In ten years’ time, demand in Ontario’s rental market is expected to outstrip supply by almost double, according to a new study from the Federation of Rental-housing Providers of Ontario (FRPO). Prepared in collaboration with research and consultancy firm Urbanation, the study forecasts that rental demand will increase by a total of 418,000 units by 2034, while purpose-built and condominium rental supply will increase by just 211,000 units.

With the rental supply gap anticipated to grow to 207,000 units, nearly doubling the deficit accumulated since 2016, FRPO points to rental infill development as an area of potential growth. The organization notes that infill sites could be intensified “at zero land cost for existing owners.”

According to FRPO’s research, of 1,715 existing purpose-built rental sites across the Greater Toronto and Hamilton Area (GTHA), 55% — or 942 sites — have the potential to accommodate infill development, meaning that they have “sufficient excess land available for intensification.” Of those 942 sites, 36% are transit-oriented.

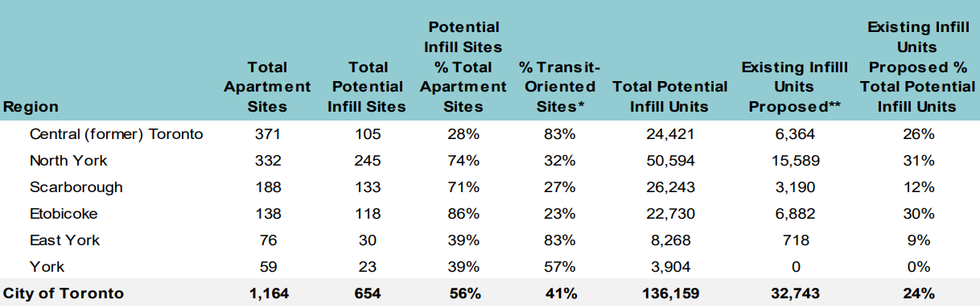

“The potential infill sites could accommodate an estimated 182,023 units, which was 4.5 times as many units as currently proposed at existing rental sites when including both purpose-built rentals and condos,” the study says. “While the greatest potential for infill development was in the City of Toronto, with 136,159 units that could be accommodated, most of the supply potential totalling 111,738 units was in more affordable areas outside of Central Toronto, with an additional 45,865 units located in the 905 region.”

The study also looks at the current landscape of rental infill development in the GTHA, and shows that of 180 purpose-built projects (totalling 37,040 units) completed since 2000, just 30 (totalling 5,804 units) were infill projects, “representing a 16% share of the total rental stock built in the region during the past 25 years.”

Meanwhile, of the 82 new purpose-built rental projects (totalling 23,665 units) under construction across the region as of the fourth quarter of 2024, just nine (totalling 1,826 units) are infill projects, marking an 8% share. “This represented a marginal increase in infill development compared to five years earlier in Q4-2019, when five infill projects totalling 1,298 units were under construction,” the study says.

“Securing financing for infill projects isn’t necessarily more difficult than other rental projects — evaluation criteria of lenders is effectively the same — however, there could be additional legal work to ensure different financing arrangements and other encumbrances specific to each building are treated equally for the entire property,” says Tony Irwin, President and CEO of FRPO, when asked why infill projects make up such a small proportion of overall purpose-built rental development.

“Issues around securities on loans and agreements governing shared elements are examples of legal issues that need to be sorted out. On an operational level, it could be harder to get an accurate appraisal of the land value to get financing from federal programs because there is no recent sale of the land.”

He adds that developing a site that’s already occupied by rental income-generating properties can come at a near-term revenue loss for the property owner.

“In addition, there are costs associated with finding existing tenants places they can live in during this interim period. Even in situations where the existing building is not being demolished, construction activity on the property can result in more units remaining vacant as the building becomes less desirable,” says Irwin. “There may also be additional costs for off-site parking if, for example, you are redeveloping a parking lot previously used by tenants. Property taxes may also go up before rent starts coming in from the new building as they are based on highest and best use, not the actual building on the site.”

Coming back to FRPO’s study, it shows that of the 561 purpose-built rental projects (totalling 203,711 units) proposed for the GTHA as of the fourth quarter of 2024, 90 (totalling 25,937 units) are slated for infill sites. “This represented a 16% share of total proposed purpose-built rental projects and a 13% share of total proposed purpose-built rental units,” the study says. “Compared to five years earlier, the number of proposed purpose-built rental units at infill sites increased 75% from 14,808 units in Q4-2019, which represented a 25% of total proposed rental units at the time.”

While a 75% increase is certainly substantial, Irwin is careful to point out that the total number of purpose-built rental units proposed also surged 245% during that time (from 59,095 units in 2019 to 203,711 units in 2024). He also underscores that the proportion of infill purpose-built rental proposals compared to overall purpose-built rental proposals has shrunk, which suggests that developers are “running into barriers” with infill now even more than before.