According to new data from the Canadian Real Estate Association (CREA), the month of June saw a "steep decline" in Muskoka waterfront property sales.

But agents in the area say that, in realty, the lowering isn't as intense as the numbers might lead you to believe.

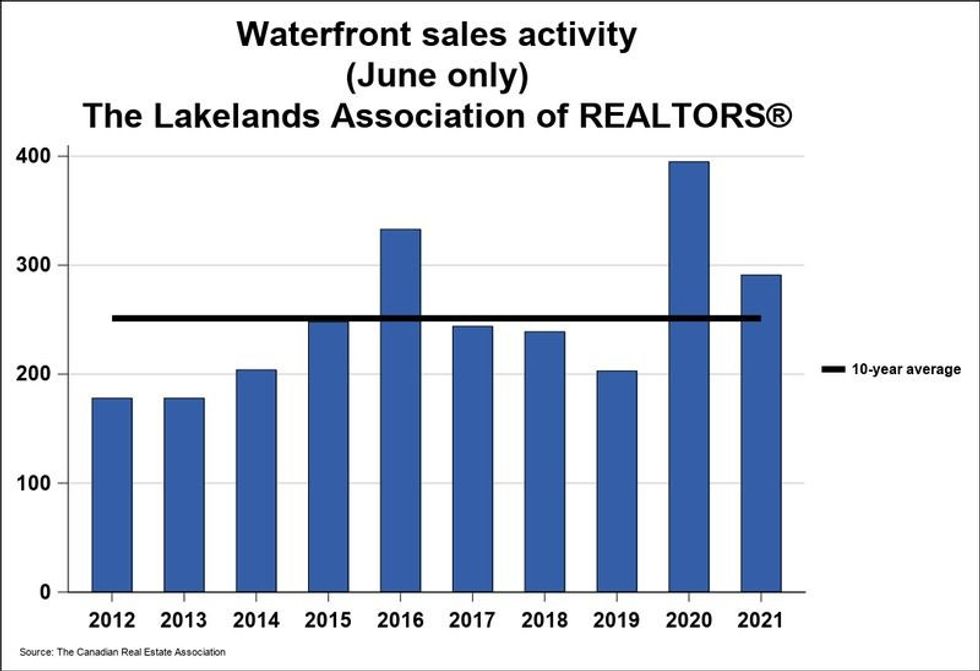

CREA reports that waterfront property sales numbered 291 units in June 2021 -- a 26.3% decline described as "sharp" compared to the same month last year. However, this category of sales remained 6% above the five-year average, and 15.8% above the 10-year average for the month of June.

Where year-to-date data is concerned, 2021's activity reigns over that of 2020. Waterfront sales totalled a record 1,222 units through the first half of the year, up 46.7% from the same period last year.

READ: From the Ground Up: Building Your Dream Cottage Could Be the Best Move You Make

