Most people have probably come away from COVID-19 with a few purchases they now question, but for Canadian homebuyers who purchased a home during the pandemic, that home wasn't one of them, at least that's according to a new survey.

A survey of 1,183 Canadians published this week by Zolo -- a national real estate marketplace -- found that 63% of home buyers have no regrets. (As opposed to in the United States, where there have been many regrets.)

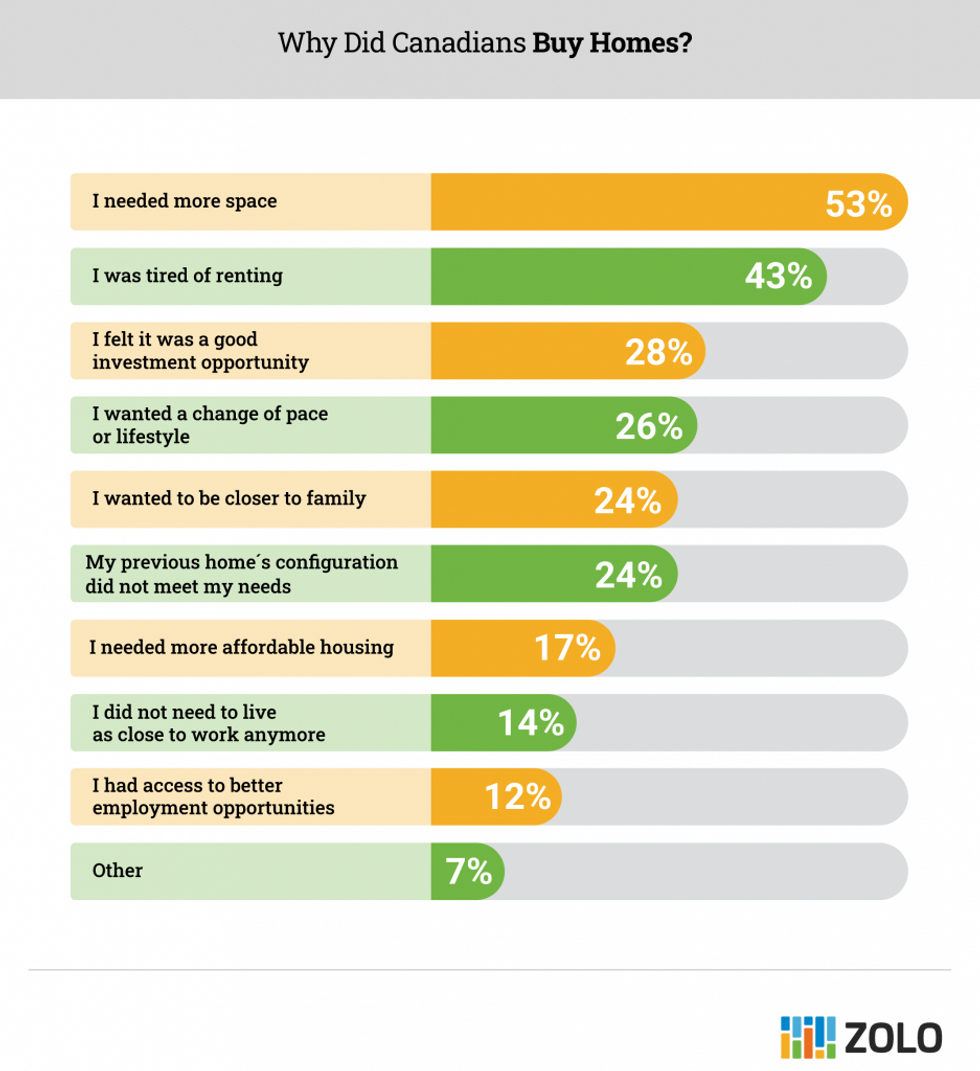

When surveyed about the reasons behind their decision to purchase, the most-selected response was the need for more space, cited by 53% of the 1,183 respondents. Second was being tired of renting (43%), followed by the investment opportunity (28%), and a lifestyle change (26%).

Approximately 79% of respondents used a real estate agent to buy their homes, with 43% also using a mortgage broker.

A surprisingly high 40% of Canadian homebuyers saw the property they would end up purchasing in-person just once before they bought it, while 39% saw the property more than one time, 27% attended an open house, and 8% purchased the home without seeing it at all. However, 79% of those who purchased their home without seeing it in-person have no regrets.

Due to the competitiveness of the market during the COVID-19 pandemic, 21% of buyers participated in a bidding war for the property, 28% ended up paying more than the asking price, but, again, 84% of those included in those statistics have no regrets about their purchase.

To speed up transactions and improve their offers, it became increasingly common for buyers to waive inspection clauses and financing clauses. According to the survey, 17% of buyers waived inspection clauses, while 11% waived financing clauses, but, once more, 58% of those who waived either remain happy with their purchases.

Perhaps most interesting, however, is that 63% of homebuyers who purchased during the pandemic said that they would remain happy with their purchase even if the real estate market took a dive.

Zolo points out that in 40 out of the 53 real estate boards across Canada, prices fell this quarter. Inflation is still high, interest rates continue to rise to counteract said inflation, and the real estate market will likely ebb and flow along with those things, and Zolo's survey found that 77% of pandemic homebuyers recognize that a recession would affect whether or not they could afford their mortgages.

READ: Rising Interest Rates Will Continue to Push Buyers to Sidelines: RBC

A different survey published in August found that Canadians recognize the importance of homeownership -- and not just income -- as it relates to one's wealth. Accordingly, 46% of respondents who participated in the Zolo survey published this week said that buying a home has helped them achieve their financial goals.

All in all, Zolo says that regardless of how you look at it, it's clear that Canadians who purchased their homes during the pandemic are happy with their decisions, proving that homes are oftentimes more than just an asset.