It’s a tough time to be associated with the Mizrahi name. We’re not even midway through June, but the month has already seen The One embroiled in more turmoil amid a dispute over the sale of the project, and Mizrahi’s condo project at 128 Hazelton Avenue slapped with a receivership order amid allegations of a $47M debt.

And onto the next one: the Ontario courts have granted another receivership order over another one of Mizrahi’s projects at 180 Steeles Avenue West in Vaughan. The project is a multi-tower development set to bring over 2,000 new residential units to the area. The site is presently awaiting rezoning.

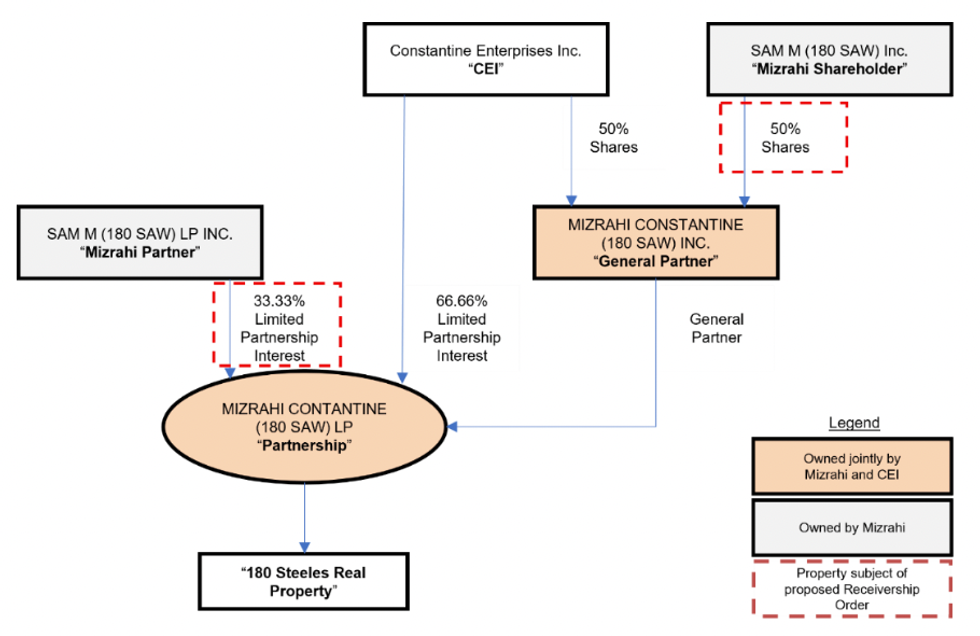

The receivership proceedings over 180 Steeles were initiated on February 23, 2024, by Toronto-based private real estate fund Constantine Enterprises Inc., who are partners on the project. This case and the earlier mentioned Hazelton Avenue case were heard together due to the fact that they involve Constantine as the applicant and Mizrahi as the principal of the respondents, and the respondents were represented by the same counsel.

READ: Mizrahi’s Yorkville Condo Project In Receivership As Partner Alleges $47M Debt

For the Steeles site specifically, Constantine alleged that the debtors — identified in the court documents as Sam M (180 SAW) LP Inc. and Sam M (180 SAW) Inc. — were owning over $28.9M. According to an April 26 affidavit from Constantine, demands for payment were made, but the indebtedness remained unaddressed.

“The debtors’ defaults have severely impaired the development of the 180 Steeles project, a planned high-rise mixed-use development with up to 2,196 residential units across four condominium towers,” Constantine’s affidavit said.

“CEI has lost confidence in Mizrahi and the Mizrahi Group’s ability to fulfil their financial obligations, past and ongoing and there has been a complete breakdown in the relationship between CEI and Mizrahi. The development has been brought to a halt and the appointment of the receiver is required to salvage the 180 Steeles Project. There is a real and material risk of further development delays and enforcement action being taken by the mortgagees, which would materially diminish the value of the property because of the significant costs associated with either of those outcomes.”

In addition to the close-to-$29M owing to Constantine, the partnership between Constantine and the Mizrahi entities, a second mortgage — registered with Trez Capital in the amount of $20M — and a first mortgage — registered to CWB Financial Group in the amount of $78M — are also linked to the Steeles project partnership.

The April 26 document also included a series of events that precipitated Constantine’s petition for receivership, including the fact that the sale of the property was attempted, “but the sales process failed to result in any viable offers.”

It also noted that, in mid-January, Mizrahi attempted to bring a foreign purchaser group into the partnership, however, once that purchaser “gained a better understanding of what stage the 180 Steeles Project was at in the development process, including what steps remained to be completed prior to construction,” they opted to put a pin in their investment “until certain milestones were achieved.”

“At this stage, CEI submits that there is no viable path forward for the transaction or any reasonable prospect of completing a sale of the 180 Steeles project in short order that would result in CEI being repaid its indebtedness in full. There is also significant risk that the value of the property will be materially diminished because of continued development delays and/or enforcement by CWB or Trez of their respective mortgages in connection with the 180 Steeles Project,” Constantine’s affidavit said, later adding that Mizrahi has additionally “failed to make necessary go-forward contributions required” under their partnership agreement.

READ: "A Difference In Vision": Mizrahi On Being Pushed Out Of The One

It appears that the debtors attempted to refute some of the claims made by Constantine on May 8, 2024, while also arguing that receivership is not the best course forward. It’s worth noting that they refuted the receivership in the case of the Hazelton Avenue project as well.

Nonetheless, the Ontario courts opted to oblige Constantine’s pleas by granting the receivership order on June 4, 2024, appointing KSV Advisory as receiver and manager over the 180 Steeles property. Constantine’s hope is that this will be the first step in securing “a partner who can make the requisite financial contributions and work cooperatively with CEI to make decisions in respect of the partnership.”

Although it bears no weight on these receivership proceedings, the relationship between Constantine and Mizrahi has deteriorated further because of a civil suit that’s ongoing. Those proceedings were initiated by Mizrahi against Constantine and its co-founders, Robert Hiscox and Edward S. Rogers III, on the basis of “bad faith” and “breach of duties allegedly owing by the defendants.” Constantine maintains that these allegations are “bare” and “unparticularized,” and that they will be pursing a motion to strike if need be.

- Senior Lender, Jenny Coco Trade Allegations Over Sales Process Of The One ›

- Sam Mizrahi's 'The One' Placed Under Receivership ›

- Lender Seeks Receivership For Mizrahi, Rogers Yorkville Condo Development ›

- Receiver Petitions For Sales Of Mizrahi's Yorkville, Steeles Ave Projects ›

- Spotlight Developments' Kitchener Project Under Receivership ›

- Mizrahi Developments Project In Ottawa Enters Restructuring ›