Canadian homeowners got some reprieve in the second quarter of the year as the burden of homeownership costs eased ever so slightly.

Rather than a true easing of housing costs, though, the improvement was attributable to growing household incomes. According to a new report from Robert Hogue, Assistant Chief Economist at RBC, ownership costs actually rose in Q2 as strong springtime demand bolstered property values. But at the same time, household income rose 1.4% from Q1.

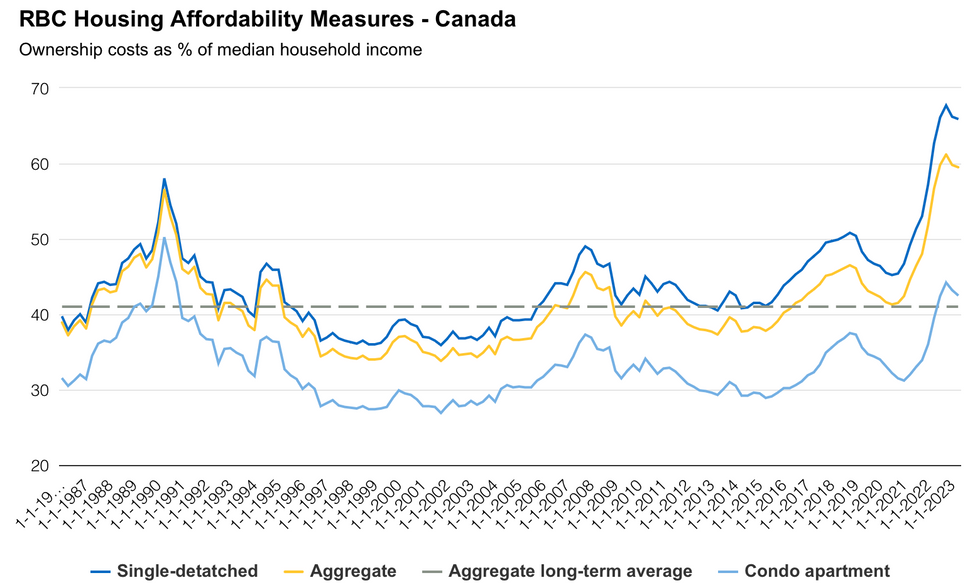

The gain was significant enough to lower RBC’s Aggregate Affordability Measure by 0.3% to 59.5%, marking the second consecutive quarter of decline. The tool measures ownership costs as a percentage of median household income; when the ratio falls, affordability improves.

Despite the dip, the measure remains near its all-time high of 61.2%, which it reached in Q3 2022.

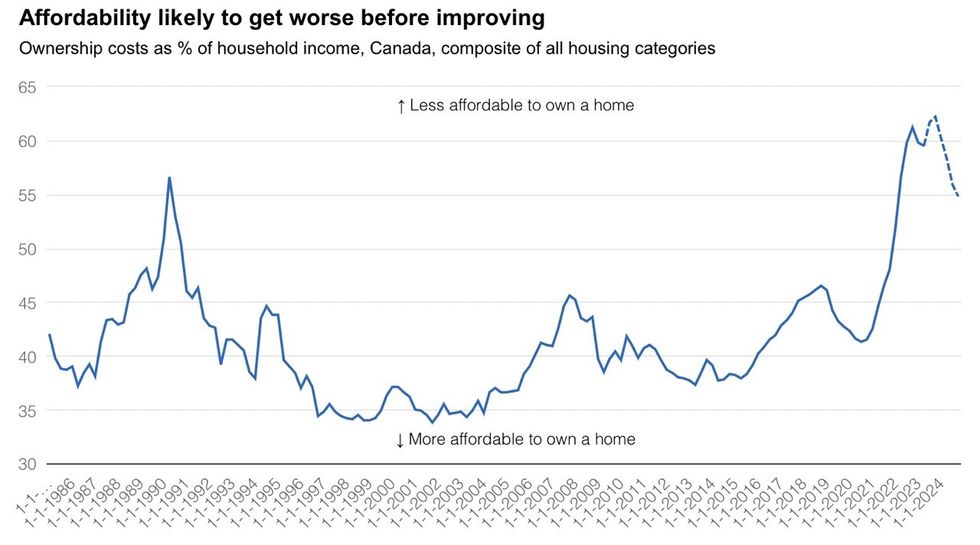

With mortgage rates remaining high and prices still appreciating, Hogue expects housing affordability to erode further in Q3 and Q4. RBC forecasts the affordability measure will rise to 62.2% by the end of 2023.

However, the landscape looks set to improve in 2024, particularly so once the Bank of Canada starts cutting interest rates, which Hogue predicts will happen around mid-year. By Q3 2024, the affordability measure is forecasted to fall to 54.8%.

Until then, buyers in Canada’s largest markets "will continue to contend with extremely difficult affordability conditions." Such pressures are likely what drove cooling resale activity in Ontario and British Columbia this summer, with many buyers "entirely priced out” in Toronto and Vancouver.

In the former, RBC’s Aggregate Affordability Measure sat at 79.6% in Q2, keeping the dream of homeownership "far out of reach for ordinary folks." In the "prohibitively expensive" latter, the measure edged up to 97.5%, just shy of the worst level of affordability ever recorded in a Canadian market (99.1%).

Victoria’s 73.0% is barely off the city’s own worst level of 75.7%, and in Calgary, the "hottest market in the country," the measure sunk to a 15-year low of 44.0%. Meanwhile, the already-affordable St. John’s saw the greatest improvement in Q2, with the measure dropping 1.1% to 26.2%.

"Short of a housing crash that would destroy property values or an unexpected about-face in monetary policy, any progress in restoring housing affordability is likely to be slow," Hogue said.

"Supply must increase by giant leaps to make a material difference. But building new homes takes a long time…and it’s increasingly hard to build units ordinary Canadians can afford to buy given soaring construction costs and finite construction capacity."