As demand for office space dwindles, some developers are deviating on planned projects and instead opting to cater construction to the life sciences sector.

The emerging trend is detailed in Avison Young's Greater Toronto Office Market Report for Q2 2023, which relays that vacancy and availability rates have continued to inch upwards, with both rising 30 basis points (bps) on a quarterly basis.

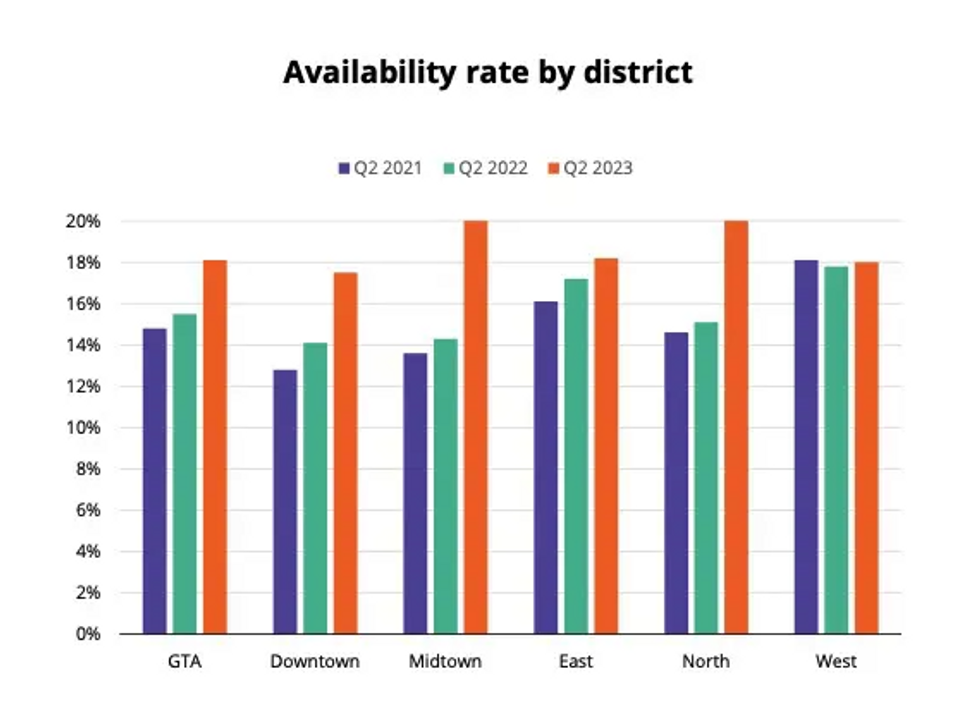

The jump brought the overall office vacancy rate in the GTA to 12%, and the overall availability rate to 18.1% -- 219 buildings in the GTA had more than 50,000 sq. ft of office space available in Q2.

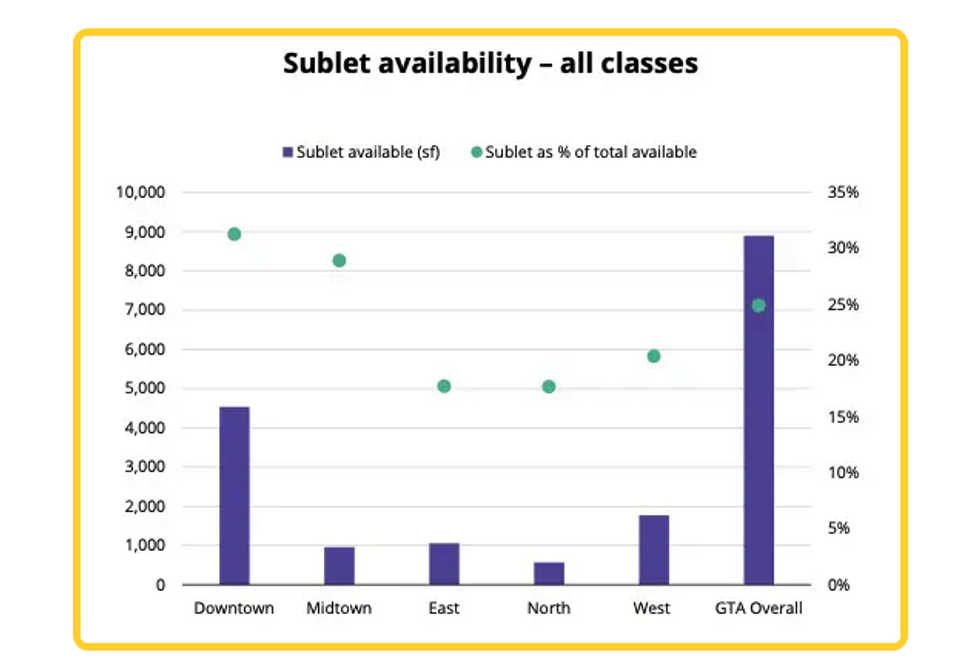

The office vacancy rate in downtown Toronto also stood at 12% in Q2, a 40-bps increase from Q1, while the availability rate fell 30 bps to 17.5%. Although this marked the first quarterly decline since the onset of the pandemic, availability was still up 340 bps annually. Similarly, available sublet space dipped 50,000 sq. ft. on a quarterly basis, to 4.5M sq. ft., but was still up 1.8M sq. ft. year over year.

Across the GTA, 8.9M sq. ft of sublet space was available in Q2, a 42% annual increase. In suburban markets, sublet space as a proportion of total available space hit 19%. In downtown Toronto, it was 31%.

Despite this, seven new office buildings, totalling 480,000 sq. ft, were completed in the region in Q2, and another 6.2M sq. ft of space is under construction, equal to 3% of existing inventory.

With demand expected to continue on its downward trajectory, Avison Young reports that some developers have begun to repurpose new office construction projects for the life sciences sector.

It is decidedly difficult to convert existing offices into lab space, as most buildings lack the ceiling height, separate loading areas, and infrastructure required to do so. The challenges present a unique opportunity for developers to make the switch before, or even during, the construction process.

An example of this trend can be seen at 77 Wade Avenue in Toronto's Junction neighbourhood. The 155,000-sq.-ft space was originally slated for office use until AIMCo partnered with Canadian Life Science Property Group, Avison Young said.

Another instance is the four-storey, 187,000-sq.-ft addition KingSett Capital is adding to 700 University Avenue in the Discovery District, which will now be used solely for life sciences and research space, rather than its initial mixed-use designation.

Also previously eyed for office use, The CORE at 2395 Speakman Drive in Mississauga will be the first purpose-built life science campus in the GTA, offering 400,000 sq. ft of lab and research and development space.

Avison Young expects both office vacancy and availability to continue rising across the GTA in the short term as companies continue to adjust to their new realities.

With existing options for lab space slim, particularly so in Downtown Toronto, repurposing office developments may prove to be a viable solution to promoting the region's life science's sector.