A mere 310 new home sales were recorded across the entire GTA in April — the seventh consecutive month that saw sales hit historic lows, surpassing the infamous 1990 downturn. For context, a typical April would historically see around 2,750 new home sales, according to the latest data from the Building Industry and Land Development Association (BILD).

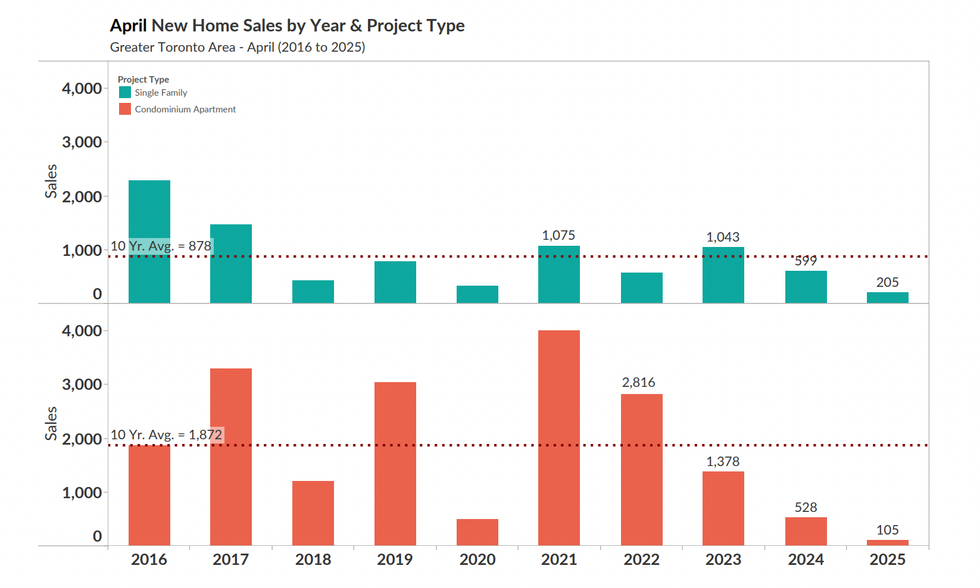

Compared to last year, sales were down 72% in April and sat 89% below the 10-year average. The majority of sales were made up of new single-family homes, which totalled 205 sales, sliding 66% year over year. New condos made up the remaining 105 sales, a bleak 80% drop from April 2024 and 94% below the 10-year average.

Senior Vice President of Communications, Research, and Stakeholder Relations at BILD, Justin Sherwood, says that previously high interest rates and the GTA's lingering 'cost to build crisis' first landed sales in choppy waters in 2024, but economic uncertainty stemming from tariffs has squashed any demand that was beginning to return.

“We saw interest rates starting to come down, then the market starts to stabilize. It looks like [demand] is starting to come back, and then you get tariff and economic uncertainty, and everyone's concerned and pulling back to see what happens," Sherwood tells STOREYS.

Before tariff mania kicked in, January saw a promising uptick in new home sales, but by February, sales had plunged back down posting the worst February on record. Since then, different variations of "record-breaking low" have continued to plague headlines of BILD's monthly new home sales reports.

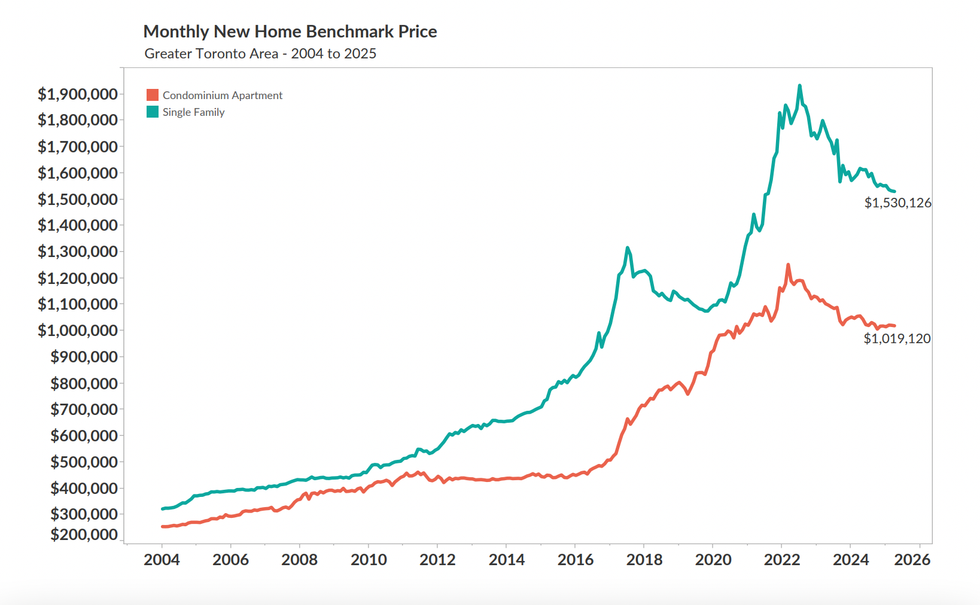

But as BILD often points out in their reports, a slow new home market doesn't just mean less profit for builders — it's a harbinger of future supply gaps and skyrocketing prices for Canadian homebuyers.

