As of result of all of this, what developers want the most, at least according to this survey, is loans with low interest rates, particularly from government bodies.

"Amidst the ever-increasing challenges associated with sourcing project funding, CMHC's role in encouraging and supporting rental development has become more significant than ever before," said Ernst & Young. "A striking 95% of survey respondents indicated they're currently considering securing CMHC and/or other government funding for their projects, including CMHC mortgage loan insurance programs, representing a notable increase from 75% reported last year."

"The widespread utilization of CMHC funding/mortgage loan insurance for rental housing development underscores the pivotal role of CMHC's programs within the market, as many projects would likely be unviable without low-cost project funding," they added. "In fact, two-thirds of respondents expressed the belief that rental development becomes unviable once construction interest rates exceed 7.0%."

One of the downsides of the government funding, however, is the prolonged timelines associated with sources such as the CMHC's programs, and developers emphasized the need to reduce the time to development, since project revenues on rental projects already take years to materialize. "Guaranteed approval timelines and shorter approval periods were viewed as meaningful changes CMHC could implement," said Ernst & Young, and we have seen some action towards that end this year, with the CMHC introducing the Frequent Builders Framework in July to fast-track loan applications.

Sentiment among rental developers is improving heading into 2025, the survey found, but there's always more that can be done. Until then, it's once more unto the breach.

- Inside The Metro Vancouver DCCs And The Potential Housing Price Increases ›

- Inside The Cost-Profit Analysis Of Three-Bedroom Units In Metro Vancouver ›

- Taxes Make Up 36% Of Ontario New Home Prices, Study Finds ›

- 10 Major Metro Vancouver Developments Set To Complete In 2025 ›

- CBRE: What Canadian Real Estate Lenders Are Watching In 2025 ›

- How Long Does It Take New Market-Rate Housing To Become Affordable? ›

- A Breakdown Of Metro Vancouver's Housing Needs By Geography & Tenure ›