Slowing inflation in June “sets the table” for a July rate cut, according to a media release from RBC following the most recent Consumer Price Index (CPI) numbers.

After an unexpected upswing in May that left economists unsure about the likelihood of a July cut, headline CPI fell back down to 2.7% from 2.9% in June. This lands us back at April's recorded inflation rate of 2.7%.

For context, inflation, or CPI, numbers influence the BoC’s decision to make rate cuts because the data reflects how stable the economy is, i.e., how ready we are for a rate cut. Cutting rates while inflation is still too high would only cause prices to soar even higher. But equally important is not cutting too late, as this would unnecessarily burden consumers and homeowners. The objective is to use interest rates to keep the inflation rate at a healthy 2%.

So, 0.7% to go everyone.

The June inflation drop was largely due to a 3% decrease in gasoline prices month-over-month from May, which was enough to offset the rise in food inflation to 2.8% from 2.4% in May, according to RBC’s release.

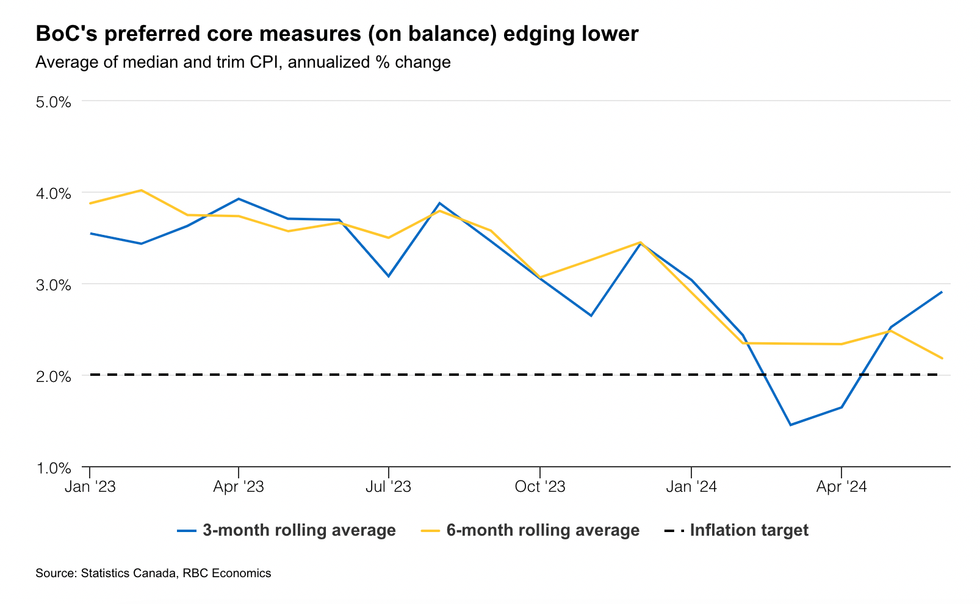

But excluding food and energy, core CPI remained at 2.9% year-over-year from May. Other measures, including the CPI trim and CPI median increased at a slower rate of 0.2%, but the “supercore” CPI measure increased by 0.3%. Pushing the three-month reading of that measure from 3% to 3.4% in June.

Still, it seems the BoC has a positive outlook. “From the BoC’s perspective, the broader picture remains that inflation pressures are easing in Canada,” said RBC. “The closely watched 3-month rolling average increases in the preferred core measures rose but that was following a string of earlier downside surprises, so the 6-month rolling average continued to ease.”

Based on these promising numbers, RBC sees a July rate cut as a likely possibility. “All told, we expect the BoC will carry on with easing the monetary brakes on a weak economy, and follow up with another rate cut at its July meeting next week.”