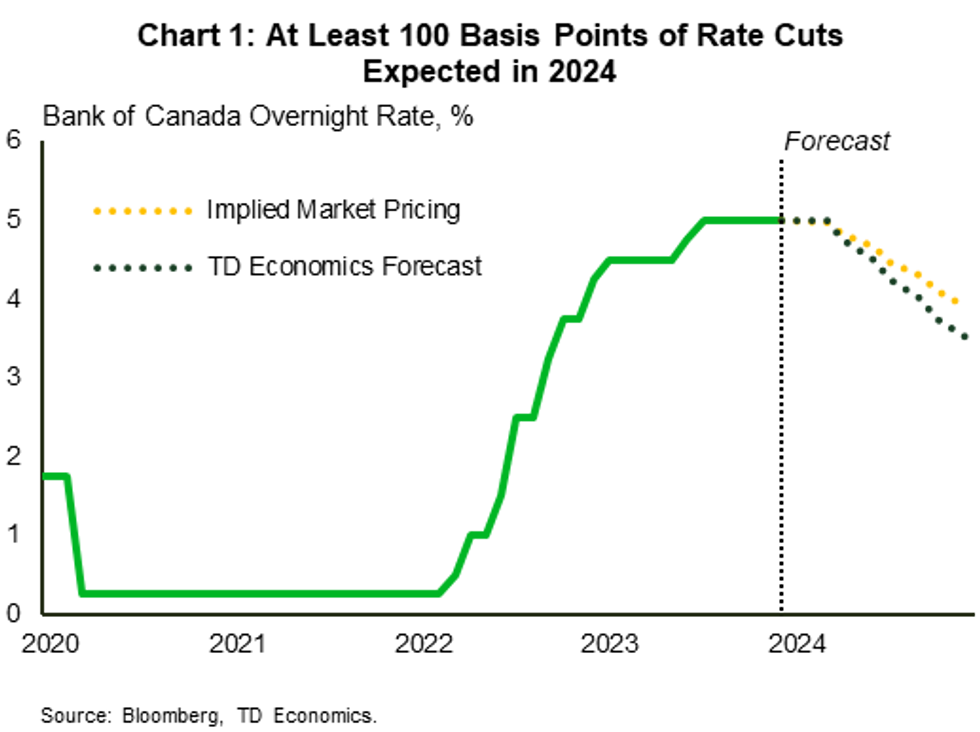

TD Economics is calling 2024 '“the year of the cut” in Canada, with markets pricing the first interest rate cut as soon as April.

In a note from Friday, TD’s Marc Ercolao writes that the Bank of Canada (BoC) is expected to bring the policy rate — which currently sits at a 22-year high of 5% — down to 3.5% by the end of 2024.

That figure is “slightly lower than market expectations of 3.75%,” but also “notably tighter than pre-pandemic levels,” Ercolao adds.

Although Ercolao says there is plenty of proof that the BoC’s policy of quantitative tightening has been working — he notes that “consumers are reeling in their spending, and growth is evolving in a manner consistent with inflation inching closer to the BoC's 2% target” — he cautions that we’re not out of the woods quite yet.

“Inflation remains elevated and wage growth is still running hot,” Ercolao writes. “Thus, we sit at a critical crossroads between prematurely cutting rates and potentially reigniting inflation, or keeping conditions too tight, causing more economic pain than necessary.”

Speaking specifically to inflation, Ercolao warns that the next reading, slated for January 17, could see the metric “accelerate on the back of base effects that saw weak inflation a year ago.” Even so, he notes that inflation is “trending in the right direction” and is expected to “durably break below the 3% level in 2024.”

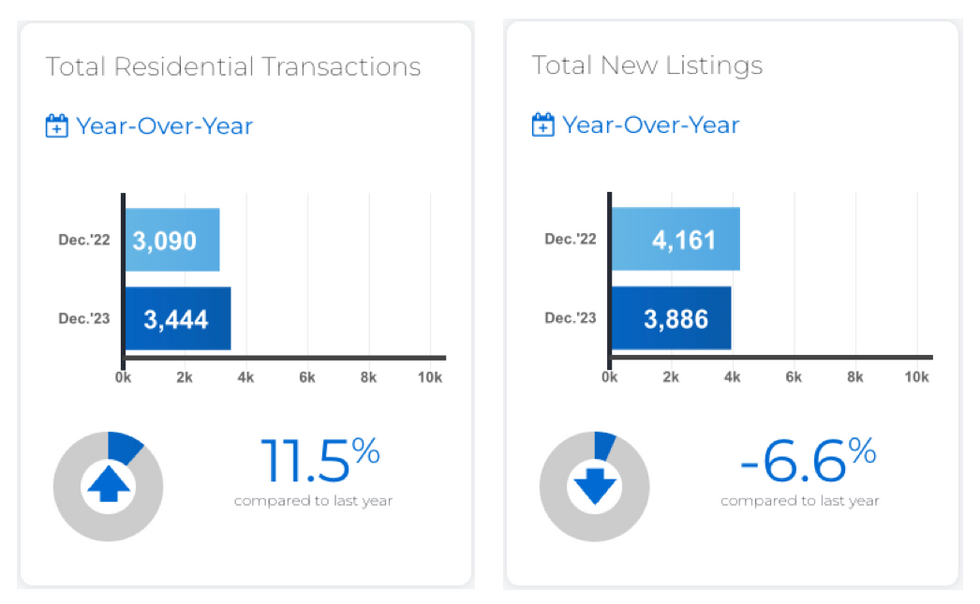

On the housing front, Ercolao points out that Canadian housing markets saw “tightening conditions” and showed “surprising strength” as 2023 drew to a close, citing the latest data from local real estate boards. He adds that markets across the country could be in for a “seasonally strong spring,” which would “fall directly in line” with the expected timing of the first interest rate cut.

Ercolao’s sentiments on the spring market seem to be well-founded. Canadian Real Estate Association Senior Economist Shaun Cathcart said last month that this spring is poised to be “more active” than previously expected.

It certainly helps that borrowing costs are already coming down. BMO Economist Robert Kavcic wrote in a recent note that they may have already peaked now that the BoC’s tightening cycle seems to be in the rearview.

To his point, lenders like Equitable Bank, THINK Financial, and MCAP have already dropped their five-year fixed rates below 5%. Kavic notes that with five-year GoC yields having crumbled by around 115 basis points from the early October high, fixed mortgage rates will likely come down further as 2024 progresses. Variable-rate mortgages are expected to follow suit as the bank drops the policy rate.