As Canadians continue to absorb the news that the Hudson's Bay Company (HBC), our oldest and most iconic retailer, is now insolvent, there is a significant subplot that has received little attention: the creditor protection HBC was granted last Friday also applies to RioCan (TSX: REI.UN), one of the country's largest REITs by market cap.

RioCan was not an applicant and there is nothing to suggest that RioCan is in any kind of financial jeopardy, but it has a very large and complex joint venture with HBC that is now also under creditor protection, which means RioCan will undoubtedly be impacted — positively or negatively, significantly or insignificantly — by the restructuring of HBC.

How The RioCan-HBC Joint Venture Was Formed

The joint venture between RioCan and Hudson's Bay was announced on February 25, 2015, in separate press releases by both companies.

The general structure of the JV was that both partners would transfer some of their real estate assets to a new JV limited partnership, the general partner of which they would jointly control. HBC would contribute 10 properties it owned — five it owned via freehold (inclusive of the land) and five it owned via leasehold (not inclusive of the land). RioCan would then contribute a 50% co-ownership interest in the Georgian Mall and Oakville Place shopping centres — both located in Ontario — plus a cash contribution.

According to their respective press releases, HBC's contributions amounted to $1.7 billion, based on a capitalization rate of 5.08%, for an eventual stake of 79.8%. RioCan's contribution amounted to $325 million for an eventual equity stake of 20.2%, with the $325 million contribution including $52.5 million in capital commitments that would go towards improvements of the properties HBC was contributing.

The JV entity would assume approximately $48 million of existing debt secured against one of the HBC properties and also sublease the 10 stores to HBC for 20 years, with moderate annual rental increases. The intention was also that the JV entity would acquire additional properties in the future and that it would form the basis of a new publicly-traded REIT.

What neither company mentioned in their press release, however, was that there had been some last-minute changes to the structure of the JV as a result of a conflict with a third party: Oxford Properties, the real estate arm of the Ontario Municipal Employees Retirement System (OMERS).

At the time when the joint venture was announced, the conflict was playing out in private, but then became public after it had to be resolved in court.

The conflict arose because Oxford Properties was HBC's landlord at three locations being contributed to the JV — the Yorkdale, Square One, and Scarborough Town Centre shopping centres in Ontario — while simultaneously being a direct competitor of RioCan, both of whom own and operate many big shopping centres (among other things) across the country.

Representatives of HBC met with Oxford in January 2015 to discuss the JV it was planning with RioCan, but Oxford voiced concerns about the degree of control that RioCan, its competitor, would have over the leases. HBC then made some underlying tweaks to the structure of the JV to address Oxford's concerns, then returned to seek Oxford's consent to assign and sublease its three leases to the joint venture.

Oxford refused to grant its consent, however. As summarized by the presiding judge, Oxford's position was that it was a "fundamental premise" of the leases that the leasehold interest be held by a retail department store operator and that the RioCan-HBC JV entity, as the proposed holder of the lease, is not that and is more of a real estate business, in addition to being a competitor.

The two sides agreed to let the matter be determined by the court, with HBC filing an application to the Ontario Superior Court in April 2015 arguing that it did not actually need to seek consent from Oxford, legally. The judge ultimately ruled in HBC's favour, citing the fact that HBC would continue to be in control of the leases and continue to be the operator of the stores.

The judge's ruling came in August, by which point the joint venture transaction between RioCan and HBC had been advanced and completed with the three Oxford leases excluded, pending court judgement.

The Current Joint Venture Structure

A decade later, in HBC's creditor protection application last week, the company's New York-based Chief Financial Officer Jennifer Bewley described the joint venture with RioCan today as "Hudson’s Bay’s primary real estate subsidiary and an integral part of Hudson’s Bay Canada."

