As cost of living edges upward, even those who can afford to live in the Greater Toronto Area (GTA) are finding their budgets stretched thin. As such, a new report from Zoocasa draws attention to property taxes in cities across the region, urging homeowner hopefuls to factor in this “significant carrying cost” when shopping around for a home.

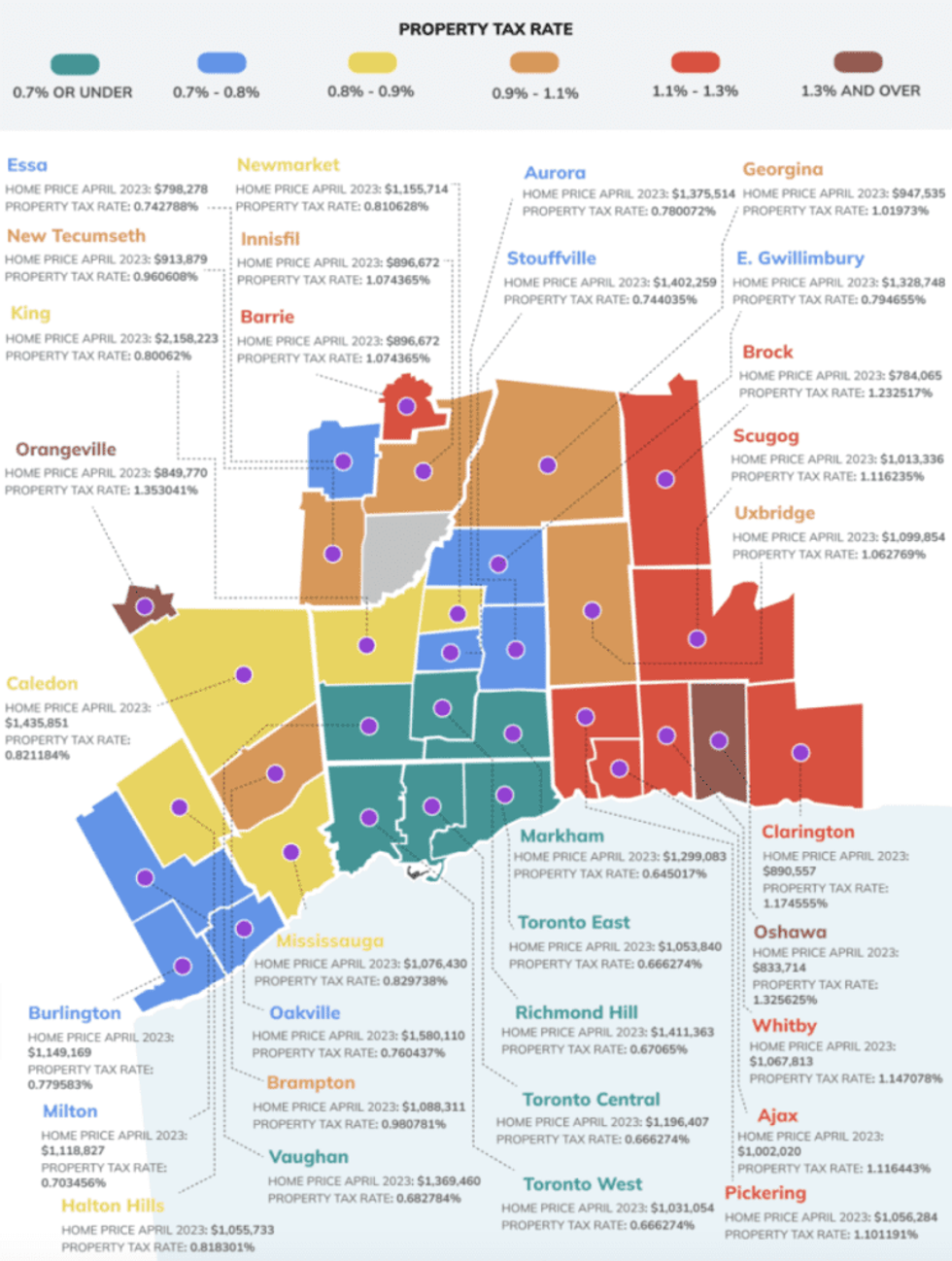

More specifically, the Toronto-based real estate agency digs into where in the GTA property owners are subject to the lowest and highest property tax rates. This is based on the municipal tax rate and average home price in 32 GTA cities.

“Property taxes vary from city to city and are set by individual municipalities to cover the costs of various services in the community such as transportation, infrastructure, maintenance, and park services,” writes Mackenzie Scibetta, Content Marketing Specialist for Zoocasa. “Understanding which areas have higher or lower property tax rates can help ensure that the location you choose fits your budget for the long term.”

Generally speaking, the report finds a correlation between municipalities with higher average home prices and lower property tax rates. This doesn’t necessarily translate into lower property tax bills however.

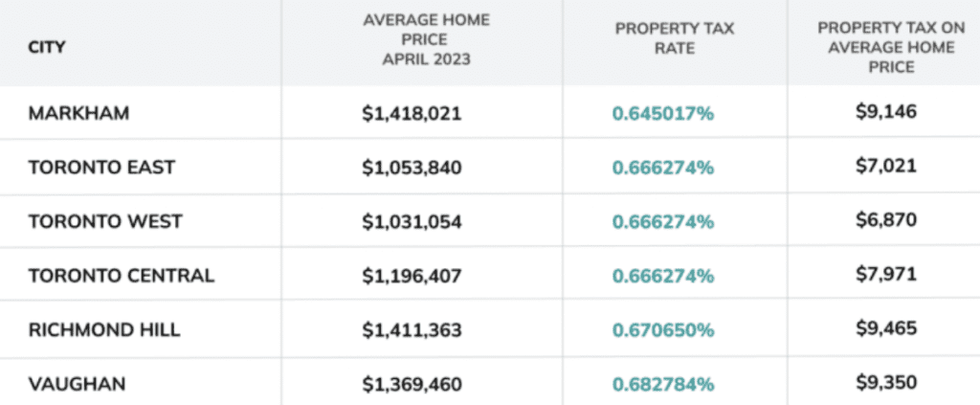

For example, Markham’s average home price is on the high end, at $1,418,021, however, it also has the lowest average property tax rate of any other municipality included in Zoocasa’s ranking, at 0.645017%. That said, the property tax bill on an average-priced home in Markham comes out to $9,146.

Toronto East, Toronto West, and Toronto Central rank just under Markham, all with a property tax rate of 0.666274%. Property tax rates in Richmond Hill and Vaughn were in a similar 0.6% range.

Of the municipalities with rates in the 0.6% range, Toronto West boasts the lowest physical property tax bill -- not to mention, the second-lowest property tax bill in the rankings. With an average home price of $1,031,054, homeowners in the area can expect to pay around $6,870 in property taxes.

That said, the lowest physical property tax bill tracks back to Essa, at $5,930. This is based on a property tax rate of 0.742788% and an average home price of $798,278 -- one of the lowest averages included on the rankings.

On the flip side, the most heavily-taxed municipalities in the GTA can be found in Durham Region and Dufferin County. Orangeville has the highest property tax rate of the bunch, at 1.353041%. This means that homeowners can expect to pay $11,498 in taxes on an average-priced home of $849,770.