It’s shaping up to be a quiet fall for Canadian real estate. Sales are down, prices have plummeted, and with another interest rate hike looming, sleepy conditions are expected to persist in the months to come.

This is according to a new report from RBC Economics, authored by Assistant Chief Economist Robert Hogue, which forecasts prices to bottom out by next spring and the national benchmark price to drop 14% quarter over quarter from peak to trough.

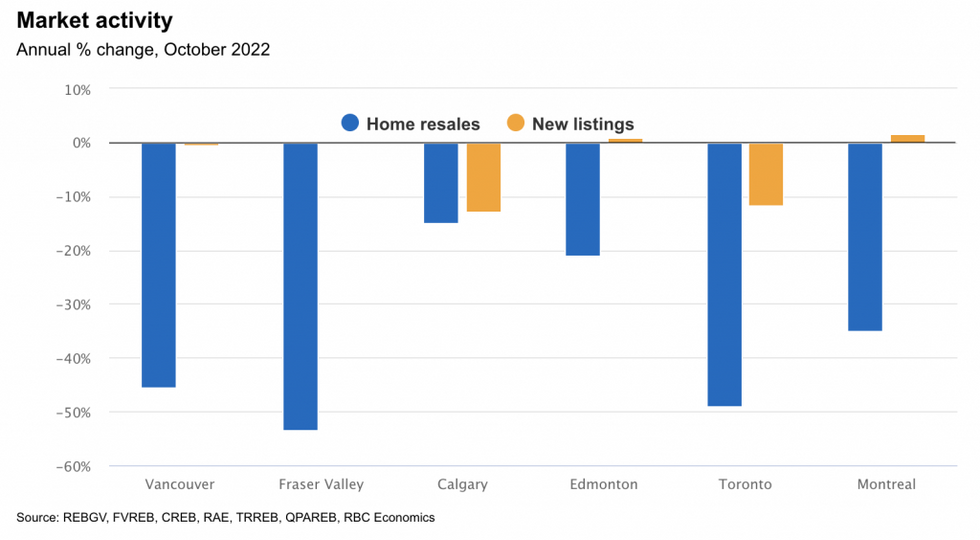

Generally speaking, the temperature is “significantly down” in Canadian markets, but activity in local real estate boards is varied.

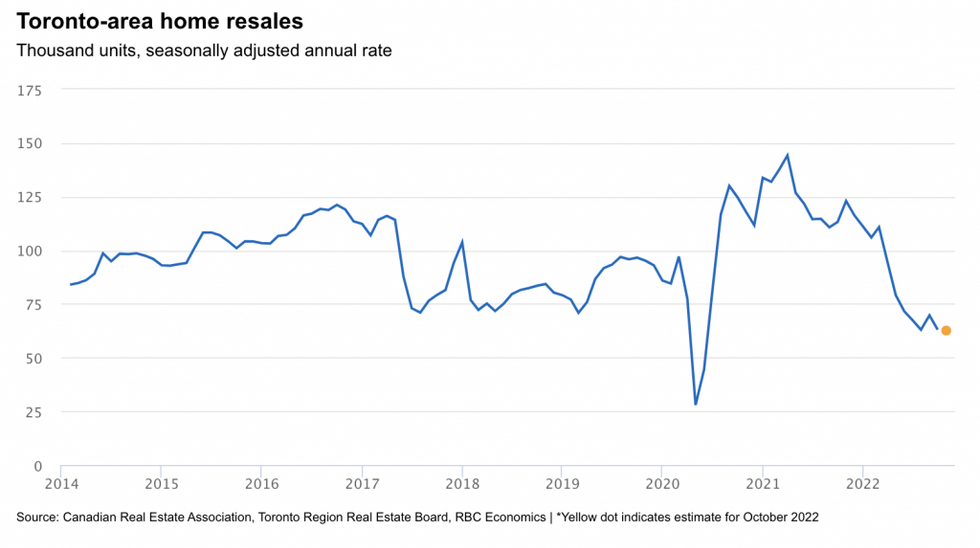

Although the Toronto area has seen a dramatic housing correction this year, the market may be gradually balancing out. Home sales have remained more or less flat since July, increasing just 0.2% between September and October.

