According to a report published last week by real estate sales and marketing firm MLA Canada, Metro Vancouver just saw "the largest release of inventory since mid-2022" in Q2, which brought a diverse range of absorption trends across the region.

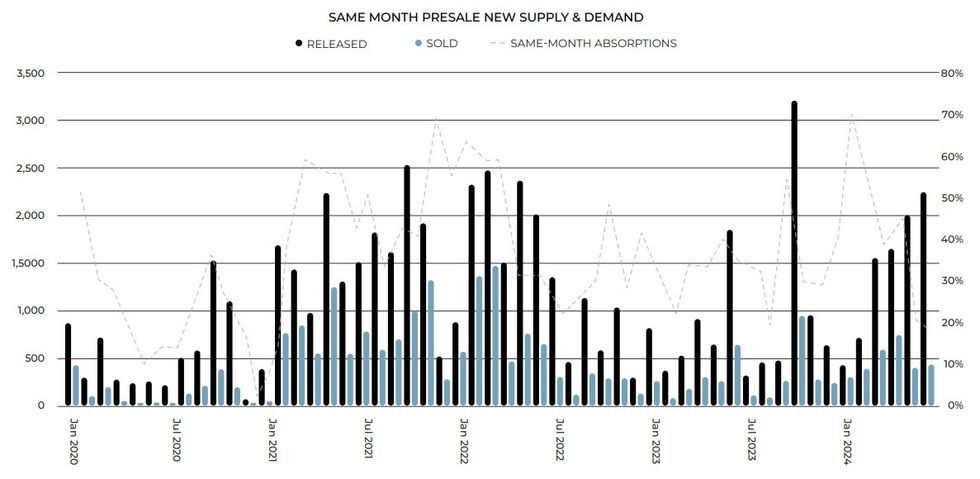

MLA Canada data shows that April saw about 1,600 units released, followed by approximately 2,000 in May and then around 2,250 in June, for a total of 5,850 units in Q2.

Although October 2023 saw a huge release of supply that exceeded 3,000 units, that quarter still saw fewer units released than Q2 2024, with the next comparable quarter being Q2 2022, which saw approximately 5,900 units released.

Prior to that, Q3 and Q4 2021 both saw approximately 4,900 units released.

Demand, however, in terms of the amount of units sold and same-month absorptions, were much higher in those quarters than Q2 2024.

"At the start of the year, same-month absorptions were notably high," says MLA Canada. "This surge was fueled by projects that had been previewing for several months, strategically launching ahead of the expected Spring wave. These elevated absorption rates continued into April, reflecting strong initial demand. However, by May and June, absorption rates began to taper off. This decline can be partly attributed to the seasonal shift as the Spring market wound down, giving way to the slower summer months."

Overall, across the first half of 2024, the Lower Mainland finished with an average same-month absorption rate of 33%, with a total of 2,848 units sold, out of 8,593 released units across 68 projects.

Of note, however, is that the Fraser Valley accounted for both more units sold and released — 1,631 out of 4,546 — than the Greater Vancouver region — 1,217 and 4,047.

"The average sales-to-listings ratio for all projects launched in the Fraser Valley since 2024 has been around 36%, compared to Greater Vancouver's ratio of approximately 30%," says MLA Canada. "This heightened demand can largely be attributed to its competitively priced offerings compared to Vancouver, making them more accessible and appealing to potential purchasers."

The firm adds that because sales velocity has been reduced, developers are extending the average length of sales campaigns and sales teams are no longer seeing towers selling out within weeks of launch. This also creates more competition among developers, resulting in more options for prospective buyers, and that has shown up in the market in the form of an abundance of incentives.

MLA Canada is now projecting 10,500 units across 42 more launches in the second half of the year, with an average same-month absorption rate of 35%. The projected amount of launches is in line with MLA's projections of 110 total launches in 2024 at the beginning of the year, although the expectation regarding absorption is now lower.

"Presale project launch activity at this level would be an improvement from 2023, but still below historical norms and in line with slower years," says MLA Canada. "With an estimated 110 projects, this would reflect activity approximately 17% above levels in 2023, but 15-25% below activity seen in 2021/2022."

"Overall, presale buyer urgency is low and almost every deal is met with negotiations, especially on the higher end of the pricing spectrum," added MLA Canada's Director of Advisory Garde MacDonald. "We foresee that the remainder of the year will build on existing trends. While we anticipate a seasonal upswing in the Fall, the H2 2024 market outlook does not look markedly different from today."