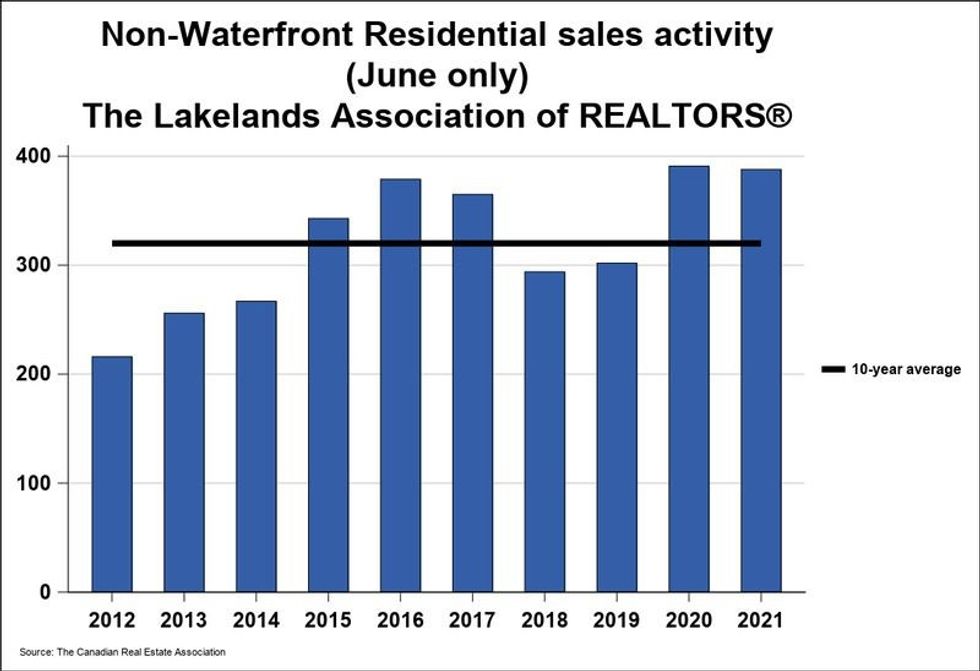

"Home sales came in at a more moderate level in June compared to the same month last year but there’s been a clear divergence in trends among property types. Sales of waterfront homes recorded a steep decline from last June’s record while sales of non-waterfront residential homes nearly ended up tying their record from last June," said Chuck Murney, President of the Lakelands Association of Realtors.

"While both property types have seen similar trends in new supply coming onto the market and a continued decline in overall available listings due to an elevated level of demand, it appears that the majority of the buying frenzy for waterfront homes may now be in the rearview mirror."

But according to Maryrose Coleman -- of both Muskoka District Rentals and Sotheby’s International Realty Canada --- June's numbers (and the claims that stem from them) present a more dramatic situation than what agents are actually seeing in the region right now.

"The rumours of the death of the waterfront market are greatly exaggerated," Coleman says. "We have seen a softening, or a slowing, but it’s too early to tell if this is a typical summer market easing -- as there has been very little product available -- or if we are actually starting to see the market ease or even turn."

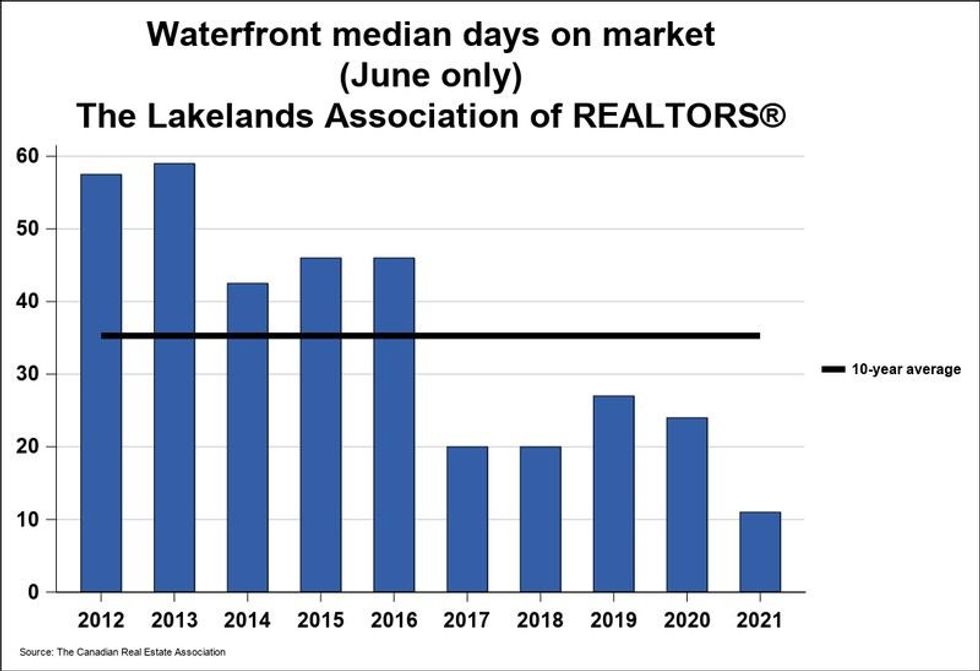

She notes that ultimately, the length of a listing's life on the market is much less about location than it is about cost.

"Demand is still strong for well priced properties. Aspirationally [sic] priced waterfront properties are sitting for longer. I expect this to continue through the summer, and by fall we will have a cleaner picture of the market trends."

Meanwhile, residential non-waterfront sales activity totalled 388 units last month -- nearly matching the data from June 2021, lowering just 0.8%. Sales came in 11.5% above the five-year average, and 21.2% above the 10-year average for the month, while the year-to-date total hit a record 1,977 units. This marks an increase of 51.3% over the same stretch of time last year.