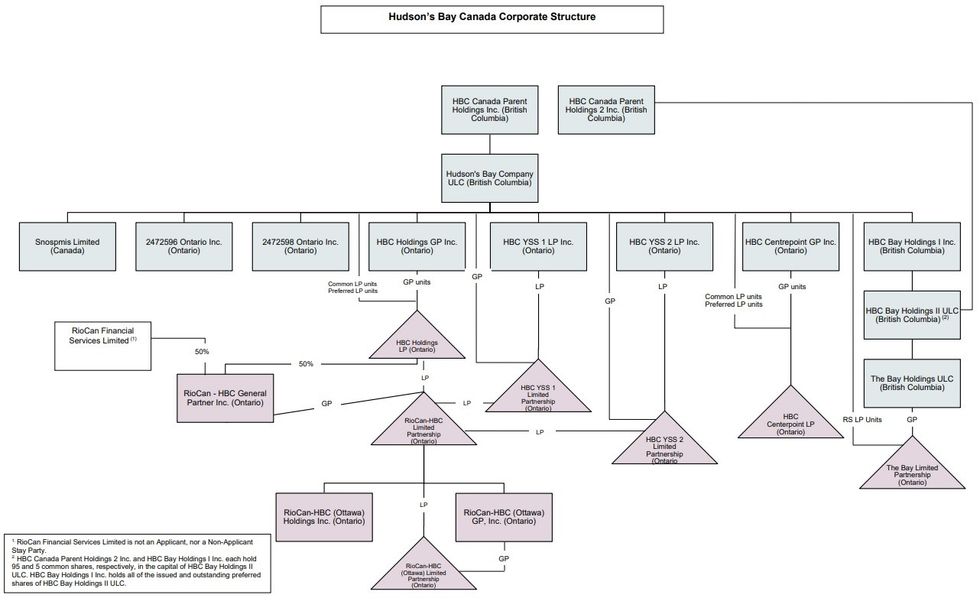

As a result of the tweaks HBC made in their attempt to address Oxford's concerns, the current structure of the JV is now more complex, but in short: the entity that serves as the general partner (GP) of the limited partnership is RioCan-HBC General Partner Inc. — with RioCan and HBC each holding a 50% ownership interest in the GP — and the two companies also have split ownership of the limited partners in the JV — now 78.0136% for HBC and 21.9864% for RioCan, according to Bewley.

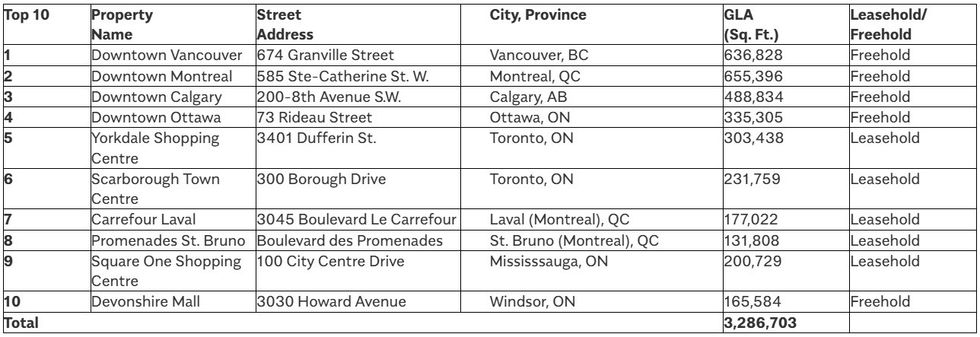

The RioCan-HBC joint venture owns 12 properties — the 10 originally contributed by HBC, plus the 50% stakes in the two RioCan contributed — that represent all of the real estate that HBC has an ownership interest in, barring the exception of its leasehold interest in Centrepoint Mall in Ontario. The 12 ownership interests are now held under various associated entities, including Snospmis Limited, 2472596 Ontario Inc., 2472598 Ontario Inc., RioCan-HBC (Ottawa) Limited Partnership, HBC YSS 1 LP Inc., and HBC YSS 2 LP Inc.

