Today's release of Proptech Collective's 2024 Year in Review and 2025 Trends provides insights into the growth of an evolving Canadian industry at the forefront of progress and innovation within real estate.

According to the report, the past year saw companies hone in on sustainable business models in the face of softer funding conditions, while industry trends from AI to modular construction to demand for more integrated transactions are expected to continue driving growth and innovation into 2025.

For those in need of a refresher, Proptech is short for property technology and generally encompasses any technology or innovation that is used in the real estate sector, including everything from platforms like Zillow and Redfin to smart cities and climate friendly building technology.

Muted Funding Environment Drives Sustainable Business

One overarching trend proptech companies have been seeing in recent years, and through 2024, is a more muted funding environment compared to the pre-2021 peak. But lead author on the report, and Vice President of real estate venture capital fund Alate Partners, Stephanie Wood tells STOREYS this isn't necessarily a bad thing.

"I think that today, investors are being more cautious, and they're also looking at metrics to a much deeper degree than they used to [...] There are a number of companies that have raised a lot of money and they haven't actually been that successful, unfortunately," says Wood. "But I think that paves the way now for this next round of businesses to actually learn and build more sustainable companies [...] A lot of these founders are looking at ways that they can become profitable or break even sooner, because then they can choose their own destiny, rather than relying on venture capital funding."

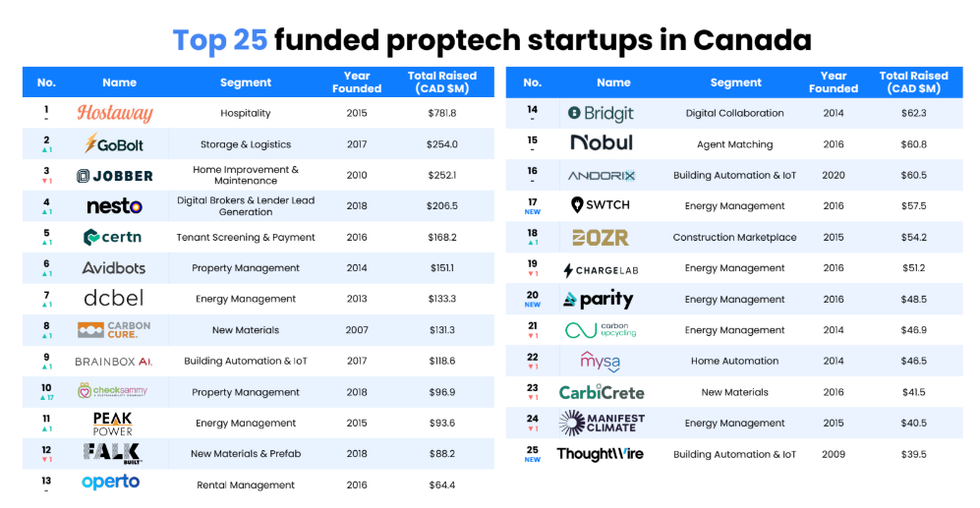

In total, 2024 saw $800 million in funding raised by Canadian proptech companies, though a large portion of those funds came from a particularly successful growth round for short-term rental property management platform Hostaway, which raised a whopping $525 million in funds.

Ben Smith, President of new home sales software company Avesdo, says he's also seen how stringent economic conditions have driven innovation in the proptech sphere. "At Avesdo, we exist in the new home sector, which got — I don't think it's overstated to say — obliterated," Smith tells STOREYS. "So we had to switch from a heavy growth phase to really getting down to, how do we improve our operations? How do we get leaner and try to be really efficient and offer great value?"

Smith also sees continued tight economic conditions and government regulations facilitating further business improvement moving forward. "We're going to see a lot more desire for technology to aid in cost cutting. We're also going to continue to see more government intervention in real estate. Everyone wants to solve the housing crisis, and with that there's going to be an increased focus on compliance," says Smith. "I think that it presents an opportunity for technology companies to really aid in cutting costs and creating more efficient workflows, while also making it easier to deal with all of this compliance that's coming down the pipe from all levels of government."

