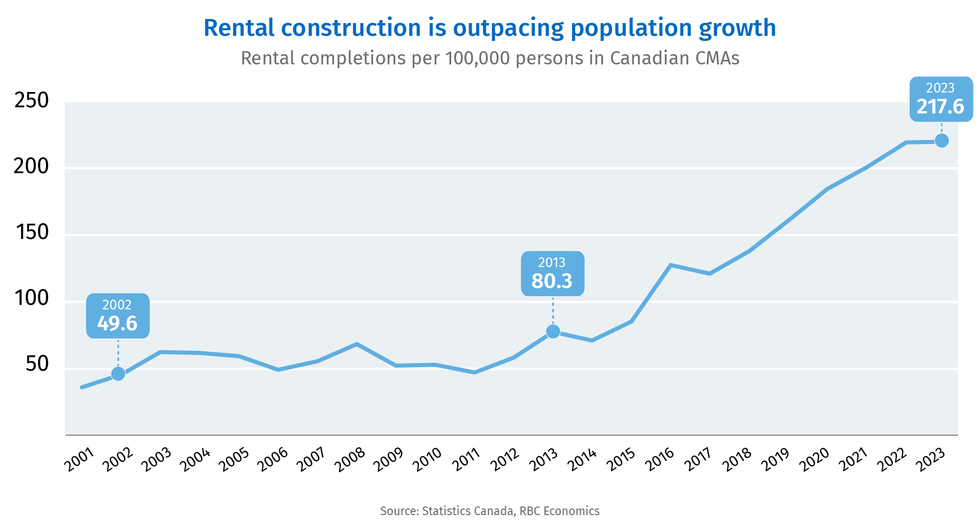

The Canadian real estate market may be a far cry from what it once was (and where stakeholders need it to be), but there are glimmers of positivity to speak of. In a report from last Wednesday discussing the factors putting downward pressure on rents, RBC Economist Rachel Battaglia wrote that rental construction is having a “renaissance” that’s resulting in an uptrend in supply.

“[…] rental completions have ramped up significantly in recent quarters as construction projects that started some time ago reach the finish line,” Battaglia said. “The number of purpose-built units started nearly quadrupled in the past decade, accelerating significantly since 2018 after the introduction of various government incentives.”

Battaglia discussed the fact that rental starts — so, purpose-built rentals, as well as condo apartments and secondary suites — are accounting for an increasing share of overall housing starts in Canada in a July 3 report as well. At that time, she noted that rental housing starts came in around 80,000 per year in 2022 and 2023, “nearly doubling the average pre-pandemic (2015–2019) annual increase.”

Coming back to her most recent report, Battaglia noted that this “rental construction boom” is most evident in Toronto and Vancouver, “where growth in unit completions well outpaced population growth in recent quarters, pushing up the number of units per 100,000 people.”

“This comes after decades of little rental construction that contributed to extremely tight market dynamics,” Battaglia added.

More recently, Canada Mortgage and Housing Corporation (CMHC) presented a different, but not unrelated, cross section of new rental supply — or, at least, the prospect of it — in its financial report for the third quarter, released Friday.

The government agency said there was “continued strong demand for multi-unit insurance products” in Q3, and attributed that, largely, to the agency’s MLI Select product, which uses a point system to offer insurance incentives. Points are based on a project’s 10-year rental affordability commitment, degree of greenhouse gas reduction, and accessibility in accordance with national and/or universal standards for such. The product is also available for existing builds.

According to Friday’s report, CMHC insured 64,979 multi-unit residential units, of which 29,878 are new construction, over July, August, and September of this year. That first figure represents a 26% increase over 51,443 units insured during the third quarter of 2023. Year to date, 206,157 units have been insured through CMHC’s multi-unit products.

“Facilitating the construction of purpose-built rentals remains a key factor in tackling the country's housing supply and affordability challenges,” CMHC’s Chief Financial Officer and Senior Vice-President, Corporate Services, Michel Tremblay, said in a press release. “We are pleased to see such consistent and increasing uptake in our multi-unit insurance products, which are an important factor in supporting the creation of rental supply in Canada.”

- Dream Unlimited Plans 5K Purpose-Built Rentals As Feds Drop GST ›

- ‘Won’t Move The Needle Enough’: Toronto Approves Incentive Stream For Purpose-Built Rental ›

- “A Rare Occurrence”: Average Canadian Rent Falls For First Time Since 2021 ›

- GTA Home Sales Jump 40% In November ›

- Canadian Rents Decline To 15-Month Low In November ›

- STOREYS Trend of the Year: The Pivot To Purpose-Built Rentals ›

- 55% Of Purpose-Built Rental Sites In GTHA Have Infill Potential ›