Rising Ontario home prices have been a major topic of debate ahead of Thursday's provincial election, with each party framing themselves as the one to best tackle the issue.

Each party leader has presented their respective platform on how they will handle the housing crisis and bring down home prices, proposing everything from building 1.5M new homes to bringing back rent control to penalizing municipalities for not processing development applications at rapid speed. But of course, there's no sure way to know what proposed policies will come to fruition, or better yet, which will end up having a meaningful effect on the housing market.

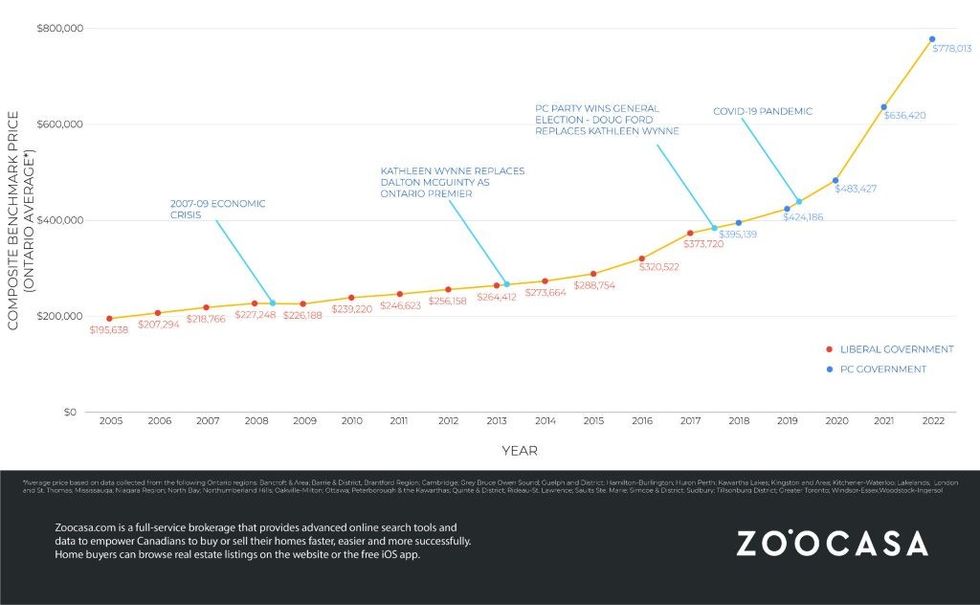

Taking a retrospective view, a new report from Zoocasa analyzed how prices have fared under the past three provincial governments. Although rising home prices have been an issue exacerbated during the pandemic, it has "been a noticeable trend for decades," the report notes.

Beginning with former Liberal Premier Dalton McGuinty, home prices increased steadily during his term, rising from an average of $195,638 in 2005 to $264,412 in 2013. There was a slight dip in 2009 as a result of the economic crisis, but as the report notes, "the recovery was swift enough that the price decrease is not particularly noticeable."

The Liberal term continued under Premier Kathleen Wynne, and so did home price growth. From 2016 to 2017 in particular, rapid home price growth occurred, especially in Toronto, which saw more than 30% gains between March 2016 and March 2017. In an attempt to cool the market, the government implemented the Fair Housing Plan which included measures like a 15% foreign buyer tax and expanded rent control regulations. Although price growth slowed, it kept an upward trajectory.

Under current Premier Doug Ford, Ontario has seen unprecedented, skyrocketing home prices, largely brought on by the COVID-19 pandemic.

"As [the pandemic] hit, interest rates dropped to all-time lows, meaning it was far easier for those in the market to receive a low interest home loan," the report reads. "Home prices dipped after the initial lockdowns were short-lived and prices quickly shot up to record highs as inventory numbers tumbled, particularly during 2021. Towards the end of the year multiple cities were seeing all time price highs paired with all time housing stock lows, which continued to drive the price of homes up."

Surging home prices have not only affected Ontario, but markets all across Canada. In response, the Bank of Canada has implemented several interest rate hikes bringing the historically low 0.25% rate implemented at the onset of the pandemic up to 1.5% as of June 1. The effects of previous hikes have already been felt, with some markets settling or even dropping. With even more raises expected throughout the year, prices are likely to continue dropping, the report says.