In their most recent monthly statistics report, CREA’s Senior Economist Shaun Cathcart deems May “another sleepy month for housing activity in Canada.”

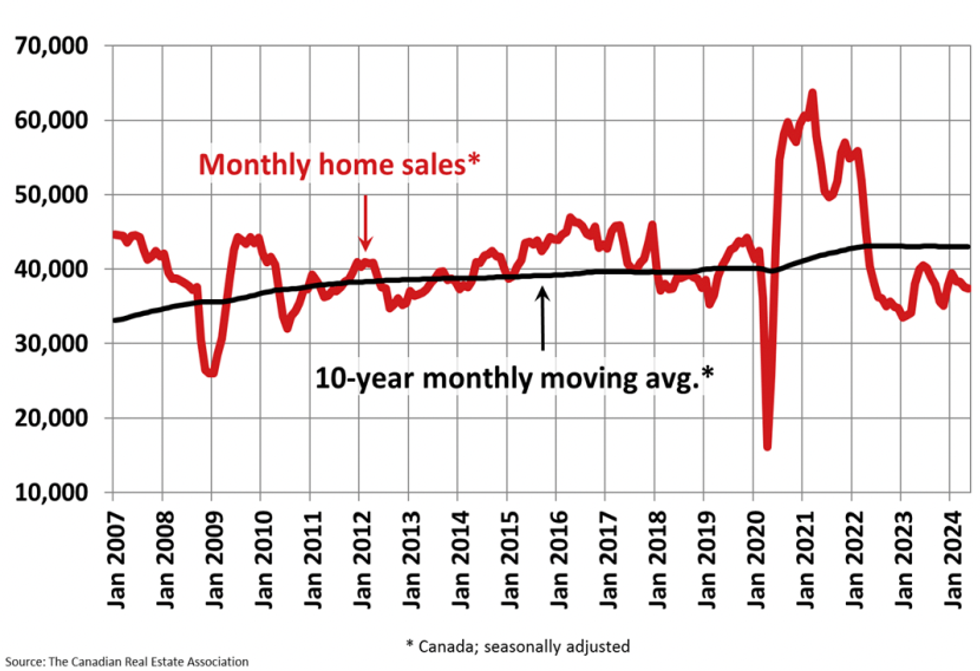

Home sales decreased 0.6% month-over-month from April, following a four-month trend of steadily decreasing home sales. Still, May’s drop wasn’t as significant as the 1.7% decrease between March and April. These numbers remain slightly below the 10-year average.

In more encouraging news, Cathcart expects the recent rate cut to breathe life back into the market. “The Bank of Canada’s June 5 rate cut may have only been 25 basis points, but the psychological effect for many who have been sitting on the sidelines was no doubt huge,” he says. “[The rate cut] will likely lead to increased activity moving forward.”

As for new listings, the number of homes up for sale by the end of May was up by a nominal 0.5% on a month-over-month basis, but compared to last year, listings are up 28.4% at 175,000 properties. This is a significant increase from last May, but still below historical averages, according to the report.

“The spring housing market usually starts before all the snow has melted, somewhere around the beginning of April, but this year I believe a lot of people were waiting for the Bank of Canada to wave the green flag,” said James Mabey, Chair of CREA. “That first rate cut is expected to bring some pent-up demand back into the market, and those buyers will find there are more homes to choose from right now than at any other point in almost five years.”

With this increase in supply and decrease in sales, the national sales-to-listings ratio has settled at 52.8% compared to 53.3% in April. This is a comfortable spot to occupy with a sales-to-listings ratio between 45% and 65% being generally consistent with balanced housing market conditions, according to the report.

As of the end of May, months of inventory continues to skew slightly towards a buyers market, with 4.4 months of inventory on a national basis, up from 4.2 months at the end of April — the highest level for this measure since the fall of 2019, excluding the volatility at the pandemic’s onset. This puts May a little below the long-term average of roughly five months of inventory.

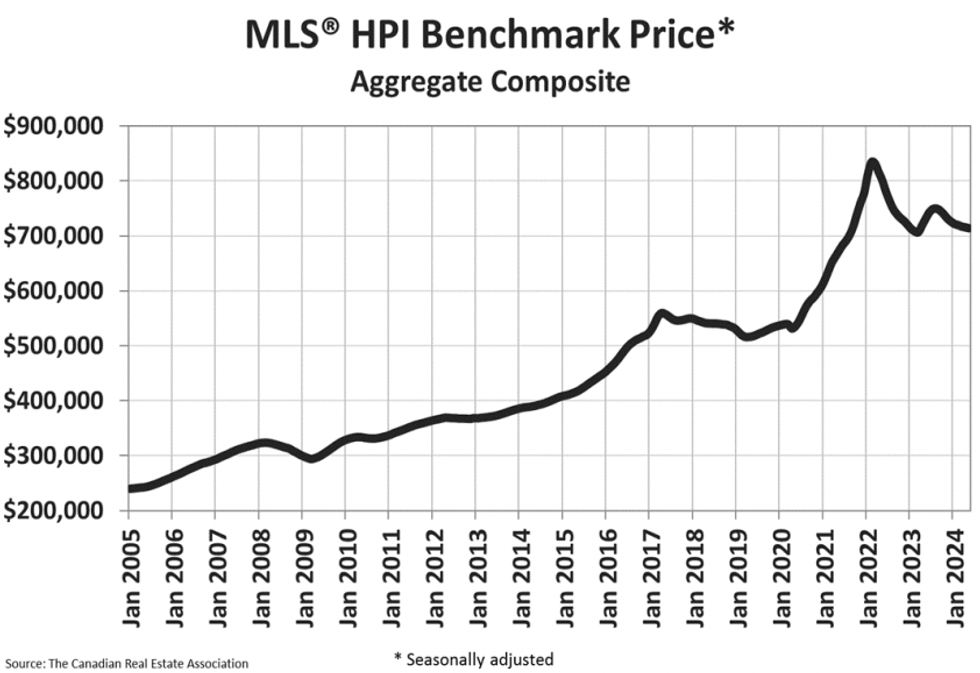

On the home prices front, the National Composite MLS® Home Price Index (HPI) dipped 0.2% from April to May, with the actual (not seasonally adjusted) national average home price sitting at $699,117 in May 2024, down 4% from May 2023.

The numbers show that home prices are “generally sliding sideways across most of the country right now,” with the exceptions continuing to be Calgary, Edmonton, and Saskatoon, where prices have been climbing higher since the start of last year.

- Canadian Home Sales Surged in April Creating Tightest Market in Over a Year ›

- Canadian Home Sales See Worst Year Since 2008 Financial Crisis ›

- ‘Most Balanced Since Before The Pandemic’: Canadian Home Sales Dip, Inventory Rises ›

- May Was The Second Lowest Month For New GTA Home Sales Since 1990 ›

- Signs Of Life In Housing Market, CREA Reports ›