As originally contemplated when the JV was formed, the JV owns the freehold or leasehold interest in the properties and subleases the properties to HBC. In her affidavit from last week, Bewley referred to this as their "PropCo-OpCo structure" and this was implemented "as part of Hudson's Bay's business plan to monetize the value of these JV Head Leases and its other freehold properties."

All in all, the Hudson's Bay Company now operates a total of 96 stores across Canada, including those under the Saks Fifth Avenue and Saks OFF 5TH brands. Aside from the aforementioned stores, all of the remaining stores are operated by HBC under traditional leases with third parties.

What Happens Next

After being granted creditor protection on March 7, HBC is now working on its application for an extension of the protection period, while also figuring out how it plans to restructure. However, there are already some hints about what the company's plans are, and those hints suggest that there will be an impact on RioCan in one way or another.

"The Companies intend to conduct an orderly liquidation with respect to certain retail stores," said Bewley in her affidavit. "The Applicants intend to seek Court approval for a process to conduct an orderly liquidation in a manner that is fair and reasonable for the Applicants, landlords, and other stakeholders.

As Bewley has also said, all of the properties that HBC has an ownership stake in are held under the RioCan-HBC JV (and several of them are carrying large mortgages). Presumably, HBC can sell some or all of its ownership interests to RioCan, or the ownership interests can be sold to a third party, which would likely require approval from RioCan and the court. (In 2018, RioCan and HBC reached an agreement to sell their downtown Vancouver store for $675 million, but the deal ultimately fell through.)

"Hudson’s Bay has various leases which have value as the rents are below-market," she added. "The Applicants intend to seek Court approval for a process to market such leases in a manner that is fair and reasonable for the Applicants, landlords, and other stakeholders."

Although Bewley did not specify which leases she is referring to, elsewhere in her affidavit she uses the same language to describe the leasehold interests the RioCan-HBC JV owns, which includes the three with Oxford Properties in Ontario, plus the two in Quebec.

"Under the five JV Head Leases that are part of the PropCo-OpCo Structure, the monthly rents payable by RioCan-Hudson’s Bay JV, YSS 1, or YSS 2, as applicable, to the third-party landlords under the JV Head Leases are below current market rents and the monthly rents payable by Hudson's Bay Company under the subleases for the same leased premises," said Bewley. "The monthly rents paid to the landlords and the longer terms under the JV Head Leases reflect the leasing market at the time that the JV Head Leases were entered into."

In a document dated March 10, the judge presiding over the creditor protection proceedings summarized the dire state of the company, which is carrying $1.129 billion in debt, $724.4 million of which is tied to mortgages.

"Hudson's Bay today is facing an imminent liquidity crisis. It has not paid rent at several of its leased stores and a number of its trade creditors have not been paid. The failure to pay rent will imminently trigger an escalating chain of events leading to defaults under other leases, where Hudson's Bay has failed to pay rent and cross defaults on its secured obligations."

As it relates to RioCan, the judge described the JV as "highly integrated," "fully intertwined," and "indispensable to the business" of HBC, thus requiring the creditor protection to be extended to the JV.

Hudson's Bay is scheduled to return to the court on March 17. STOREYS reached out to RioCan on March 11 for comment but has not received a response.

- All 96 Hudson's Bay Stores In Canada, The Landlords, And The Mortgages ›

- Hudson's Bay Facing $1.1B Debt, Granted Creditor Protection To Restructure ›

- Cracks Emerge In RioCan And Hudson’s Bay Joint Venture Over Unpaid Rent ›

- RioCan Recognizes $209M Investment Loss From Hudson's Bay JV ›

- Primaris REIT To Repurpose Hudson's Bay Stores That Saw No Bids ›

- RioCan Demands Payment From Hudson’s Bay, Files for Receivership of Joint Venture ›

- RioCan Eyeing Buyout Of Hudson's Bay From Georgian Mall, Oakville Place ›

- RioCan Bids $141M To Buy Out HBC JV From Georgian Mall, Oakville Place ›