Proptech Trends Driving Growth And An Increase In M&As

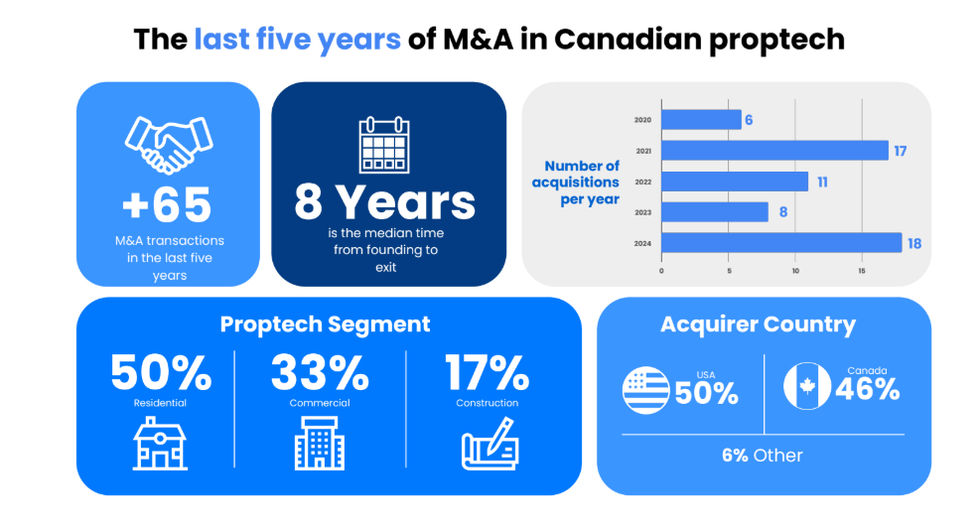

At the same time, a record number of mergers and acquisitions have taken place in recent months as larger, more established proptech companies absorb smaller businesses in pursuit of meeting customer demand for increasingly integrated solutions. Over the last five years there have been over 65 proptech mergers or acquisitions with a ramping up to 20 transactions in January 2025 alone — a substantial trend deviation from the long-term average of roughly 100 transactions a year.

"Real estate customers are demanding more seamless tech, and they want it to do more than just one thing," says Wood. "They don't want to have to Frankenstein together a bunch of different technologies. So as these companies grow and become bigger, we're seeing more mergers."

The report from Proptech Collective also identifies a number of more sector-specific trends within the construction, residential, and commercial spheres.

Leading growth in construction proptech are companies that focus on modular and offsite construction, workforce tech, and new building materials. In the commercial real estate space, decarbonization and grid infrastructure, investment tech, and smart building solutions are in high demand. While on the residential side of things, companies that enable affordability, integrated transactions, and solutions for alternative brokerage models are seeing marked growth.

AI Revolution And The Proptech Industry

Across all sectors, AI is flagged as an overarching propellant for growth in the proptech industry. "Investors are obviously really excited by it, and it feels like this generational shift that is happening," says Wood. "One of the big things in real estate is there's so much data [...] and there's a lot of people that are always involved. So how can you reduce repetitive tasks, how can you process more data and make better decisions quicker?"

Despite the excitement around AI, proptech AI solutions are still in their infancy. "We think that there's going to be some really interesting applications of it, but we're still in the earliest days, for sure," says Wood.

Avesdo's Smith echoes this outlook, highlighting the need for more fulsome and polished AI products. "We've seen a lot of experimentation in AI. But I'd say for the most part, I haven't seen anything really proprietary," says Smith. "I think there's a lot of people who are coming out with AI powered ideas, but they aren't something that everyone couldn't do if they just tried. So it's more about first-to-market sort of stuff right now, but there's not too much that's really changed the game yet."