This is an indication that “rising interest rates are clearly keeping demand cool at this stage,” according to RBC’s report. “Yet they aren’t heating up supply either. So far there’s no indications higher rates are triggering any distressed selling wave. Demand-supply conditions appear to be levelling off following this spring’s sharp deterioration. Property values are still falling though the pace is starting to ease.”

The composite MLS HPI is in the midst of a seven-month decline, dropping 1.1% in October, however that figure is less than a third of the average rate of decline (3.4%) between April and August. Since reaching a peak in March, the HPI is off by 18%, reflecting a reverse of nearly half of the gains from earlier in the pandemic. In addition, the index is below the year-ago level for the first time in more than three years.

The overall price depreciation is largely due to the single-family home segment, which fell 3.7% year over year. On the flip side, condo prices have held strong, with an HPI 7.5% above the year-ago level.

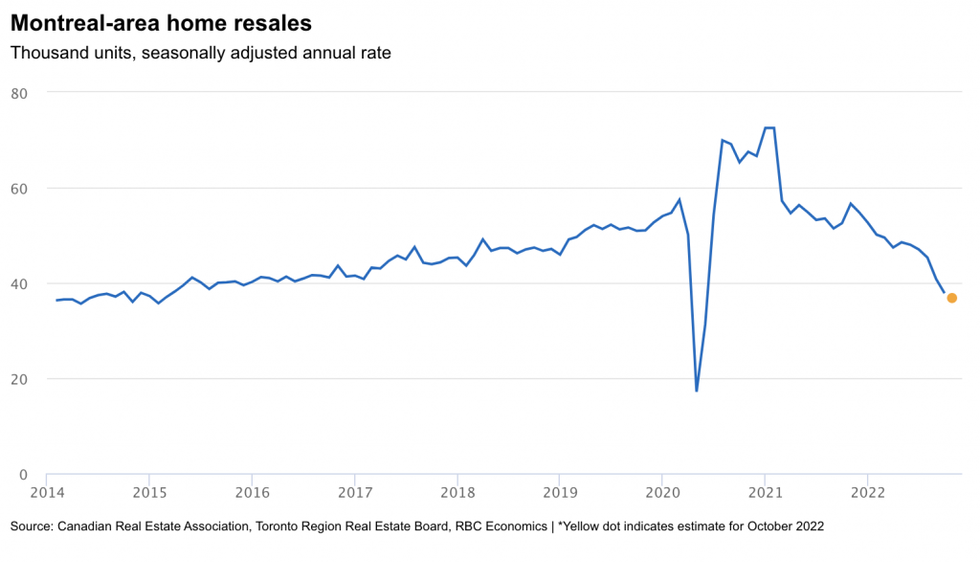

In the Montreal area, the housing correction is yet to relent, and activity is at a seven-year low. The high interest rate environment continues to push buyers to the sidelines, causing inventory levels to rise as prices decline. But RBC’s report notes that “the situation is far from dire.”

“Demand-supply conditions are reasonably balanced and, despite rising, inventories remain historically low. Depending on the measure and part of the area being looked at, prices are either up slightly from a year ago or on par. In any case, they’re still significantly above—nearly 40%—pre-pandemic levels.”

This “controlled softening” is expected to persist in the near term, and home resales are estimated to drop 2.6% month over month. This is certainly a slower pace of decline compared to the past three months, which saw an average drop of 7%. RBC forecasts Montreal’s market will bottom out in the early spring of 2023.

