Over the past year, the development industry across Canada has slowed down significantly, and the high cost of borrowing has often been cited as one of the biggest culprits. Experts are now warning, however, that even when rates are cut, as they were this morning, a construction boom is not something to be expected immediately.

"Interest rates have a profound impact on the housing construction sector," said Marc Desormeaux, Kari Norman, and Hélène Bégin of Desjardins in an outlook earlier this week. "When the BoC raised its key interest rate to combat inflation, borrowing costs for construction projects surged. The resulting financial pressure has forced some builders to delay or even cancel planned developments, while other projects have gone into receivership."

Evidence of that is not hard to find. According to the Canadian Home Builders' Association, as of Q1 2024, 65% of its members said that interest rates have directly resulted in them building fewer units, with 31% saying they have cancelled projects. Urbanation has also found that 60 projects in the Toronto-Hamilton area have been shelved indefinitely since 2022, amounting to over 21,000 units. Insolvencies are also, unfortunately, in abundance, whether it be in Ontario or in British Columbia.

While high interest rates are undoubtedly resulting in difficulties for developers, numerous other factors will remain even after today's rate cut to 4.75%.

To even get to the construction stage, developers typically need to hit a certain level when it comes to presales, and presale activity has been timid, at best, largely due to the uncertainty around interest rates. Following today's rate cut, some of that uncertainty and lack of confidence will likely linger in the market until further cuts.

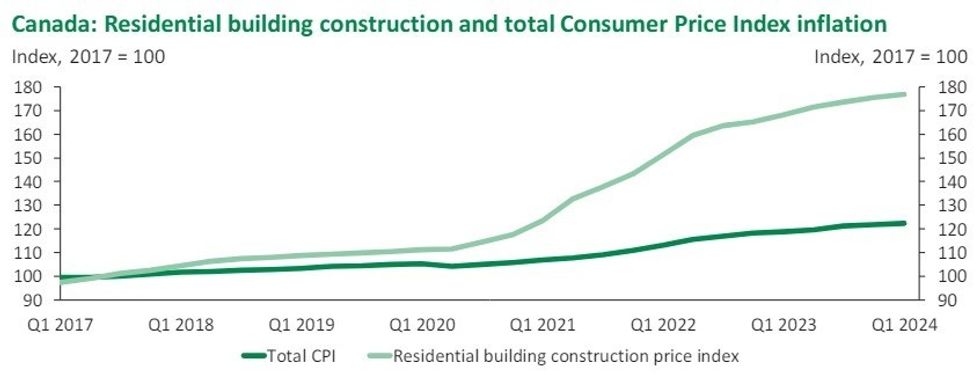

For those who can get to the construction stage, the hard costs of construction are still sky high. According to Desjardins, the residential building construction price index has increased by 59% between Q1 2020 and Q1 2024. That's also something that won't be immediately cleared up with a rate cut.

Assuming a developer can get past both of those hurdles, the construction industry is still mired by persisting labour shortages. According to Desjardins, shortages remain worse than they were prior to the COVID-19 pandemic, registration in Canadian apprenticeship programs has declined, and over 700,000 trade workers are expected to retire by 2028. Again, a rate cut would not alleviate that.

Another big factor is the bond market, where the 10-year Government of Canada bond serves as a proxy for where debt is priced in real estate, says CoStar Group Chief Economist & Head of Market Analytics Carl Gomez.

"Most of the debt that real estate investors use, whether you're commercial or residential, is mainly determined by the bond market and bond yields," Gomez says, "and bond yields have already kind of absorbed the idea that inflation has kind of gone away, and it is already reflected in their pricing, which is why long-term bond yields currently are below the Bank of Canada policy rate."

Normally, a yield curve is upward-sloping, reflecting the fact that short-term bond yields should be lower than long-term bond yields, as a result of the higher risk associated with the latter. However, the yield curve has been inverted for about the past year, which in essence is the market saying it believes the Bank of Canada has made a policy error by keeping the policy interest rate too high, Gomez explains.

In effect, what this looks like in the market is that the availability of credit becomes constrained, which is indeed what has occurred.

"Across the board, lending conditions have tightened up and that's because the lenders themselves are having difficulty," says Gomez. "They borrow on the short end and lend on the long, but right now with the inversion of the yield curve, it's hard to find lending."

A cut of 25 basis points, as the Bank of Canada announced today, doesn't resolve this, as Gomez says the inverted yield curve won't be normalized until the Bank of Canada policy interest rate is down to around 2.00%, which he expects won't happen until the end of the 2025.

"25 basis points is not going to do a heck of a lot, but if they do the full 200 or 300 basis points, that's going to open up a little more cushion and flexibility for a lot of developers scratching out returns right now," adds Gomez. "The issue for a lot of developers is the cost of financing for sure, but it's also that the input costs are still very high. Giving them some cushion with interest rates would probably be helpful, but I don't think it's going to unlock significant growth giving how incremental the rate cuts are likely to be."