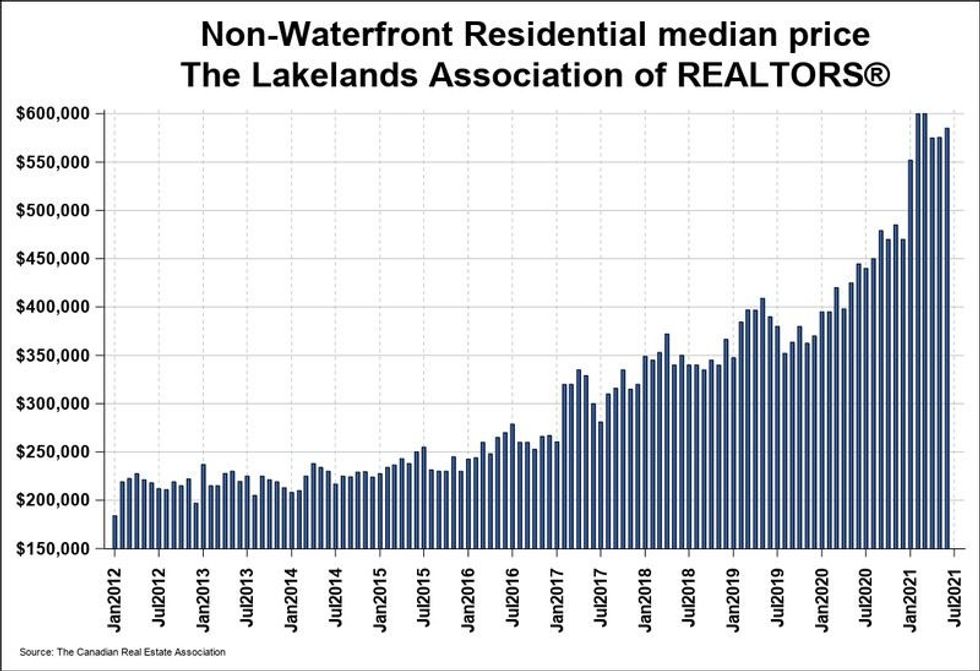

The MLS Home Price Index (HPI) -- which tracks price trends far more accurately than is possible using average or median price measures -- recorded the single-family benchmark price to be $616,500 in June, an increase of 45.6% on a year-over-year basis.

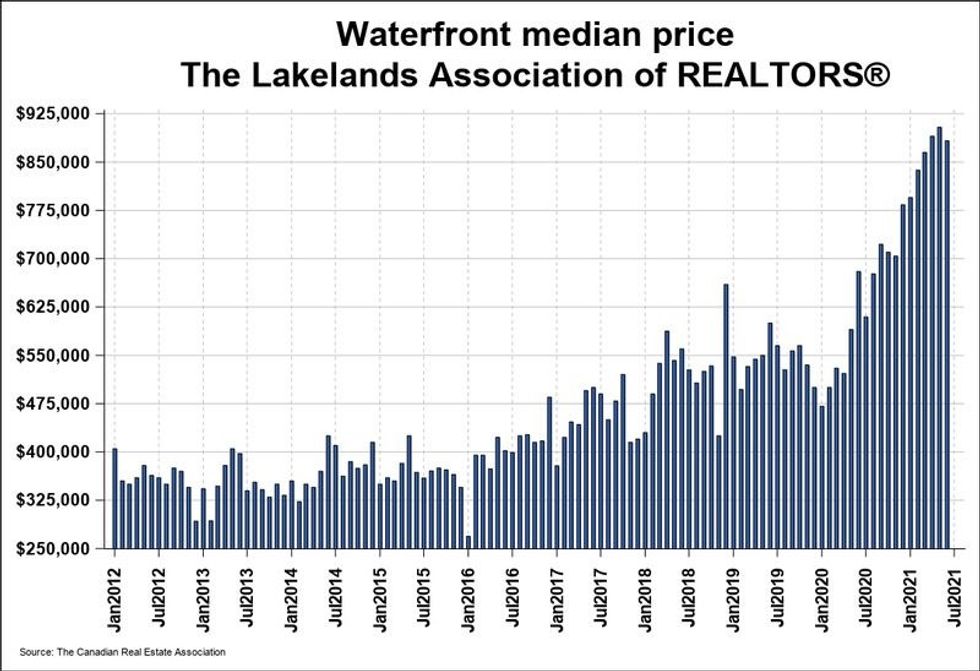

The median price for waterfront property sales was $883,000, up 29.9% year-over-year, while the same measure for non-waterfront sales was $585,000, or 31.5% higher than June 2020. Even more comprehensive, the year-to-date residential waterfront median price was 47.5% over that of 2020, reaching $880,444. Non-waterfront properties showed a gain of 39.8%, closing June at $580,000.

Total dollar values for waterfront and non-waterfront sales reached $248 million and $344.2 million respectively -- the former showing a year-over-year gain of 28.4%, and the latter, a decrease of 2.9%.