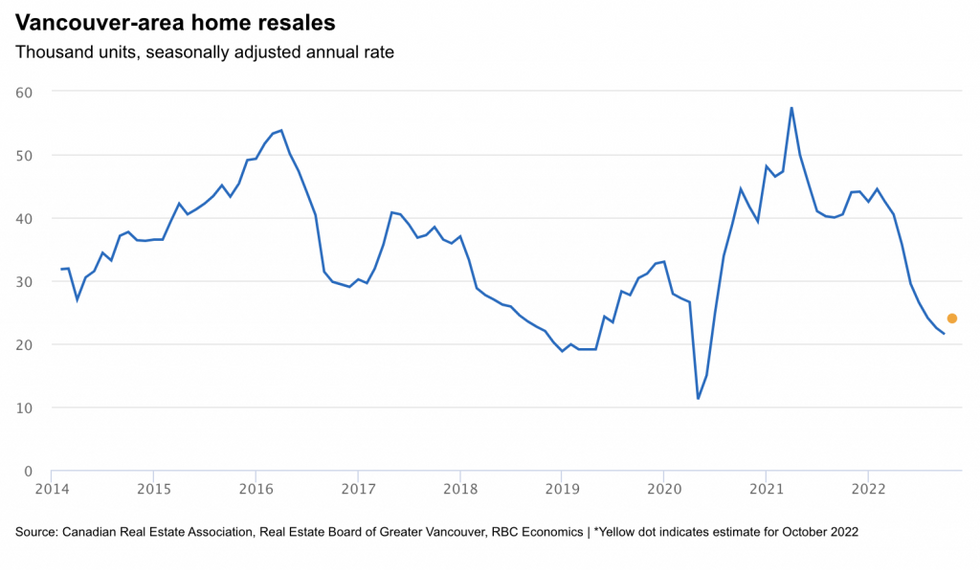

The situation is more nuanced in the Vancouver area, where dwindling affordability has aggressively stamped out buyer demand. The high interest rate environment has triggered a 44% drop in sales activity since March, mitigating the region’s low-inventory-woes.

Although RBC estimates a 10% monthly increase in home resales, the report notes that “this is unlikely to mark a turning point” and activity is expected to “stay soft for a while longer given the intense unaffordability pressures.”

Since reaching a peak in April, property values are down 9.2%, including a 0.6% drop between September and October, and that downward trajectory is expected to persist. With that said, the decline is anticipated to be at a more moderate rate than in months past, with October’s decline being the slightest in the past five months.

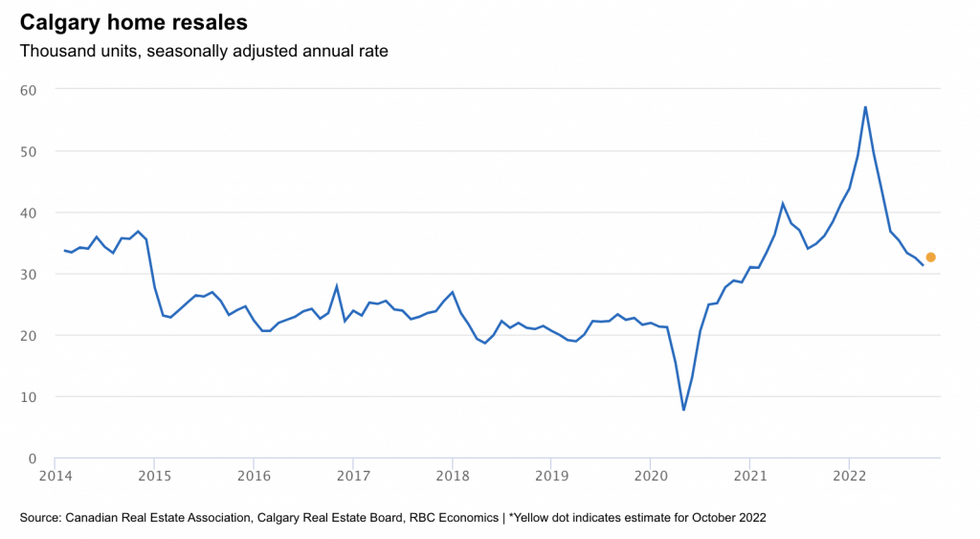

Calgary is one of the only markets in Canada to see activity above its pre-pandemic levels. Home resales are estimated to climb 5.5% MoM, however, demand-supply conditions remain tight.

Nonetheless, home prices are declining. Calgary’s MLS HPI is off 4.2% since reaching a peak in May, indicating that although the housing correction has hit Calgary’s market with less ferocity, “Calgary homebuyers haven’t been immune to the loss of purchasing power arising from higher interest rates,” according to RBC’s report.

“We expect this will continue to maintain downward pressure on prices in the near term. That said, we think Calgary property values might be quicker to recover than most other markets. Tight demand-supply conditions are bound to become the dominant force driving prices once interest rate stabilize. Rebounding in-migration is also likely to set a supportive backdrop for the market.”