“If you're seeing a downturn in sales, what that means is you have a whole series of projects that should be coming down the pipe that are either being delayed or just not progressing at all, because they're not financially viable." says Sherwood. "What that means is the cranes that you see in the sky now will go away [...] and new home supply just won't be there."

On top of that, the population will continue to expand in the interim and by 2027-2029 — the period in which the supply gap will begin to take hold — "Demand is going to be there and housing is not,” says Sherwood. This will ultimately lead to the return of rapid price appreciation and lack of housing options as inventory decreases.

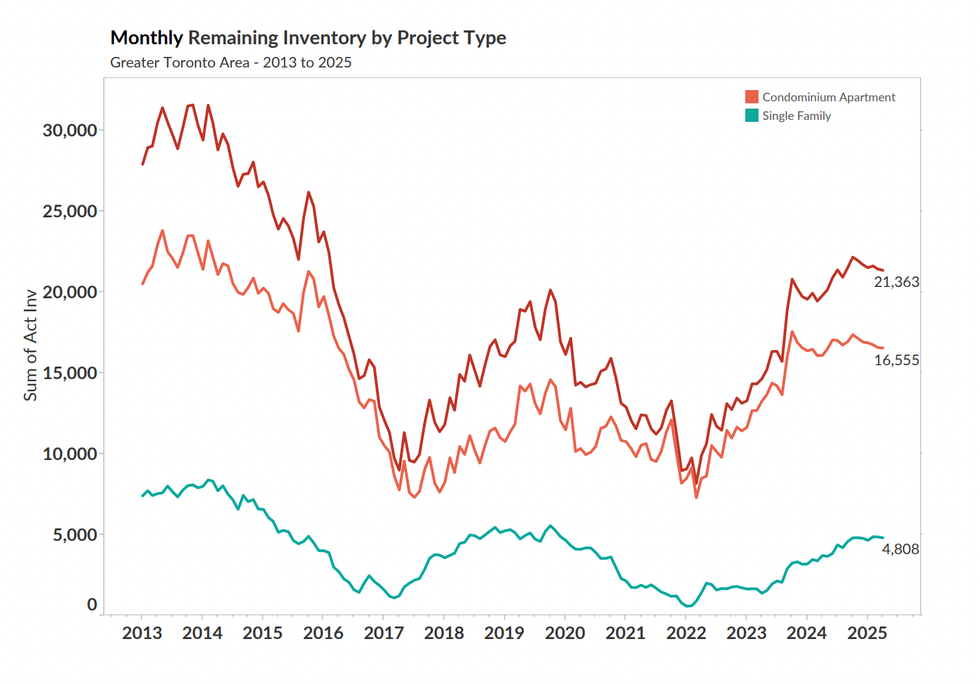

Returning to the April data, inventory ticked down from 21,707 in March to 21,363 units but remains well above average levels at 15 months of inventory. This includes 16,555 condominium apartment units and 4,808 single-family dwellings.

With inventory high, Sherwood points out that now is an ideal time to buy. "There's a tremendous amount of choice out there, there's a lot of inventory, interest rates are coming back down to within historical norms, and there's a lot of deals to be had," he says.

On the price front, the GTA continued to see new home values fall in April with benchmark prices for both single-family homes and condos falling year over year. Condo prices have fallen 3.6% over the last 12 months to $1,019,120 and slid from $1,020,864 in March, while single-family homes fell 5.4% since last April to $1,530,126 and dipped from $1,532,279 in March.

In order to help return new homes sales to sustainable levels, BILD has been calling for the feds to implement and expand on the proposed HST reforms, but they remain unsatisfied with the steps being taken thus far.

“Yesterday the Federal Government tabled its proposed measures to provide GST(HST) relief to first-time new home buyers. Unfortunately, this limitation to first-time buyers only will have a very small impact, as a very few new home buyers are first time buyers. It will not substantially help address affordability, nor will it help significantly stimulate sales and construction,” said Sherwood. “The government has reaped billions in additional tax revenue on new homes by not indexing GST price rebate thresholds since 1991 and instead has created a new mechanism that will apply to very few purchasers. In order to have maximum impact and address the effects of GST/HST on eroding home affordability, the Federal government must broaden the scope of the GST (HST) measures to all new home purchases."

Sherwood says there are a number of other federal measures he feels are only getting in the way of development. One such measure being the foreign buyer ban, which he says is critical to facilitating new housing development.

“The reality is, foreign buyers are a critical financing mechanism for getting new housing, especially condos, built," he says. "Once those condos are built, the foreign buyers either... rent it out, which adds to the rental stock, or they're going to live in it, or they're gonna sell it."

On top of that, Sherwood questions the necessity of the Liberal's Build Canada Homes endeavour — Carney's plan to create a federal housing entity that would act as a public housing developer — calling it "a little problematic."

"The problem that we have in terms of getting housing supply and housing built in Canada is not because we have a shortage of builders. So to have a new government builder added to the mix isn't going to solve the problem," says Sherwood. "The Government should be focusing on clearing the regulatory barriers that are holding back the industry from providing the supply that is required.”

- GTA New Home Sales Hit "Rock Bottom" (Again) In March ›

- Mark Carney Reaffirms Pledge To Eliminate GST For First-Time Homebuyers ›

- Carney Pledges To Get Feds Back Into "Business of Homebuilding" ›

- May GTA New Home Sales Extend "Worst Downturn" On Record ›

- GTA New Home Sales In June Down 80% From Historical Norm ›